Starting today, Credit Europe Bank is launching the Confirmation of Payee Service – SANB (Serviciul Afișare Nume Beneficiar), „which offers free of charge to all customers an even higher level of security through the option to verify the identity of the real beneficiary of payments and transfers in lei, made through electronic channels such as Internet and Mobile Banking” – according to the press release.

The service is offered in partnership with TRANSFOND, the administrator and operator of the Automated Clearing House for Interbank Payments, and administered by the Romanian Association of Banks.

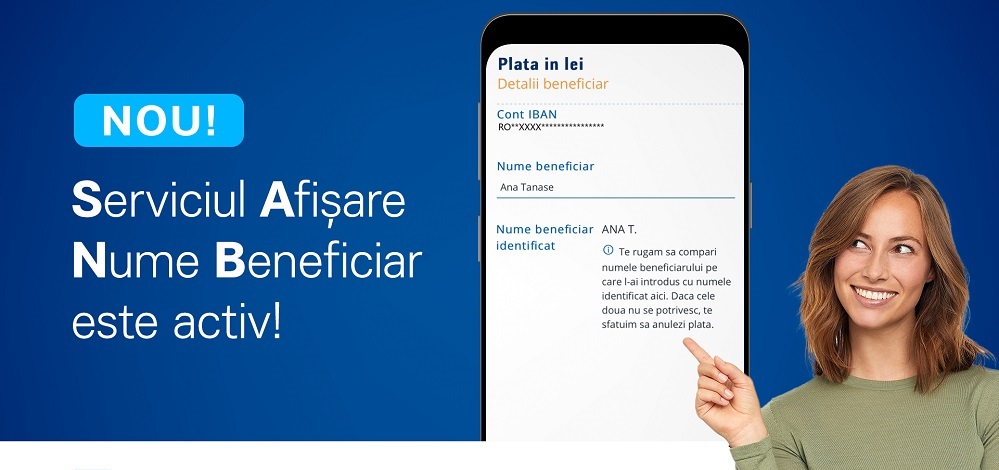

When entering the IBAN account of the beneficiary, the payment initiation screen will automatically display the partial name/truncated name of the IBAN account holder introduced by the paying customer. In the case of payments to individuals, the first name and initial of the beneficiary’s surname will be displayed, and in the case of a transaction to a legal entity, part of the company name will be displayed. Thus, if the payer notices a discrepancy between the known information about the account holder and the information displayed, they have the possibility to correct the payment order or to stop the payment.

„We are pleased to announce that we are joining the Beneficiary Name Display Service (SANB), an important new step in growing the security of electronic payments operated by Credit Europe Bank clients. SANB brings added protection against online fraud by automatically verifying the identity of the IBAN account holder for transfers in lei, thus reducing the risk of erroneous transactions. Through this partnership with TRANSFOND, we continue implementing our digitalisation strategy, to provide our customers with a safe experience through using the newest solutions in the field”, said Yakup Çil – CEO Credit Europe Bank.

„To uphold public confidence in the banking system and support the development of a secure and efficient payment ecosystem in Romania, beneficiary verification is becoming an essential element. Cases of fraud can negatively impact banks’ reputation and affect both trust in cashless payments and the financial stability of the institutions involved. In this context, we invite all banks to collaborate to enhance the security of payment orders – whether instant or traditional – and to actively participate in strengthening this protection system,” stated Sabin Carantină – General Manager of TRANSFOND.

To take advantage of this new SANB functionality in Credit Europe Bank’s monet Mobile Banking app, customers need to make sure they have downloaded the latest version from Google Play or App Store. When using Internet Banking, the functionality is automatically activated without any further action required.

The Beneficiary Name Display Service is available 24/7 among SANB participating banks. In the case of a payment to an account opened with a bank that has not yet joined this service, the beneficiary’s name will not be displayed. The bank has also developed a similar functionality for intra-bank payments (between Credit Europe Bank customers).

A member of the Dutch financial group Credit Europe Bank NV, the Bank has been active since 1993, when it operated as the Industrial and Commercial Credit Bank, becoming Finansbank (in 2000) and then, in 2007, following a rebranding process, receiving the name of Credit Europe Bank Romania.

___________

TRANSFOND is the administrator and operator of the Automated Clearing House for interbank commercial payments. Its main activity is providing services to financial and banking institutions for interbank retail payments in both the local currency and euro, covering both national and cross-border transactions.

In October 2024, TRANSFOND launched RoPay – the first national instant mobile payment service in Romania, enabling account-to-account (A2A) transfers directly between bank accounts. RoPay utilizes technologies such as QR code scanning, deep link, NFC (contactless), or mobile numbers as an alias (proxy) for IBAN.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: