Deloitte study about digital banking maturity: are EMEA’s banks prepared for the new world of banking?

Comprehensive digital maturity study of 248 financial institutions across 38 countries reveals significant gaps – and opportunities.

A mixture of changing consumer preferences, competition from FinTech start-ups, and regulations like the European Union’s revised Payment Services Directive (PSD2) have been forcing banks in Europe, the Middle East, and Africa (EMEA) to develop their digital capabilities. But not all of them have taken it on board to the same degree. Yet if you ask the banks themselves, nearly each one would consider itself a leader when it comes to digital. So what is the reality?

Until now, what has been lacking is objective data about how each bank is positioned with respect to its digital offerings, comparing apples to apples by taking into account the full spectrum of products and functionalities, mapped against consumer preferences in each market. That’s where the Deloitte EMEA Digital Banking Maturity project comes in, uncovering a number of surprising findings and serving as a digital playbook for any financial institution looking to come out as a winner in the post-PSD2 new world of banking.

Key findings

. Digital champions are those financial institutions which offer a wide range of functionalities relevant for customers and a compelling User Experience;

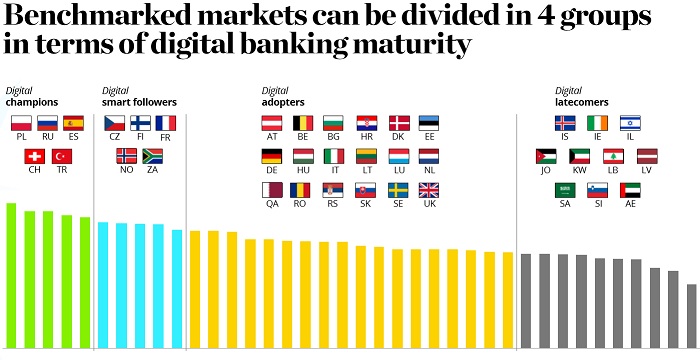

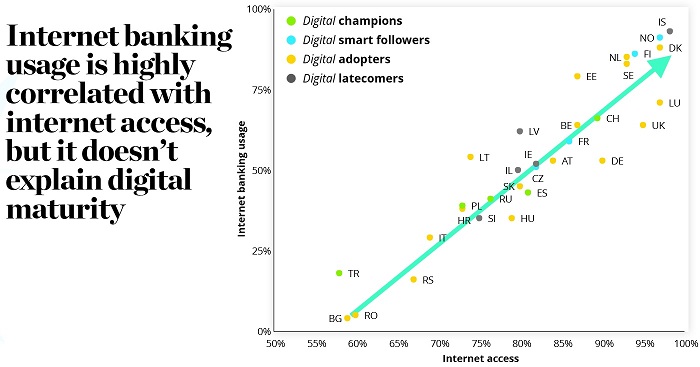

. EMEA markets can be broadly divided into 4 groups: digital champions, digital smart followers, digital adopters, and digital latecomers;

. Environmental pressure from customer preferences (expectations regarding services) and competitive pressure (digital “arms race” ignited by banks which decide to leverage digital channels as key competitive advantage) is responsible for creating EMEA’s digital champions;

. PSD2 and FinTechs will increase the market pressure, especially in those markets where customer expectations for digital services are already high and incumbents are unable to meet demand;

. Tomorrow’s digital banking champions will be determined by financial institutions’ readiness to offer Open Banking and Beyond Banking services, transforming themselves from a digitized traditional bank into a platform hosting both proprietary and third-party services.

Deloitte EMEA Digital Banking Maturity by the numbers: 238 banks, 10 FinTechs, 38 countries in EMEA, 136 mystery shoppers opening real accounts, 826 functionalities evaluated, 8,000+ customers surveyed, 6 customer journey steps, 3 digital channels, 197,000+ data points.

Download the Deloitte report: EMEA Digital Banking Maturity 2018 – How to become a Digital Champion and why only few succeed?

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: