Customers of all German banks can now log in to and identify with partners with their existing online banking access data via „yes”

CRIFBÜRGEL, one of the leading information service providers for companies and private individuals in Germany, and yes today announced an extensive strategic collaboration.

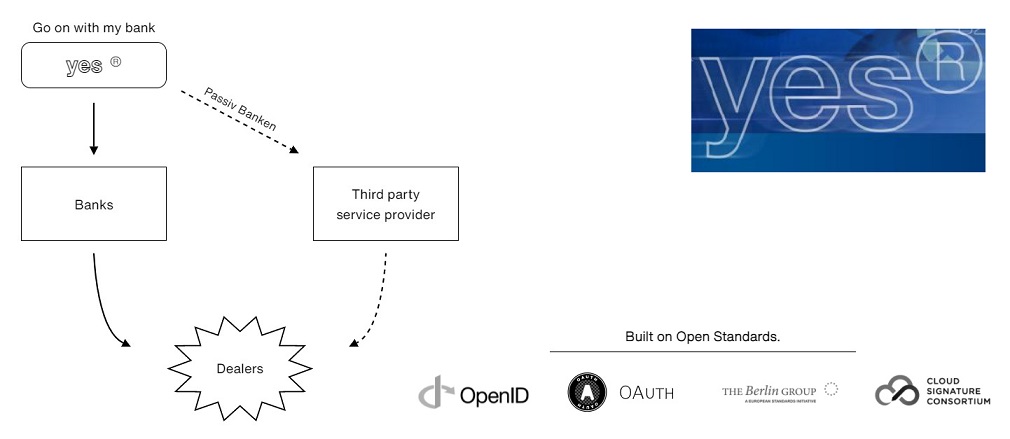

Through the cooperation with CRIFBÜRGEL as a so-called third party provider (TPP) within the meaning of the Second Payment Services Directive (PSD2), all those financial institutions are connected to the yes ecosystem that are not currently actively participating themselves. This means that customers of all German banks can now log in to and identify with partners with their existing online banking access data via yes.

Lendrise is the yes partner in Romania. As Romanian banks join the yes ecosystem, their customers will be able to use bank credentials for registration, identification, payment on various sites or applications in Romania or the EU.

CRIFBÜRGEL mediates the services of the yes ecosystem as a sales partner and combines these with the already existing services to form a holistic offer for all aspects of identity, credit risk & fraud management and open banking.

Through the partnership between the active banks and CRIFBÜRGEL within the yes ecosystem, yes’s range of services will be expanded to include services in the areas of credit risk management, fraud prevention and payment.

Like the Sparkassen-Finanzgruppe and the cooperative financial network of the Volksbanken and Raiffeisenbanken, CRIFBÜRGEL will be a strategic partner and shareholder of yes.

CRIFBÜRGEL will sell the services of the yes ecosystem in the future. Thanks to a unique combination of yes services with CRIFBÜRGEL B2B2C solutions in Ident, Credit Risk & Fraud Management, all services and products can be obtained via a single interface. yes is already connected to the CRIFBÜRGEL platform and is therefore part of customer onboarding processes in all relevant industries in which CRIFBÜRGEL is active.

Through the additional position of CRIFBÜRGEL as a third party provider (TPP), all those financial institutions are connected to the yes ecosystem that are not currently actively participating themselves. The additional services offered by CRIFBÜRGEL as TPP thus extend the yes basic functionalities and increase the added value and reach of the entire yes ecosystem. On the basis of the available PSD2 solutions from CRIFBÜRGEL, complete coverage of identity services across all banking groups is possible. In addition, there are far-reaching new ways of service expansion within the entire yes ecosystem in the direction of credit risk management, fraud prevention and payment.

Benefits for end customers in the yes ecosystem

The new cooperation brings significant advantages for end customers: Thanks to the cooperation with CRIFBÜRGEL, all German bank customers now have the option of making their identity data available to third parties for legitimation via the yes ecosystem. In addition, end customers will be able to use the yes ecosystem to pass on categorized information (for example in the tax return) and an automated budget bill (for example for credit inquiries) to partners in a very secure, transparent and data-saving way.

“The cooperation with yes is another important component of our performance promise as a best-in-class partner for integrated identity, credit risk and fraud prevention management. In the course of the extended cooperation, CRIFBÜRGEL acts in several roles and thus actively supports the growth and constant spread of the yes brand as an identity ecosystem of the banks. Thanks to the cooperation, the services are now also made available to customers of non-participating banks. In addition to initial identification services, our customers can already look forward to exciting new services in the areas of credit risk management, fraud prevention and payment within the yes ecosystem, ”says CRIFBÜRGEL Managing Director Dr. Frank Schlein.

„Together with CRIFBÜRGEL we are presenting the more data-efficient and more transparent alternative to today’s classic credit agency model,” says Daniel Goldscheider, CEO of yes.com. “CRIFBÜRGEL will connect all banks to yes that do not actively participate and at the same time support the vision that banks can provide their identity services directly. And always with full transparency and with the consent of the customers. We are pleased to have found a strong partner in CRIFBÜRGEL for a long-term cooperation.”

__________________

About yes.com

For customers of a bank with yes®, an identity confirmation is as easy as a transfer: Users: inside order the direct data transfer from the bank’s systems to the requesting partner. The data is not stored or evaluated anywhere else. The identity service yes® is a simple, fast and media discontinuity-free alternative to established identification solutions and is in writing. In addition to the approximately 35 million activated customers of the more than 1,000 affiliated partner institutions (Volksbanken, Raiffeisenbanken and Sparkassen), yes® is offered to all online banking users via CRIFBÜRGEL.

Partners participate in modular contract models, simple billing processes and transparent liability conditions. The offer was developed taking into account the PSD2 and eIDAS regulations and offers the possibility of a Europe-wide digital identity that guarantees the highest standards in terms of security and data protection.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: