Digital payments crucial to economic growth – World Bank report

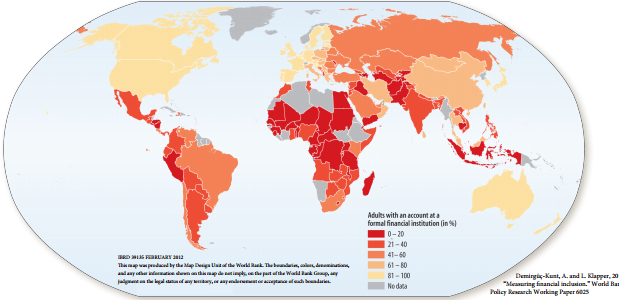

More than 2.5 billion adults around the world, and 59% of those in developing economies, do not have a formal bank account, making it harder to alleviate inequality and spur economic growth. But with the mobile phone revolution in full swing, a newWorld Bank Development Research Group report, sponsored by the Better than Cash Alliance and the Bill & Melinda Gates Foundation, argues that there is growing evidence that digital payments and remittances can play a key role in bringing banking services to these people.

„Rapid development and extension of digital platforms and digital payments can provide the speed, security, transparency, and cost efficiency needed to increase financial inclusion at the scale required to achieve G20 [financial inclusion] goals,” says the report.

According to finextra.com, the report will be discussed at a G20 meeting next month and calls on members of the group to push for specific measures to spur non-cash payments. Chief among these is the digitisation of government payments and receipts to create a foundation upon which the private sector can build. Governments should also look to create favourable regulatory regimes that encourage competition and to work with the private sector to build technical platforms on which services can be built.

Geoffrey Lamb, chief economic and policy advisor to co-chairs and CEO of the Bill & Melinda Gates Foundation, says: „The evidence shows that private sector firms will innovate and citizens will quickly learn to use and appreciate digital payments. But we need governments to establish the vision, the digital platforms and the regulatory assurance to pull the hundreds of millions of currently excluded people into full participation in the modern economy.”

For more details you can dowload the full report here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: