Greenlight® Financial Technology, Inc. (“Greenlight”), the fintech company on a mission to help parents raise financially-smart kids, announced today a valuation above $1.2 billion after raising $215 million in Series C funding.

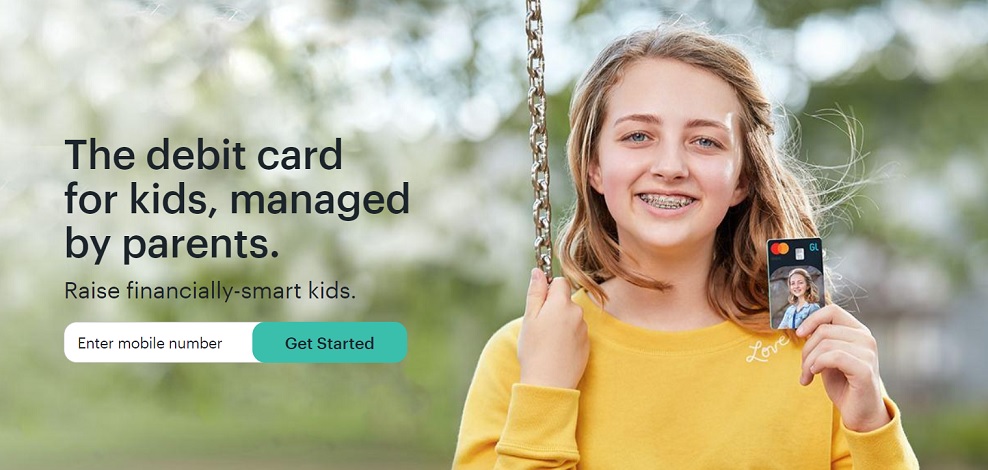

Since launchingits debit card for kids in 2017, Greenlight has experienced explosive growth. The company now serves more than 2 million parents and kids, helping them manage their family finances and navigate the world of money together. To-date, Greenlight kids have collectively saved more than $50 million.

“Greenlight’s rapid growth is a testament to the value they bring to millions of parents and kids every day. My wife and I trust Greenlight to give us the modern tools to teach our children how to manage money,” said Gardiner Garrard, Founding Partner at TTV Capital.

Greenlight is the comprehensive, all-in-one money management platform purpose-built for families. Its parent-managed debit card for kids with companion apps give parents the ability to pay allowance, manage chores and set flexible, store-level spend controls. Kids explore lessons in earning, saving, spending and giving with a debit card and app designed just for them.

“Greenlight’s purpose-based mission of bringing financial literacy to families is massively impactful.” said Neil Underwood, partner and co-founder of Canapi Ventures, “We’re super excited to back this amazing leadership team who is introducing financial services to an entirely new demographic.”

“Greenlight’s smart debit card is transforming the way parents teach their kids about responsible money management and financial literacy,” said Noah Knauf, general partner at BOND. “Having achieved phenomenal growth year-over-year, this is a company on the fast-track to becoming a household name.”

“Our vision is to help all families worldwide to be smart about personal finance, providing innovative ways for kids to learn, so that every child can reach their full potential.” said Tim Sheehan, CEO and Co-Founder of Greenlight.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: