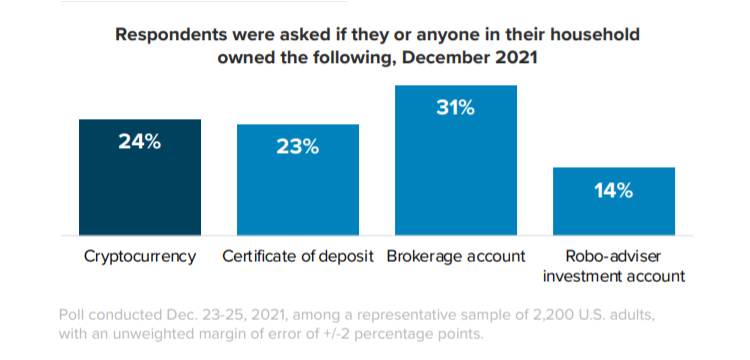

Cryptocurrency is now mainstream, at least in the U.S. market: Crypto ownership is roughly equal to certificate of deposit ownership

Prepare for the 2022 crypto boom. Cryptocurrency ownership continues to rise, buoying crypto-related brands in the process. But cryptocurrency owners aren’t abandoning their relationships with traditional providers. Instead, they’re working with more.

„The share of U.S. adults who report owning cryptocurrency is roughly equal to the share who report owning a certificate of deposit, and not a far cry from the share who report having a brokerage account,” according to Morning Consult’s quarterly report The State of Consumer Banking & Payments.

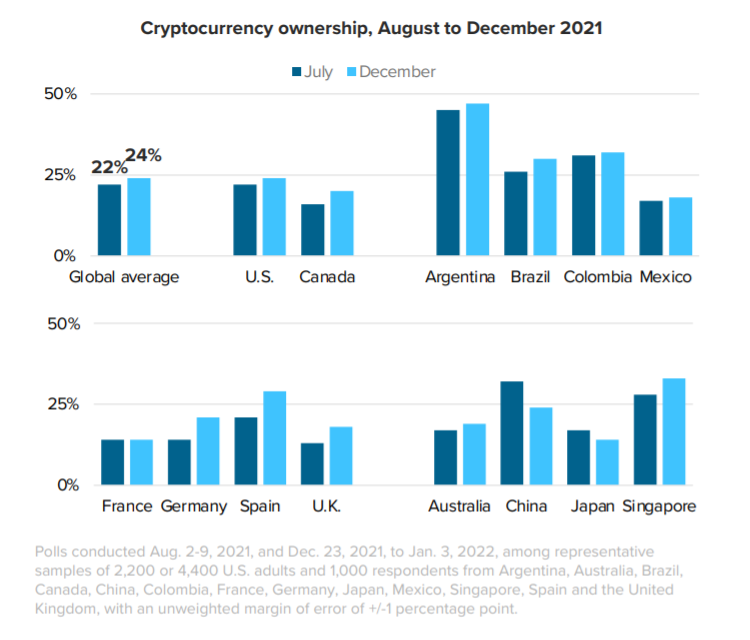

Nearly 1 in 4 consumers (24%) in our recent global survey reported household ownership of cryptocurrency, up 2 percentage points from July. Latin American countries still have among the highest rates of cryptocurrency ownership, but European nations Germany, Spain and the U.K. have grown significantly in the past six months.

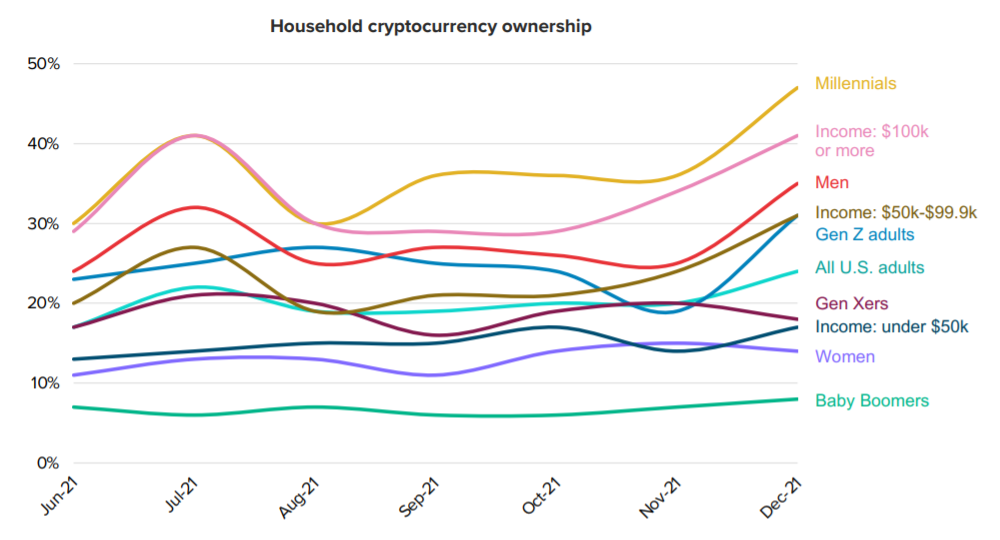

MEN, MILLENNIALS, HIGH EARNERS DRIVE CRYPTOCURRENCY GROWTH, WITH GEN Z ADULTS CLOSE BEHIND

Cryptocurrency ownership surged in July, most likely due to a drop in the price of Bitcoin and surrounding media coverage. But demographically, the new crypto-owners looked very similar to those who already owned crypto: They were mostly high-earning, millennial men.

Gen Z adults have also shown strong growth in cryptocurrency ownership and will continue to be instrumental to the success of cryptocurrency more broadly. Baby boomers remain largely disinterested in cryptocurrency. Their reported cryptocurrency ownership has stayed relatively stable throughout the year, ranging from 6% to 8%.

CRYPTOCURRENCY OWNERS ARE DISPROPORTIONATELY HIGH-EARNING, MILLENNIAL MEN

Men make up 70% of cryptocurrency owners but only 48% of the general population.

High-income individuals represent a disproportionately high share of cryptocurrency owners, a quarter of whom report annual household incomes of $100,000 or more, compared with 15% of the general population.

Cryptocurrency owners are more likely than the general population to be Hispanic. While 15% of the population identifies as nonwhite Hispanic, 24% of cryptocurrency owners say the same

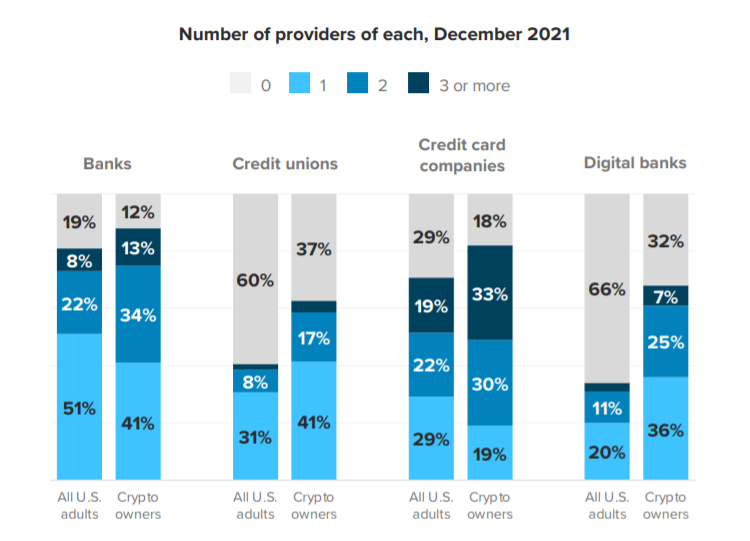

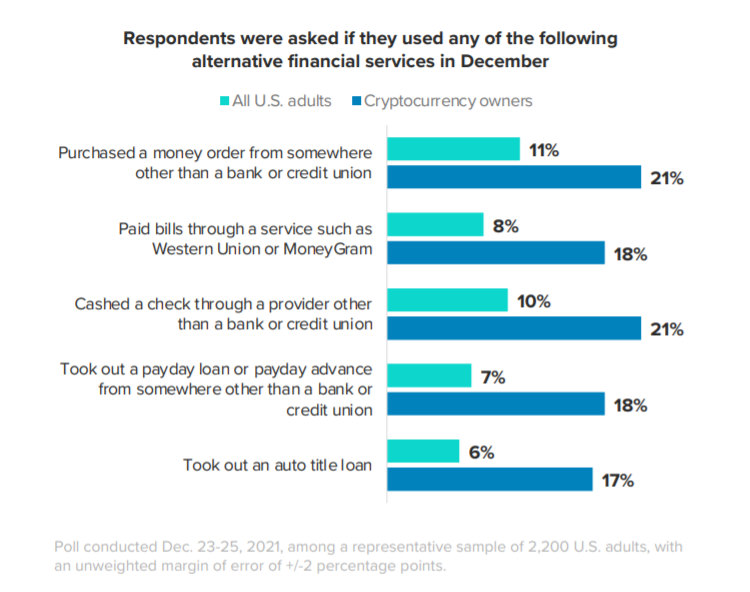

CRYPTOCURRENCY OWNERS USE MORE FINANCIAL SERVICES PROVIDERS AND ARE ESPECIALLY FOND OF DIGITAL BANKS

WHAT IT MEANS: CRYPTOCURRENCY WILL BOOM IN 2022

Look for continued adoption of cryptocurrency and related brands in the next year as younger generations lead the charge. Cryptocurrency has proved to be more than a passing fad. It will continue to gain consumers’ attention and share of wallet in 2022. But cryptocurrency owners, although concentrated among certain demographics, are not a homogenous group. They represent consumers across different income levels, generations, and races and ethnicities.

They are also not abandoning traditional financial services as a result of their interest in cryptocurrency. On the contrary, they are more likely than the general population to use multiple financial services providers.

As leaders at traditional financial institutions seek to understand the future of cryptocurrency and their role in it, they should focus closely on the habits and attitudes of current cryptocurrency owners and look for ways to meet their needs.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: