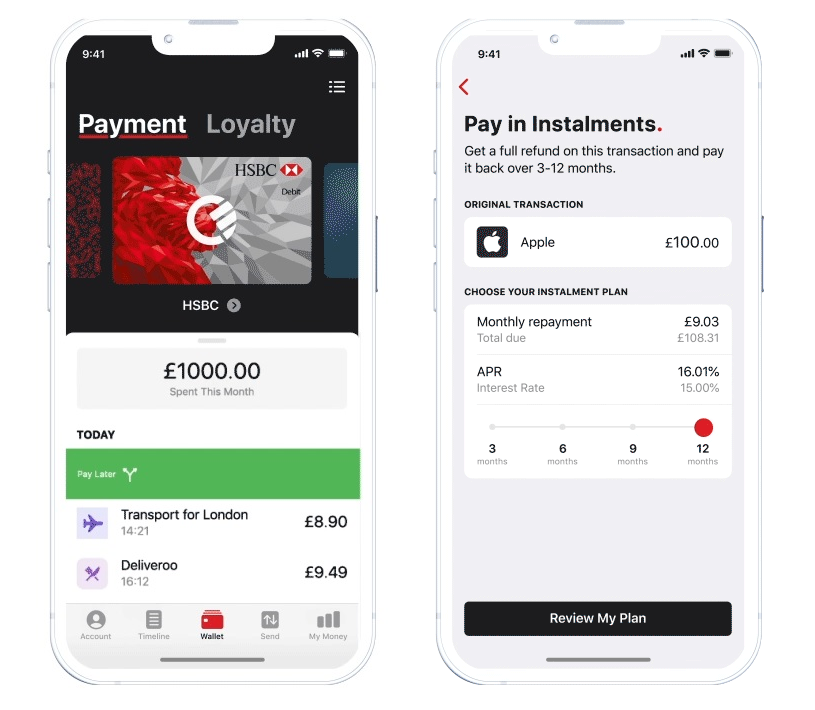

Curve customers would be able to go back in time and convert past payments from up to a year ago, into 3, 6, 9, and 12 instalment loans. Being able to Go Back in Time and Pay Later is going to forever change how customers think about managing their personal finances and cashflow. „It offers customers the power to pay later for almost any purchase made at any merchant, from any card, up to a year ago.” according to the press release.

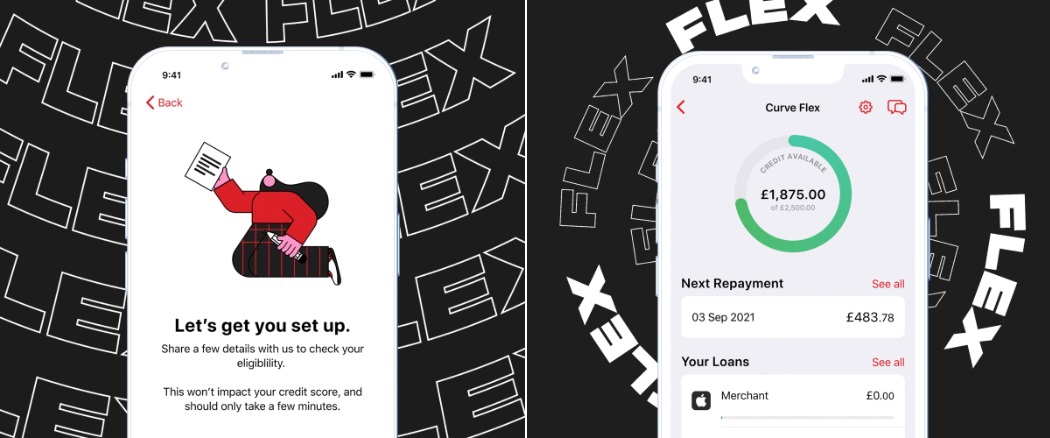

Curve, the fast-growing financial super app, announced Curve Flex, a unique rival to Buy Now Pay Later (BNPL). After receiving FCA approval on September 1st, Curve has quietly launched Curve Flex to simplify and unify credit.

Curve Flex builds on Curve’s patented and trademarked Go Back in Time technology to let customers convert almost any purchase made on any card linked to the Curve platform in the past 12-months into an instalment plan; all the customer has to do is swipe to pay later.

„Curve Flex is better than any existing BNPL solution on the market, as it is not restricted to specific merchants, accounts, cards, or products. It brings control back to the customer and is another step in Curve’s mission to become the super app for money.” the company says.

„Whether a customer wants to split a retail purchase, online order, household bill, or simply has an unexpected need for cash, they only need to swipe a transaction and select the number of instalments. The transaction is then refunded in full almost immediately, giving customers convenience and control over their money. Curve Flex is here to provide seamless and affordable cashflow support.” the company explains.

Curve Flex customers will be able to take advantage of a dedicated team of customer service agents who will be on-call solely to answer questions, amend plans, and help customers navigate their loans.

Curve Flex has been in testing since September 2020 and our 1,600 beta users have already “Flexed” around 7,000 transactions into affordable instalment loans worth over £1m.

Curve’s founder and CEO, Shachar Bialick said: “Why settle for a rigid copy when you can have the real thing? Curve Flex is almost certainly the most flexible credit solution in the market. With no limitations on merchants and the ability to accommodate all Mastercard, Visa, and Discover cards, Curve Flex will provide customers with access to easy and affordable credit.”

Head of Curve Credit Paul Harrald said: “Curve is giving customers the unprecedented ability to convert transactions made up to a year ago into free or low-interest instalment loans. Being able to Go Back in Time and Pay Later is going to forever change how UK customers think about managing their personal finances and cashflow. ”

_______________

Curve is a financial super app. It is on a mission to be the one-stop-shop for all of a consumer’s financial needs; a single point of access to a wide range of financial products and services, bundling together all your money into one smart card and an even smarter app. Unlike other services available in the market today, Curve allows customers to connect and supercharge their legacy banks to the 21st century, without leaving their bank or signing up to a new bank. Curve is live in 31 markets across the UK and European Economic Area (EEA).

Curve OS Limited is an introducer appointed representative of Curve Credit Limited, which is authorised and regulated by the Financial Conduct Authority (firm reference number 925447).

Curve supports Mastercard, Visa, and Diners Club networks. The Curve Card and e-money, related to cards issued in the UK, is issued by Curve OS Limited, authorised in the UK by the Financial Conduct Authority to issue electronic money (firm reference number 900926). The Curve Card and e-money, related to cards issued in the EEA, is issued by Curve Europe UAB, authorised in Lithuania by the Bank of Lithuania (electronic money institution license No. 73 issued on 22 of October 2020).

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: