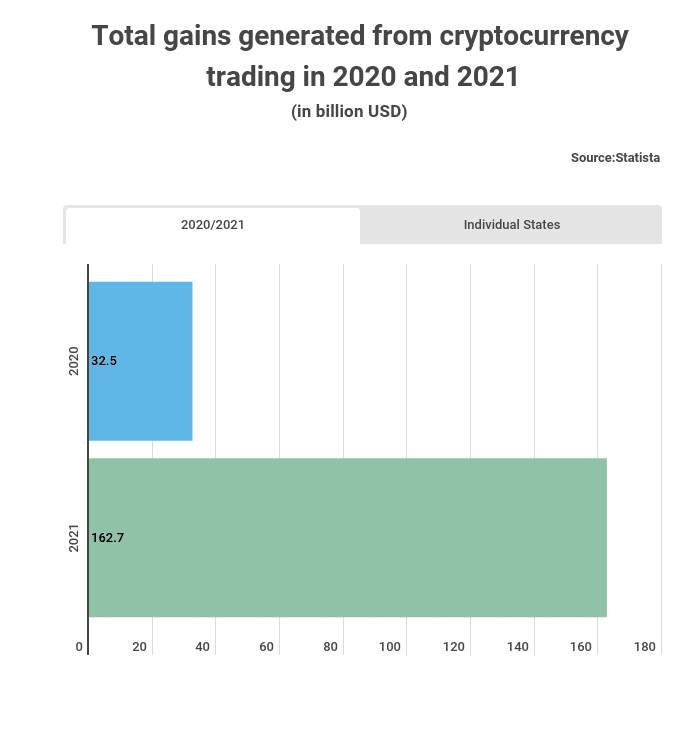

Cryptocurrency trading generated around $163 billion in profits in 2021

Despite the volatility of the virtual currency, crypto investors had a successful year in 2021. According to data presented by StockApps.com, crypto investors made $162.7 billion in profits. This significant amount of profit represented an increase of nearly 400% from 2020. A year earlier, Crypto didn’t perform well, earning a paltry $32.5 Billion.

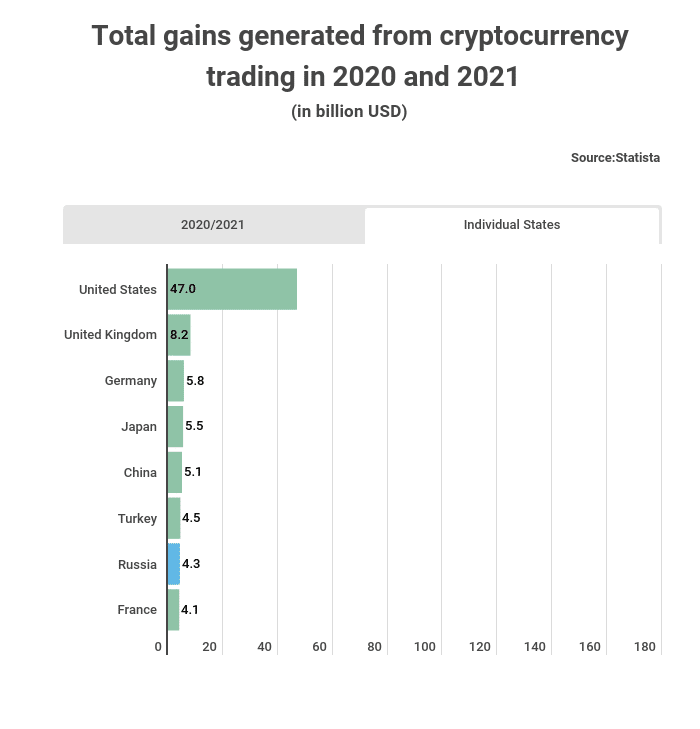

Cryptocurrency is a worldwide phenomenon. Yet, United States investors made the highest profits. Germany and the United Kingdom ranked the second and third countries in profits made.

Commenting on the data, StockApps.com Edith Reads had this to say. “The market favored the US. Out of the total profits, it collected approximately $47 billion. Thus accounting for close to 30%.” Edith further pointed out that the United Kingdom, Germany, and Japan followed in that order. He noted that China had issues hence low profits.

“China had a lot of disappointing moments. The outlawing of bitcoin mining and crypto trading platforms was a huge hindrance. Thus, it casts doubt on the viability of investing in cryptocurrencies.”

China, with its dynamics

The data indicated China’s ban on cryptos, particularly concerning mining activity in that country. The ban led to a mass exodus of crypto mining firms out of China. So, they switched their operations to jurisdictions with more favorable regulatory environments.

Earlier, StockApps.com raised attention to crypto’s slow growth rate in China. They claimed the slow growth rate was due to its regulatory crackdown against cryptos.

China has continued to believe that bitcoin and other cryptos could lead to financial instability. They see the lack of stringent restrictions as a loophole. Yet, China does not hold an utterly negative view of virtual currencies. The country is working on developing a virtual version of the yuan, which is its national currency.

There is a drop in the number of transactions conducted with cash. There will be a tremendous reduction in cash transactions in the not-too-distant future. Moreover, digital currency will overtake fiat currency.

South Africa made it to 50, with $827.6 million in realized gains. This accounts for 0.51 percent of overall realized gains. Nonetheless, the statistics did not mention Nigeria.

Most profitable coins

According to the research, bitcoin and Ether accounted for most of the gains (93 percent). The report showed that Ether had more significant gains than bitcoin, with $76.3 billion versus $74.7 billion.

The results prove that demand for Ethereum and BTC rose in 2021. Ethereum rose due to the adoption of DeFi systems since most of the protocols exist on Ethereum networks.

The report is simply an approximate estimate of how much crypto traders profited last year. StockApps claims to track the difference between cash deposited on exchanges and amounts removed.

The paper also stated that it is challenging to segment on-chain data by country. This is likely because blockchain transactions do not contain geographical information by definition. The estimations depended on transaction data and web traffic metrics from Chainalysis.

As a result, the identified crypto exchanges’ activity data were evaluated to calculate the estimated values.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: