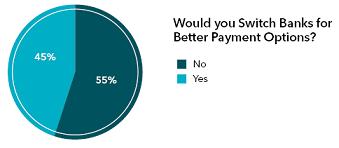

Corporates are not willing to switch banks for better payment services – survey

May 3, 2012 – The majority (55%) of corporate customers say that they would’t be willing to leave their current bank if they believe another offered better payment services, according to a SunGard survey.

May 3, 2012 – The majority (55%) of corporate customers say that they would’t be willing to leave their current bank if they believe another offered better payment services, according to a SunGard survey.

The survey of 171 corporations from multiple industries, found that the typical respondent sends thousands of payments to hundreds of vendors each month, with some spending upwards of 80 hours a month processing transactions, incurring tens of thousands of dollars in annual direct and labour costs.

Although 45% say that they would switch banks for better payment services, there is considerable ignorance among respondents about what their providers offer. Just under half (48%) either do not know what payments services their bank offer or skip the question.

Although 45% say that they would switch banks for better payment services, there is considerable ignorance among respondents about what their providers offer. Just under half (48%) either do not know what payments services their bank offer or skip the question.

Among those who do respond, more than 80% report that their current bank does not offer both of the payments services they wanted most: an integrated product and vendor enrolment services.

Nancy Atkinson, senior analyst, Aite Group, says: „Payments are fee-based, and were strong contributors to bank revenue during the economic crisis. By implementing the key solutions most sought after by business customers, banks will achieve cost savings and greater revenue opportunities going forward.”

„To gain new customers and avoid losing existing ones, banks can easily expand their payment offerings by white labeling an existing offering that supports all payments formats and has the ability to easily migrate vendors from check to ACH or virtual card. Banks would then be in a strong position to leverage their existing relationships to educate and provide corporate customers with their improved payments offerings”., according to SunGard White Paper.

SunGard is one of the world’s leading software and technology services companies with more than 17,000 employees and serves approximately 25,000 customers in 70 countries. SunGard provides software and processing solutions for financial services, education and the public sector. SunGard also provides disaster recovery services, managed IT services, information availability consulting services and business continuity management software. With annual revenue of about $4.5 billion, SunGard is the largest privately held software and services company and was ranked 434 on the Fortune 500 in 2011.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: