Digital banking users to reach 2 billion this year, representing nearly 40% of global adult population

Mobile banking users to grow 14% y-o-y, compared to 6% for online banking.

New forecasts from Juniper Research, estimates that over 2 billion users will access retail banking services via smartphones, tablets, PCs and smartwatches in 2018, up 10% y-o-y.

The new research, Retail Banking: Digital Transformation & Disruptor Opportunities 2018-2022, found that accelerated adoption in key emerging markets such as India and China means that mobile banking users now represent 50% of the global banked population. Juniper expects that the number of global mobile banking users will now overtake online users in 2018, 2 years earlier than previously anticipated.

For more insights, download: Futureproofing Digital Banking 2018 (whitepaper)

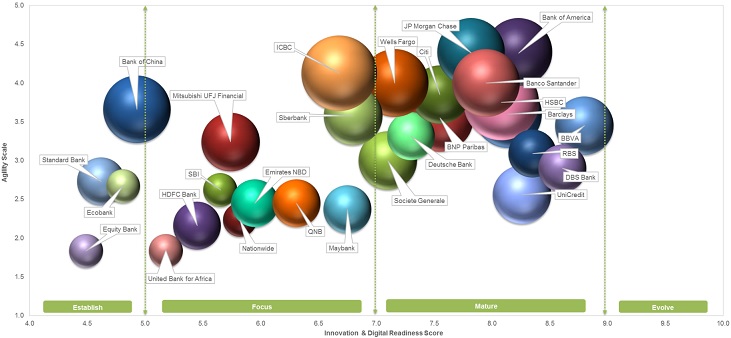

Leading Banks Positioned in Juniper’s Digital Transformation Readiness Index 2018

2017 saw banks worldwide engaging in both technology investments and new tech offerings, although the extent of these activities varied considerably. Juniper’s Digital Transformation in Banking Readiness Index analysed leading tier-1 banks to evaluate their digital transformation readiness scores and highlight their respective positioning within the digital innovation roadmap.

It identified the leading group of banks for digital transformation in the sector: Banco Santander, Bank of America, Barclays, BBVA, BNP Paribas, Citi, DBS Bank, Deutsche Bank, HSBC, JP Morgan Chase , RBS, Societe Generale, UniCredit, Wells Fargo.

These banks once again scored highly, offering a wide range of digital portfolios and investing in the rapid development of technology and customer enablement.

Research author Nitin Bhas noted: “They were found to be in the mature phase of digital transformation, approaching the final stages of objectives as defined in their current roadmap. These players also lead in customer training and employee development programmes, with regards to digital technology”.

As these banks continue towards digital transformation, technology offerings are also becoming increasingly advanced. For example, chatbot offerings deliver a greater differentiation from a normal app experience, particularly where customer service is concerned. Juniper estimates customer service cost savings achieved through the deployment of conversational chatbot platforms will reach $4.5 billion by 2022.

Source: Juniper Research

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: