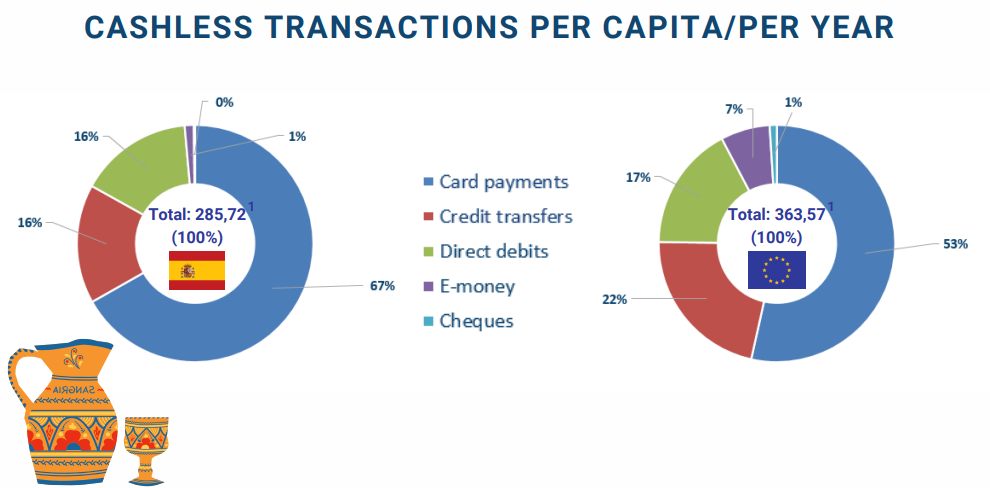

Contactless payments are over 80% of the card transactions in Spain. The instant mobile payment solution known as BIZUM, already has 26, million users and 2,724 million operations since its launch.

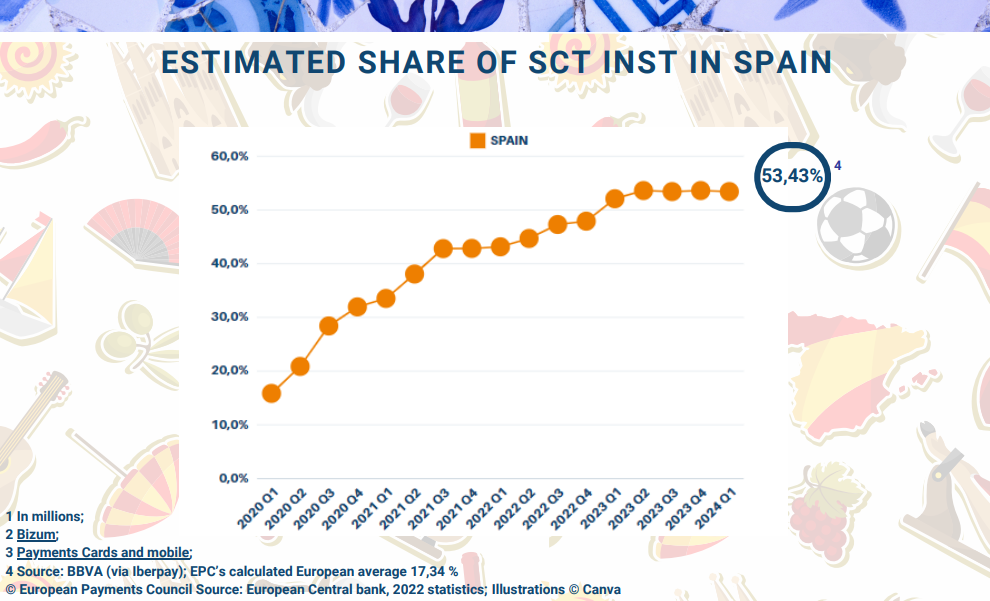

The most important change in Spain was the introduction of real-time payments in November 2017. Currently almost a hundred percent of Spanish institutions offer instant payments to their customers.

„One of the first direct applications of this payment method was Bizum. This service, providing peer-to-peer payments in real time, has been so successful that nowadays it represents almost fifty percent of payments between accounts and has 26 million users.” said in a EPC interview Raouf Soussi Laghmich – Head of Corporate Payments Strategy at BBVA.

The BBVA’s representative believes that OCT Inst scheme is the next logical step towards real-time payments to improve the customer experience.

„The proof of concept (POC) we have used in Spain has given good results, and the current version of the scheme is quite complete, although in the future it will have to evolve according to further needs that are detected. However, it needs to be widely adopted by market players. To this end, we are holding meetings at the community level to review what needs to be done so that it can be adopted by all entities as soon as possible. It would be ideal if that could be done this year.„

What is next on the agenda for payments in Spain? What developments do you foresee in the payments sector in the next few years?

„The use of real-time payments, e.g. by companies, should be further consolidated. That means we need to look at what the companies need (batch booking, advanced tracking, etc.). Another way to increase the use of instant payments is to develop and promote the use of additional services, such as Request-To-Pay, which could be used in many use cases in sectors such as insurance, utilities, etc. There will also be new use cases for Bizum, and the cross-border world will grow in functionality.”

_____________

The One-Leg Out Instant Credit Transfer (OCT Inst) scheme – is a cross-currency payment scheme to support the processing of incoming and outgoing international instant account-to-account based credit transfers. It is distinct from other EPC payment schemes as it is the first EPC scheme which covers exclusively the Euro Leg of international instant credit transfer entering or leaving the geographical scope of SEPA.

What is a One-Leg Out transaction?

It is a transaction whereby only one of the payment service providers (PSPs) – either the Payer’s or the Payee’s – is located in the Single Euro Payments Area (SEPA) Schemes’ Geographical Scope.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: