„This growth will be driven by the rise of digital-only banks and the ongoing focus on digital transformation by established bank brands.”, according to a new study from Juniper Research.

The new research, Digital Banking: Banking-as-a-Service, Open Banking & Digital Transformation 2020-2024, found that digital-only banks have gained market share from traditional banks by offering superior user experiences and tightly focused USPs.

The research recommends that established banks must personalise the app experience; using AI‑based personal financial management tools to fight back against digital-only bank innovation.

For more insights, download the free whitepaper: How Open APIs are Revolutionising Banking.

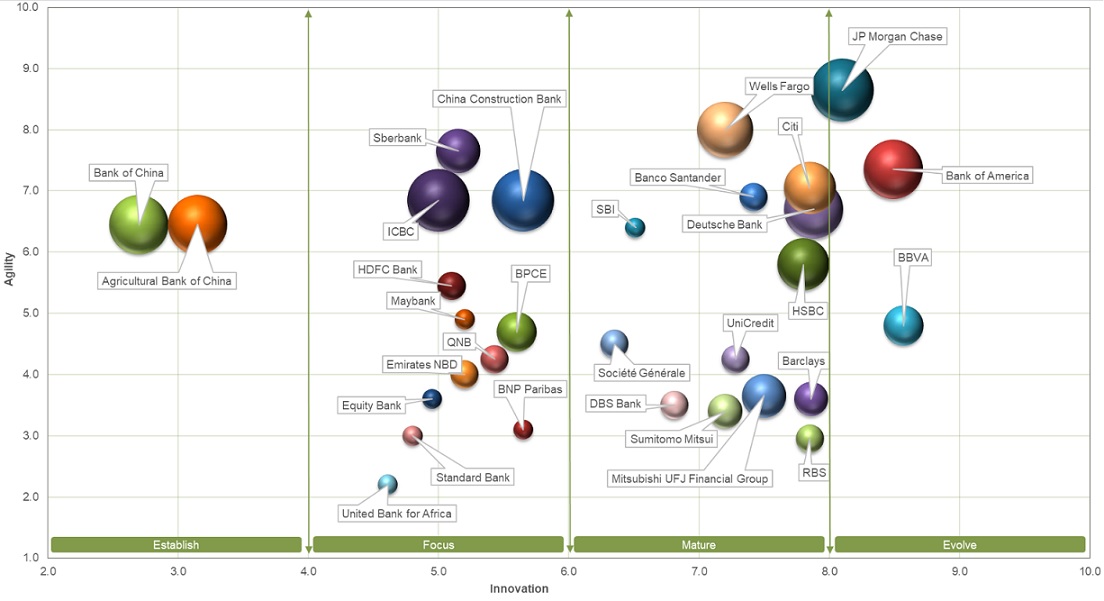

Leading Banks Positioned in Juniper Research’s Digital Transformation Readiness Index 2020

Banks invested heavily in digital transformation and new offerings in 2019, although the extent of these activities varied considerably. Juniper Research’s Digital Transformation in Banking Readiness Index analysed leading Tier 1 banks to evaluate their digital transformation readiness and highlight their respective positioning in their digital innovation roadmaps.

Bank of America offers extensive digital solutions, including the Erica chatbot, and has had noticeable upticks in digital usage and engagement. BBVA has focused on capitalising on APIs in banking, by offering the BBVA Open Platform, which is a Banking-as-a-Service platform. JPMorgan Chase has experimented with blockchain and is rumoured to be planning a digital-only launch in the UK.

Research author Nick Maynard noted: “These banks have executed highly effective digital transitions; however digital transformation is never complete. These banks must now refocus on the new strategies required to retain their digital leadership”.

The research also noted that traditional banks are launching digital-only brands, such as Bó from UK bank NatWest. The research cautioned that these launches must be differentiated from existing offerings and digital-only competition, in terms of providing a more personalised experience, or they will fail to gain momentum.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: