Consumer Confidence Declines Across Developed Markets in Asia/Pacific: MasterCard Index

March 27, 2012 – Consumer confidence among developed markets in Asia/Pacific has dropped as concerns about slow growth spread across the region, according to the latest MasterCard Worldwide IndexTM of Consumer Confidence. Nine out of 14 Markets Record Negative Sentiment across Five Key Indicators: regular income, employment, economy, quality of life and stock market. Big declines in Hong Kong, Singapore, Taiwan and South Korea in Last Six Months.

March 27, 2012 – Consumer confidence among developed markets in Asia/Pacific has dropped as concerns about slow growth spread across the region, according to the latest MasterCard Worldwide IndexTM of Consumer Confidence. Nine out of 14 Markets Record Negative Sentiment across Five Key Indicators: regular income, employment, economy, quality of life and stock market. Big declines in Hong Kong, Singapore, Taiwan and South Korea in Last Six Months.

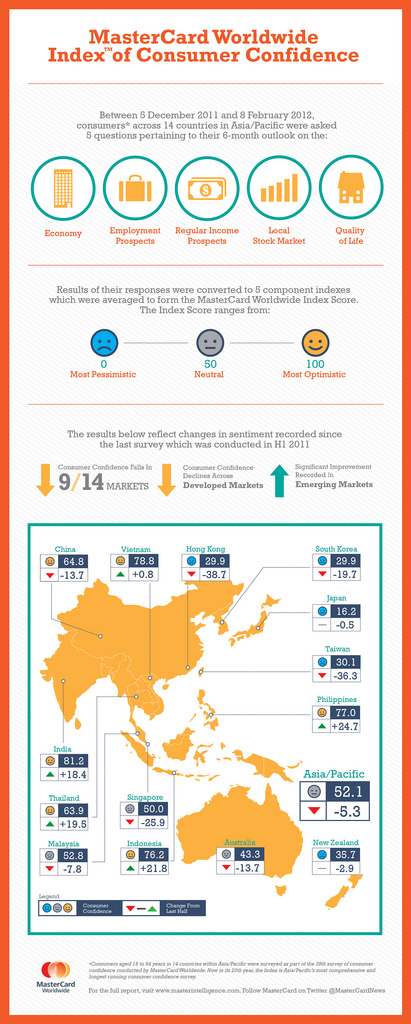

The MasterCard Worldwide IndexTM of Consumer Confidence (“Index”) is based on a survey conducted between 5 December 2011 and 8 February 2012 on 12,915 respondents aged 18 to 64 years in 25 countries within Asia/Pacific, Middle East and Africa. This is the 38th survey of consumer confidence conducted since 1993. Now in its 20th year the Index is Asia/Pacific’s most comprehensive and longest running consumer confidence survey. The Index score is calculated with zero as the most pessimistic, 100 as most optimistic and 50 as neutral.

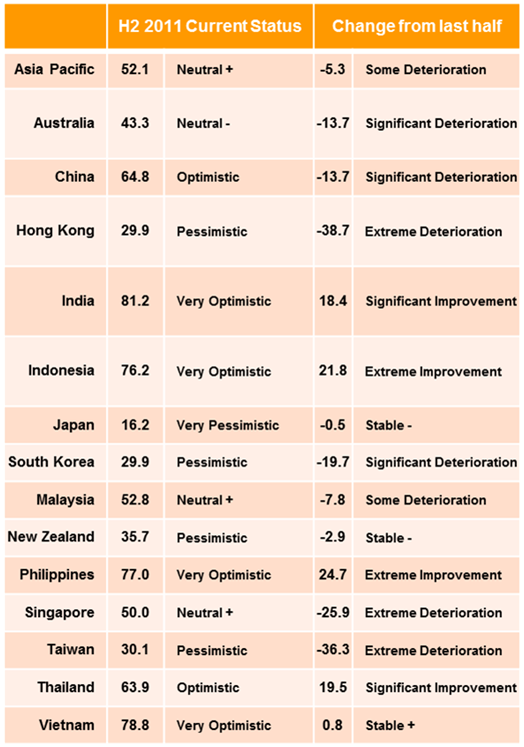

Only 5 out of 14 Asia/Pacific markets polled recorded positive sentiment when compared to the first half of 2011. The last Index conducted during the first half of 2011 showed that 11 out of the 14 Asia/Pacific markets polled recorded positive consumer sentiment with stable optimism. Overall, Asia/Pacific saw a drop from 57.4 Index points in the first half of 2011 to 52.1 Index points with declines in all key indicators of regular income (69.0 to 64.5 Index points), employment (56.8 to 49.3 Index points), economy (54.8 to 49.3 Index points), quality of life (49.7 to 49.6 Index points) and stock market (56.7 to 47.9 Index points).

Extreme deteriorations were recorded in Hong Kong, down 38.7 Index points compared to the first half of 2011. Taiwan (down 36.3 Index points), Singapore (down 25.9 Index points) and South Korea (down 19.7 Index points) also saw strong declines in consumer sentiment compared to the previous six months. However, significant improvement was recorded in emerging markets such as Indonesia (up 21.8 Index points), Thailand (up 19.5 Index points), India (up 18.4 Index points) and Philippines (up 24.7 Index points).

Confidence Crisis among Developed Markets

Overall consumer confidence in Hong Kong spiraled down from 68.6 in the first half of 2011 to 29.9 Index points, with Taiwan down from 66.4 to 30.1 Index points and Singapore down from 75.9 to 50.0 Index points.

Confidence among Hong Kong’s consumers in their economy collapsed from 66.4 to 19.9 Index points, with employment down from 70.4 to 25.7 Index points and quality of life down from 46.3 to 21.1 Index points. Steep falls were also recorded in consumers’ attitude towards the stock market (down from 79.1 to 23.3 Index points) and regular income (down from 80.6 to 59.4 Index points).

At the opposite end of the spectrum consumer confidence in Philippines increased from 52.3 Index points in the first half of 2011 to 77.0 in the second half with increases in confidence recorded across all key indicators. Indonesians also showed increased optimism with overall consumer confidence jumping from 54.4 Index points in the first half of 2011 to 76.2, alongside India (62.8 to 81.2 Index points) and Thailand up from 44.4 to 63.9 Index points. Malaysian consumers recorded a small deterioration (60.6 to 52.8 Index points), while consumers in Japan (16.7 to 16.2 Index points), Vietnam (78.0 to 78.8 Index points) and New Zealand (38.6 to 35.7 Index points) remained stable.

“The persistent Europe-centered crisis is a serious drag on global economic growth, which is a headwind common to all markets in the Asia/Pacific region. However, it is the differences in the domestic environment that have clearly caused consumer confidence to diverge sharply between the key regional markets,” observes Yuwa Hedrick-Wong, global economic advisor for MasterCard Worldwide.

“The strong showing of emerging markets like Indonesia, Philippines, Thailand and India suggests that domestic factors that boost private consumption can make a big difference in sustaining positive consumer sentiments even as overall growth is slowing,” he concluded.

MasterCard Worldwide Index of Consumer Confidence

Methodology

Respondents were asked 5 questions pertaining to their 6-month outlook on the economy, employment prospects, the local stock market, their regular income prospects and their quality of life. The results of their responses were converted in 5 component indexes which were averaged to form the MasterCard Worldwide Index™ of Consumer Confidence (MWICC) score. The MWICC Index score and the 5 component index scores range from 0 – 100 where 0 represents maximum pessimism, 100 represents maximum optimism and 50 represents neutrality.

About the MasterCard Worldwide Index™ of Consumer Confidence

The MasterCard Worldwide Index™ of Consumer Confidence survey has a 20-year track record of consumer confidence indices collected from over 200,000 interviews, unequalled both in scope and history across Asia/Pacific, Middle East and Africa.

The MasterCard Worldwide Index of Consumer Confidence is the most comprehensive and longest running survey of its kind in the region. In June 1997, the Index revealed a decline in consumer confidence – one month prior to the devaluation of the Thai baht that triggered the regional economic crisis. In June 2003, the Index score for Employment in Hong Kong dropped to a low score of 20.0. This was subsequently reflected in Hong Kong’s unemployment rate, which peaked just before September 2003 at eight percent.

The survey comprising the Asia/Pacific markets began in the first half of 1993 and has been conducted twice yearly since. Markets from the Middle East and Africa were included in the Index from 2004. Twenty five markets now participate in the survey: Australia, China, Egypt, Hong Kong, India, Indonesia, Japan, Kenya, Kuwait, Lebanon, Malaysia, Morocco, New Zealand, Nigeria, Oman, Philippines, Qatar, Saudi Arabia, South Korea, South Africa, Singapore, Taiwan, Thailand, United Arab Emirates and Vietnam.

The responses are consumers’ thoughts on the six months ahead. Data collection was via internet surveys and face to face interviews, with the questionnaire translated to the local language wherever appropriate and necessary. The survey has a margin of sampling error of plus or minus four to five percentage points at the 95 percent confidence level.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: