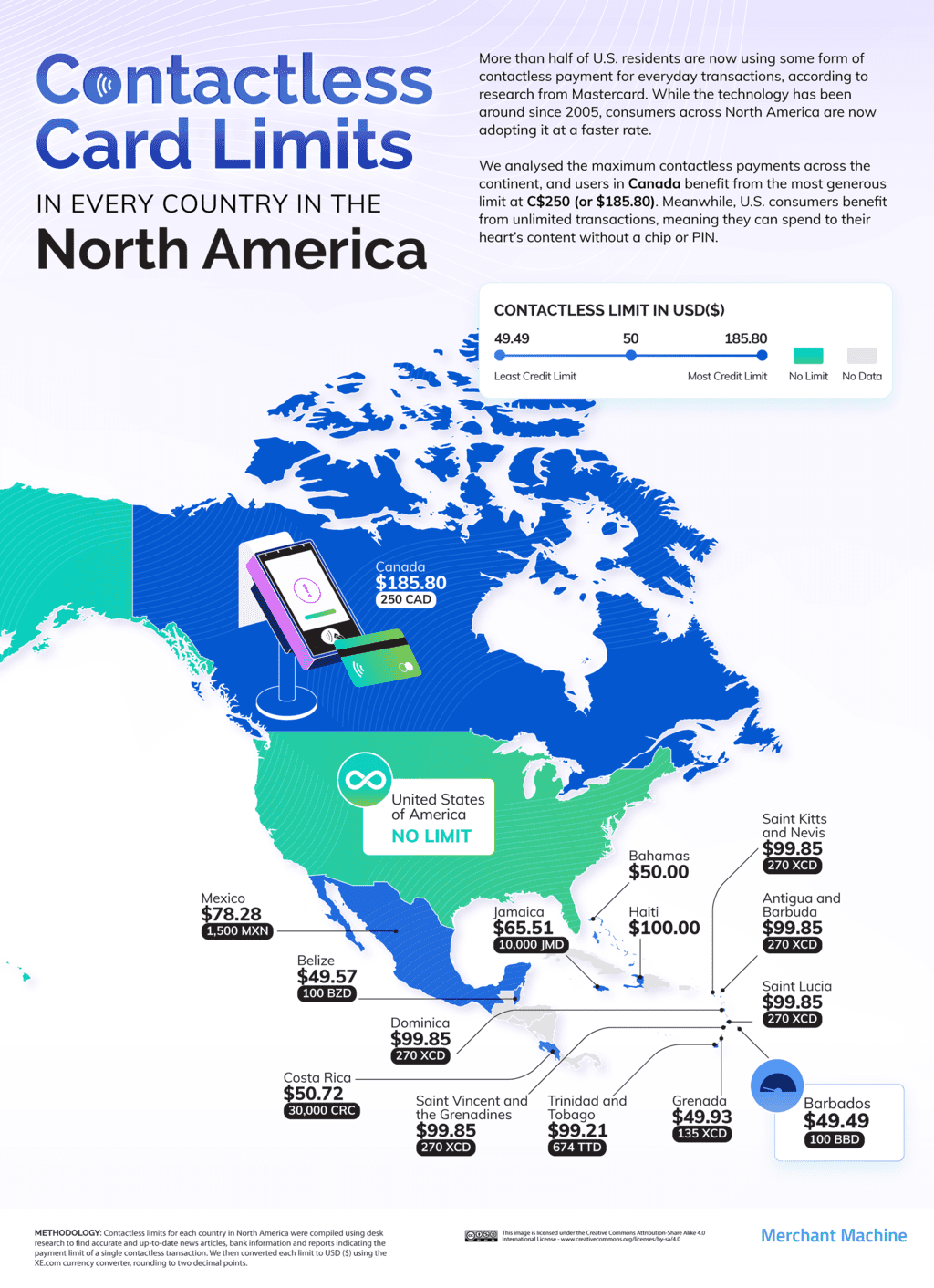

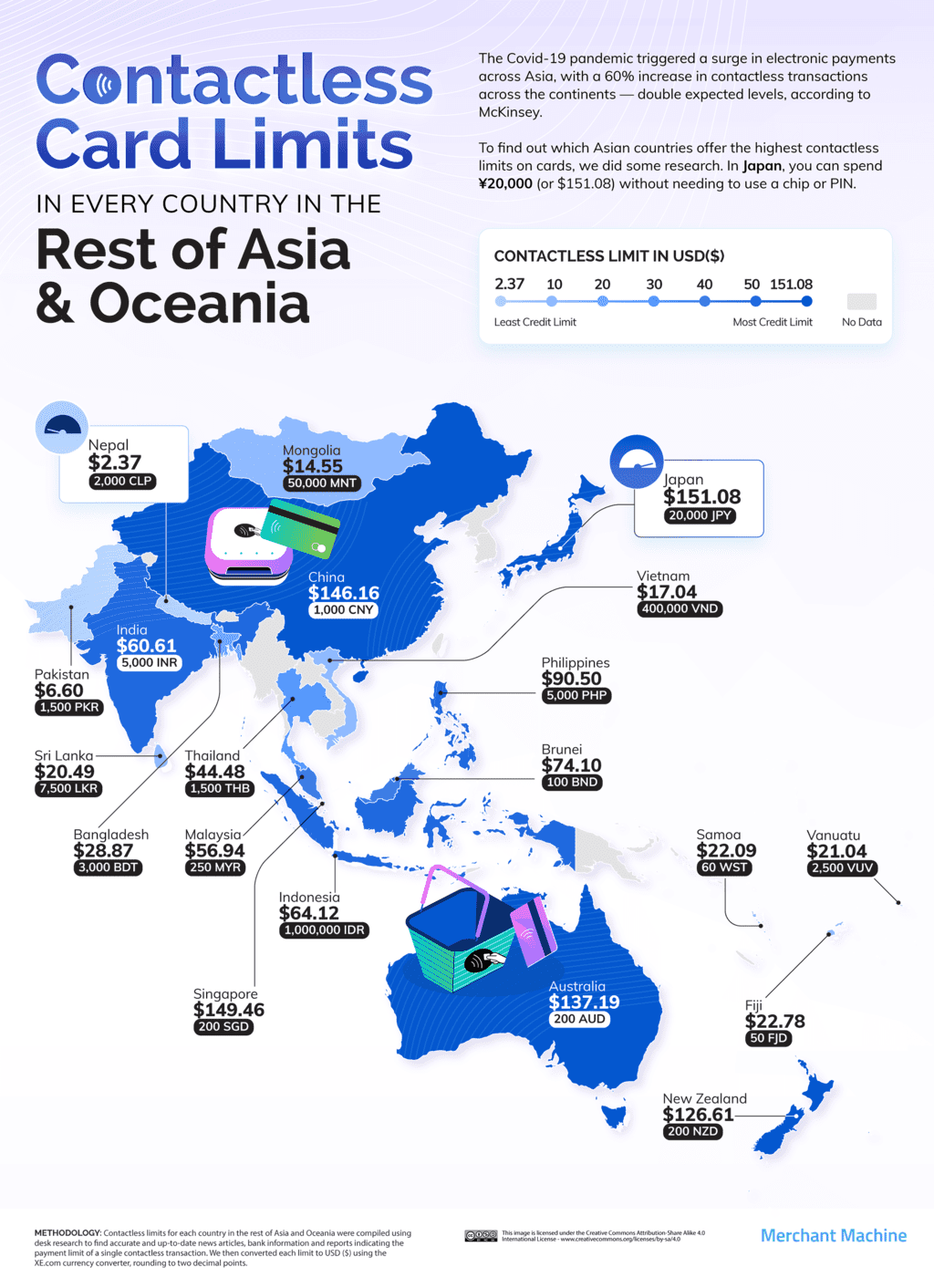

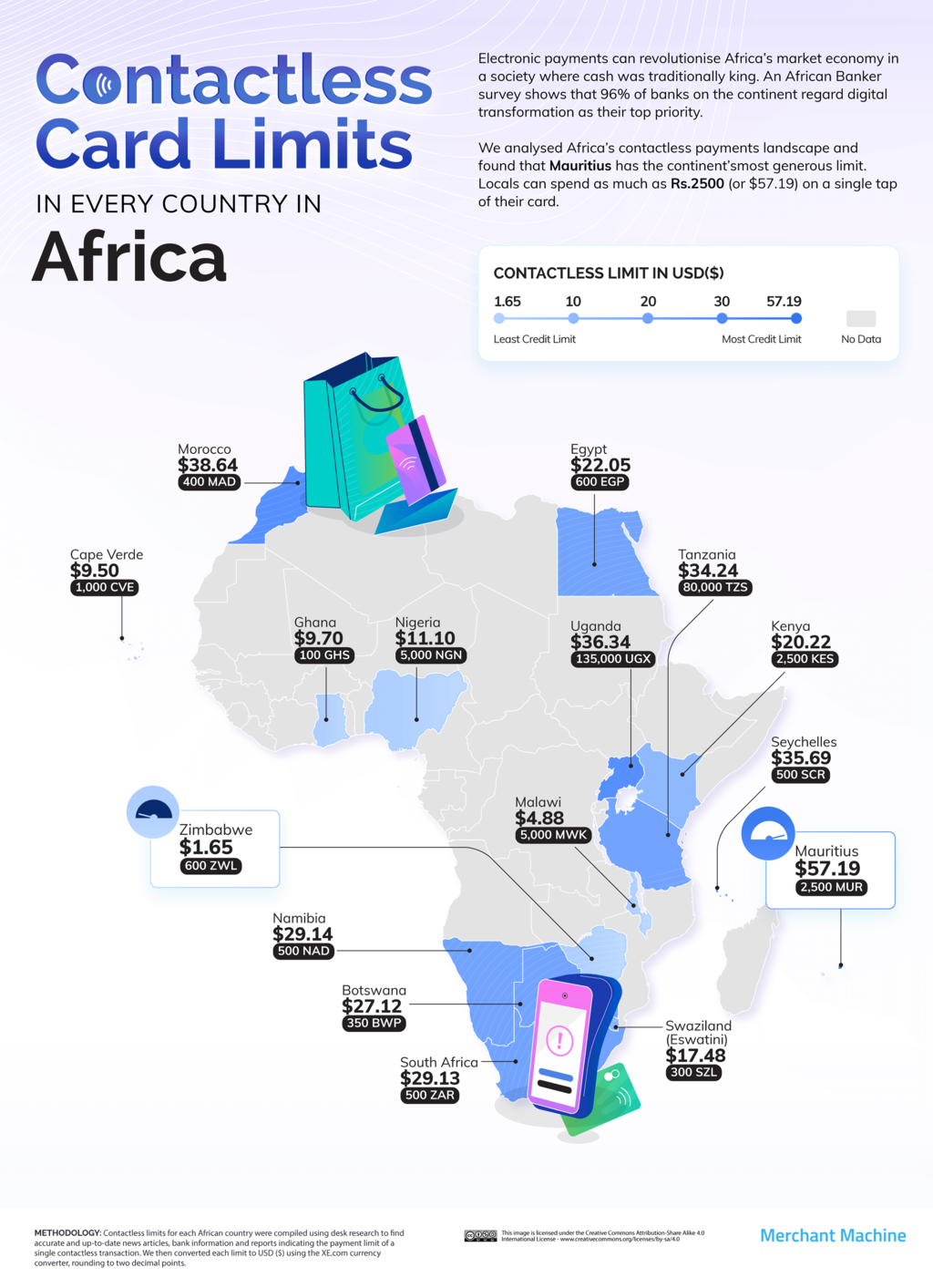

Venezuela has the highest transaction limit of any country in the world, with a limit of 5000Bs or $272.02 (£225.59). Five of the ten highest limits in the world are in Asia, with consumers in Japan benefiting from the highest transactions ($151.08 or £125.29) on one card tap. The UK ($120.65 or £100) has one of the highest card limits in the world and the largest in Europe. Two countries – Ecuador and the United States – have unlimited card limits, according to a research done by Merchant Machines.

Contactless payments are made possible with near-field communication (NFC) technology, and the concept first gained popular usage on Seoul’s transport network in the 1990s. By 2003, Transport for London had introduced the highly successful Oyster card scheme to replace paper tickets on its services; this in turn inspired Barclaycard to offer Britain’s first contactless bank card for customers in 2007.

Since then, consumers have been feeling more comfortable swiping to purchase goods and services – with a global Mastercard survey revealing that eight in ten customers are happy to do so. But which countries have the highest limits on contactless transactions in 2023? Merchant Machine has analysed the global payments landscape to find out.

Using a range of up-to-date and accurate sources, from international bank websites to government policy reports, Merchant Machine researched the transaction limit for a single purchase on a contactless credit or debit card. The research found 131 countries in total, including two – Ecuador and the United States of America – that have no transaction limit.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: