Digital Identity verification spend to exceed $20 billion globally by 2027. 80% growth in over next 5 years.

A new study from Juniper Research has found that the spend on digital identity verification checks will reach $20.8 billion globally in 2027; up from $11.6 billion in 2022. It predicts that this growth will be driven by both the increasing prevalence of digital services requiring digital onboarding journeys, and the growing requirement for more advanced and robust identity verification systems in the face of rising fraud.

Digital identity verification is where identity is checked using digitally verifiable elements, such as selfie scans, address checks and knowledge-based authentication.

To find out more, see the new report: Digital Identity Verification: Key Opportunities, Competitor Leaderboard & Market Forecasts 2022-2027

Download the free whitepaper: Why Verifying Digital Identity Is Critical

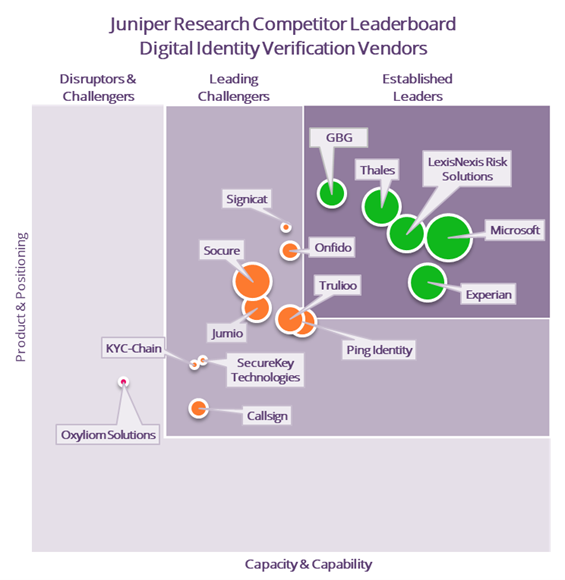

Microsoft, Thales & LexisNexis Risk Solutions Ahead in Competitor Leaderboard

The research assessed leading digital identity verification vendors; evaluating each company on criteria such as depth and breadth of offerings, service innovation and future market prospects. It ranked the top 3 vendors as follows:

- Microsoft

- Thales

- LexisNexis Risk Solutions

The research found that each of these vendors is taking advantage of the requirements for digital onboarding, as well as providing advanced anti-fraud capabilities. Microsoft has taken a leading role in verification, particularly with its Azure AD solution in a remote working context; leveraging its business environment presence. Thales has implemented a different approach; creating a broad portfolio of solutions in identity verification, that it then coordinates for each verification use case. LexisNexis Risk Solutions is leveraging its broad data coverage using machine learning to verify identity, bolstered by frequent acquisitions.

Research co-author Damla Sat explained: “There are multiple pathways to identity verification success. There are many different segments and verification types, with no single vendor covering all the solutions. As such, there is still a lot of room for innovation; vendors must focus on building out innovation partnerships and acquisitions that allow them to intelligently orchestrate the most effective verification types for each use case to drive growth forward.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: