Danske Bank has committed to become a net-zero bank by 2050 or sooner

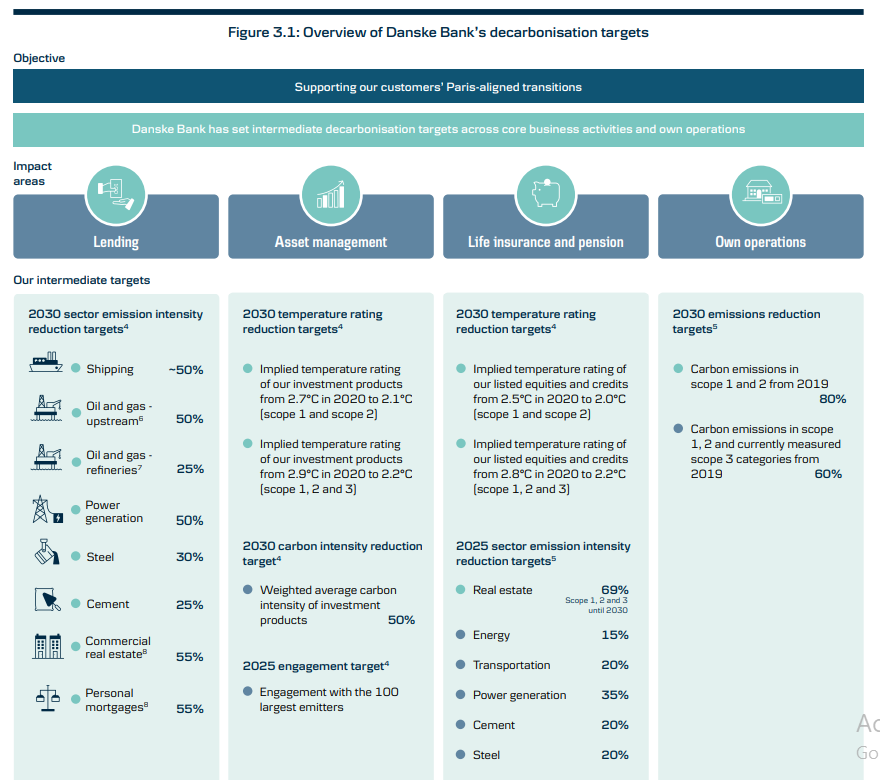

Danske Bank has released a detailed climate action plan setting goals for 2030 and 2050. Goals set in the plan for 2030 include: reducing scope 1 and 2 emissions by 80% from their levels in 2019, reducing shipping, oil and gas, and energy utility emissions by 50%, and cutting down on weighted-average carbon intensity by 50%.

Danske Bank is fully committed to leading the green transition. „We have reduced investments in and lending to oil and gas production companies by 37% and 50% respectively since 2020. The launch of a new and ambitious climate action plan that maps Danske Bank’s total carbon emissions from all of its activities, direct as well as indirect, marks the next step on this journey.” – according to the press release.

The mapping is based on 2020 figures, which provide the latest available data.

This data shows that the Group’s entire carbon footprint amounts to 41.1 million tonnes of carbon emissions, which underlines Danske Bank’s important role in the green transition as Denmark’s total carbon emissions in 2021 amounted to 44 million tonnes.

The mapping forms the basis for a comprehensive new climate action plan – a plan to ensure that by 2030 and 2050 Danske Bank and its customers will have reduced their carbon emissions in line with the goals of the Paris Agreement.

Reduction of financed emission intensity in high-emission sectors – for example: Shipping by 50%, Oil and gas (upstream) by 50% (absolute emission reduction target), Energy utilities by 50%, Commercial real estate by 55%.

“Being the second-largest bank in the Nordic region with close to 3.3 million customers and DKK 2,800 billion in invested capital and lending, we are in a unique position to contribute to solving the climate challenge. We have therefore prepared an ambitious plan to support our own and our customers’ transition towards a sustainable future. The plan encompasses all activities, from providing finance to personal customers who want to improve the energy-efficiency of their homes to businesses involved with fossil energy production that want to transition to more sustainable alternatives,” says Carsten Egeriis, CEO of Danske Bank.

„The climate challenge is incredibly complex. It is therefore crucial that our work is based on reliable data on the total emissions resulting from our financing and investment activities. This provides us with a solid foundation when defining specific targets and prioritising our efforts to ensure that we make the largest impact possible in terms of keeping the global temperature rise below 1.5°C,” says Carsten Egeriis.

More details: Danske Bank’s Climate Action Plan

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: