Challenger bank, Monzo, announced that it will be challenging high street lenders with its own short-term loans offering, according to .

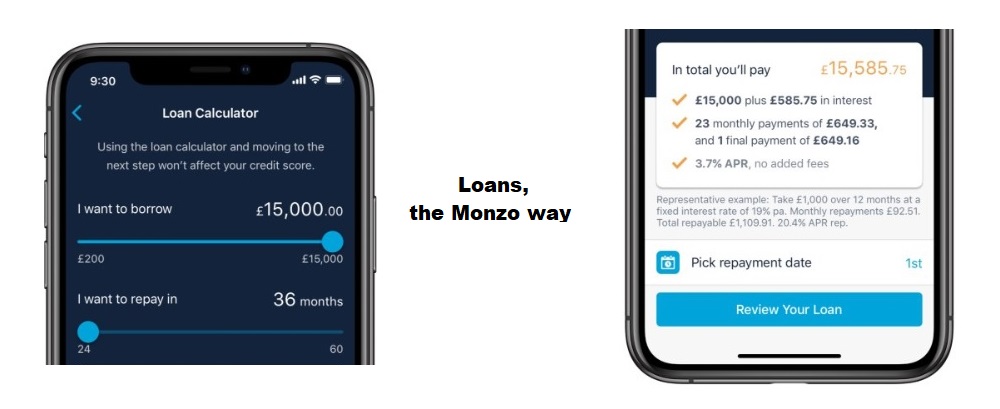

After piloting the loans with 4,000 of its users last year, the £2 billion company has now decided to roll out loans between £200 and £15,000 to its current account customers.

„Over the past 9 months or so, we’ve gradually been offering loans to more and more of our customers. We took our time to make sure we get it right. We did a bunch of user testing and research to understand the most painful things about borrowing money.

And we’ve used that feedback to continuously improve the experience of borrowing with us, so getting a loan could actually help people to solve a problem or reach a goal.”, said Tom Davies, Product Marketing Manager at Monzo.

Despite racking up £85 million in losses since it was founded five years ago, Monzo is determined to become profitable and move towards sustainability.

Monzo’s founder and CEO, Tom Bloomfield, denies trying to appeal to people with low credit scores just like Wonga did, who collapsed last year.

“These aren’t targeted at the sub-prime end of the market at all. You have to pass a relatively stringent credit check,” says Bloomfield.

“I don’t think you should force people to borrow thousands of pounds if they don’t need thousands of pounds. They just need £200 for a short-term need for three months and it’s a flexible tool.”

Unlike payday lenders, who usually scorch customers with interest charges equal to an annual percentage rate (APR) of 1,000%, Monzo is only charging a maximum 24% APR on loans up to £7,500, and loans worth between £7,500 and £15,000 are charged as low as 3.7% APR.

Monzo is the second digital bank to offer personal loans after Starling Bank launched its maximum £5,000 loans, but the competition may not end there, as both Revolut and N26 are tipped to bring them to the UK market soon.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: