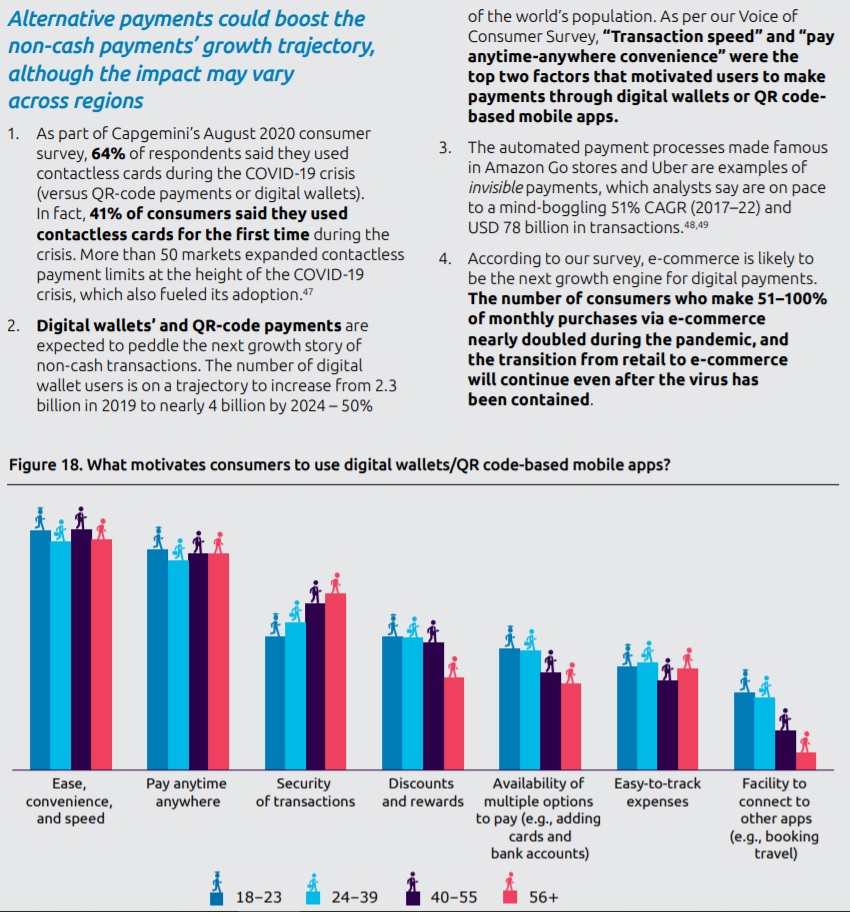

The number of digital wallet users globally will increase from 2.3bn in 2019 to 4bn in 2024 and global non-cash transactions will grow to nearly 1.1tn in 2023 from 708.5bn in 2019, according to the World Payments Report 2020.

Automated payment processes, such as self-checkout services, are forecast to reach a compound annual growth rate (CAGR) of 51% for the 2017-2022 period, while increased demand for NFC-based payment solutions, anti-counterfeit technology and wearables will see the NFC market reach almost US$50bn by 2024.

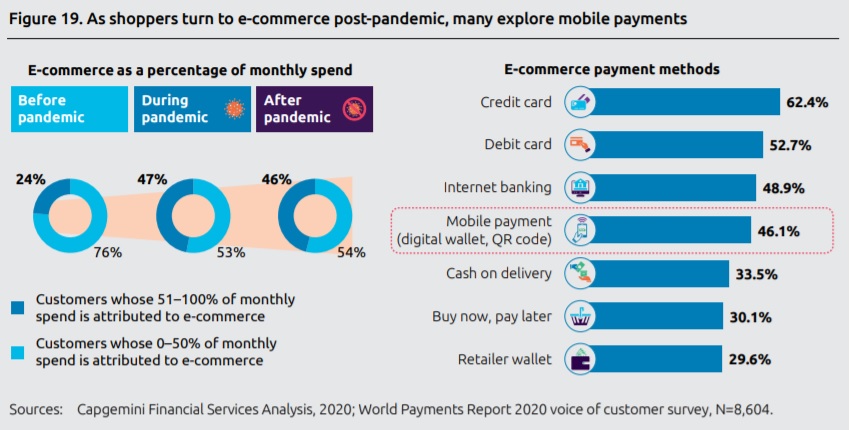

Global non-cash transactions grew by nearly 14% between 2018-19, an increase led by a 31.1% growth in China, India and SE Asia, and driven by “increasing smartphone usage, booming e-commerce, digital wallet adoption and mobile/QR-code payments innovations,” according to the report.

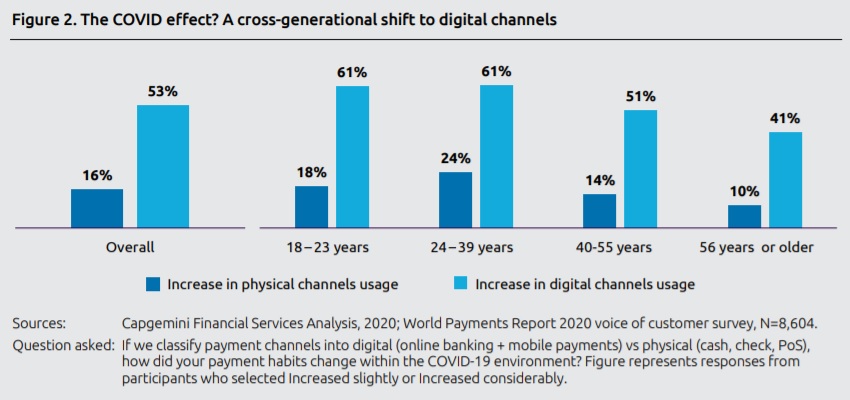

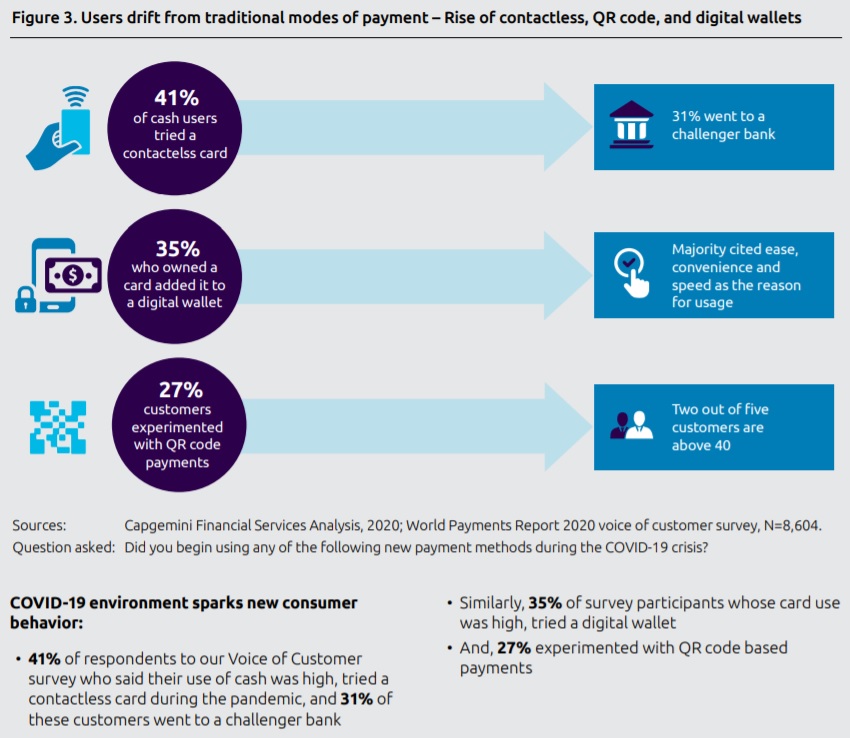

The migration of consumers away from cash and a growing affinity for digital payments are evident in changing payment preferences during the Covid-19 pandemic, the report continues.

“As of April 2020, more than 38% of consumers said they discovered a new payment provider during the lockdown.

“Internet banking and direct account transfers were, and still are, the preferred payment method throughout the global health crisis, according to 68% of consumer survey respondents.

“Contactless (tap-to-pay) cards came in second, with 64% saying they used them often.

“Digital wallets (including QR-based payments) were the preferred choice of 48% of respondents.”

The survey also found that 47% of consumers are interested in conversational commerce and using voice-based assistants to make e-commerce purchases.

The World Payments Report 2020 brings together research from 44 payments markets, Romania included, and is based on a survey of more than 8,500 consumers, 235 banks, fintechs, payments providers and corporate businesses as well as interviews with 45 executives across the banking, financial, tech and retail sectors.

Source: nfcw.com

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: