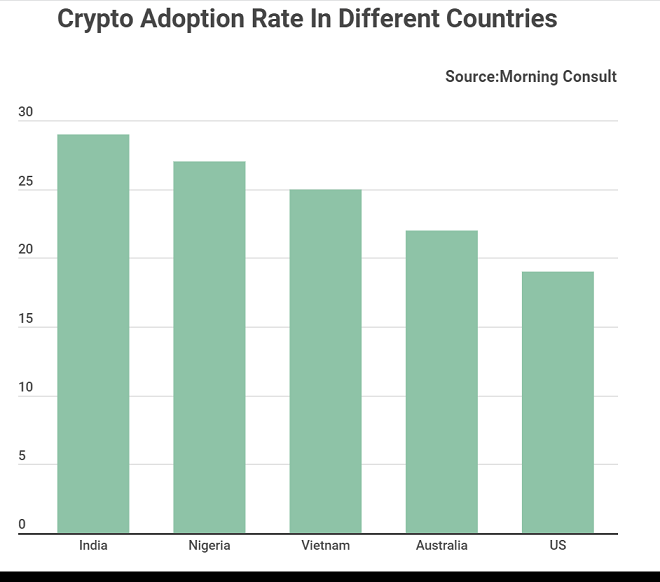

Crypto adoption nears mainstream as the adoption rate in the U.S. approaches 20%. India and Nigeria lead the pack, with 29% and 27% of the population owning digital assets, respectively.

Many U.S. citizens are now turning to cryptocurrencies as a way to store their wealth and as an investment. The adoption of digital assets has been growing at a rapid pace in the country, with almost 20% of the population now owning some form of cryptocurrency. This is according to data by BanklessTimes.

BanklessTimes.com CEO Jonathan Merry said, „The data suggests that awareness and ownership of cryptocurrencies have grown significantly in the last year. The number of American adults owning cryptocurrencies went up as the price of bitcoin began to fall. Most people saw the drop as an opportunity to buy the dip.”

Compared to other countries, the United States is still lagging in terms of crypto adoption. India and Nigeria lead the pack, with 29% and 27% of the population owning digital assets, respectively. In Vietnam, the number is around 25%, while in Australia, it is 22%.

An Imminent Executive Order

The U.S. President, Joe Biden, issued an executive order earlier this year for the government to compile a report on the „risks and benefits of cryptos.” However, the decree does not specify which asset class cryptocurrency would fall in. It is speculated that digital assets might finally get the regulatory clarity they need to go mainstream after the government’s report.

The executive order built Americans’ confidence in cryptocurrencies and, thus, more adoption. The order also meant that the government could consider drafting a proper legislative framework for digital assets.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: