Contactless Payment Market size is set to be over USD 100 billion by 2026, according to a new research report by Global Market Insights, Inc.

Contactless Payment Market size exceeded USD 40 billion in 2019 and is estimated to grow at 15% CAGR from 2020 to 2026. The global industry shipments are projected to reach 15 billion units by 2026. Growing demand from consumers and merchants to reduce transaction & billing time will propel the market growth.

Advancements in networking infrastructure and rising government initiatives

Ongoing advancements in networking infrastructure and rising government initiatives for the development of smart solutions are the key industry driving factors. Several government administrations are encouraging their merchants to adopt advanced payment solutions. For instance, the Government of Australia is insisting retailers to adopt POS systems for contactless debit card transactions, as a result, since 2018 more than 90% face-to-face transactions made in the country were contactless.

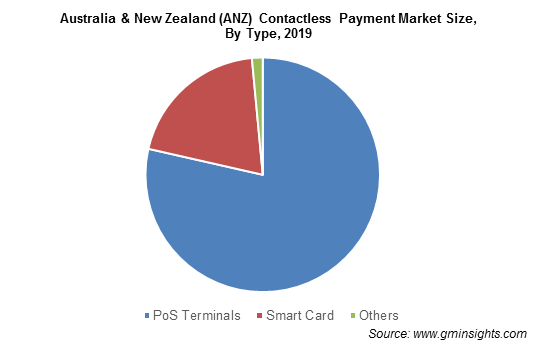

The Australia & New Zealand (ANZ) contactless POS terminals market is predicted to register over17% growth rate through 2026.The rapid shift toward advanced POS terminals will push the adoption of contactless payment solutions. According to Security Technology Alliance and Visa, Inc., more than 70% of the U.S. market players have POS terminals that are hardware-capable for contactless payments.

Growing adoption of NFC-based payment solutions globally

The NFC technology segment accounted for around 60% of global market revenue share in 2019 owing to the extensive usage of NFC technology, facilitating real-time transactions. The solutions enable faster transaction process, easy support, and secure payment. Growing penetration of NFC-based mobile handsets is contributing to the NFC-based contactless payment market growth. The technology provides short-range communication between electronic devices, providing a high degree of customer satisfaction & experience and helps in fast-tracking connections. Demand for NFC-based contactless payment systems is growing from the transportation, retail, and healthcare industries.

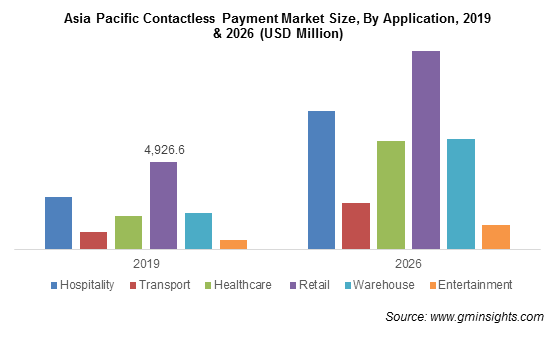

Demand for contactless payments solutions from the Asia Pacific retail industry

The Asia Pacific contactless payment market will expand at 17% CAGR during the forecast timespan. Rapid adoption of contactless POS terminals in the retail industry is being witnessed. Contactless POS reduces transactional time and helps retailers to accelerate transaction process and reduce counter queues. Inserting an EMV chip takes 30 seconds while a contactless method only takes 15 seconds, saving 15 seconds per transaction.

Consumers also prefer contactless payment options. According to the Mastercard Survey, more than 68% of consumers in Asia Pacific prefer to shop at stores with contactless payment options. As a result, retailers are moving from traditional systems to contactless payment options.

In 2020, the COVID-19 pandemic has become a catalyst in the widespread market adoption of contactless payments. As a result of the pandemic, retail stores have limited the number of consumers in their stores, improved their sanitization regimen, and introduced social distancing markers. The pandemic will force retailers to implement protective measures and adopt contactless POS terminals within their stores.

Growing circulation of contactless smart cards in Europe

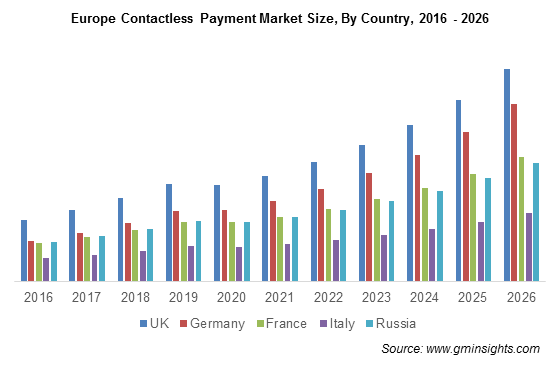

Europe held more than 25% of the industry shipments in 2019 and is anticipated to dominate the contactless payment market during 2020-2026 due to consistently growing electronic payment transactions in the region. Visa and Mastercard accounted for majority of electronic payment transactions and more than 85% of the transaction via payment cards in Europe were on these cards. The secured performance of smart card transactions along with payment solutions enabled by real-time and biometric will drive demand for contactless payments.

Prominent companies in the region are Thales Group, IDEMIA, and Ingenico Group SA. Robust growth of account-to-account payment systems at the POS terminals in countries including Russia, Denmark, Sweden, Italy, and Spain will further augment the regional demand for contactless payments. Moreover, favorable government regulations such as second payment services directive and open banking are also contributing to the market growth.

Market players are adopting several strategies to penetrate untapped markets

The contactless payment market players are focusing on business strategies, such as new product development, to increase customer base and strengthen their product portfolio. For instance, in January 2020, Mastercard certified the first contactless fingerprint payment card by Thales Group. This new certification will ramp-up product adoption in the technologically advanced countries. The project is currently deploying several pilot projects.

Stakeholders are also adopting inorganic business strategies by acquiring companies that can enhance their value proposition and complement their existing product lines. For instance, in April 2019, Thales Group acquired Gemalto and become a global leader in digital identity and security. The acquisition increased its revenue to more than USD 19 billion and enhanced its product portfolio.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: