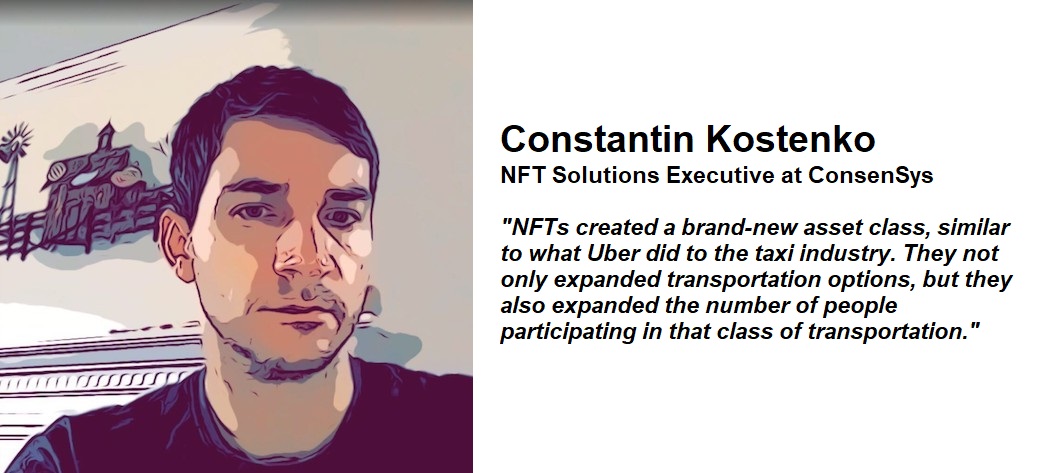

Constantin Kostenko, from ConsenSys, the operator behind the largest NFT wallet, shares ideas in an interview with The Paypers on how we can solve some pain points of web3 / transacting in the new digital economy and reap the benefits.

What is ConsenSys for those who do not know it yet? Please share more details about your business unit, focusing on NFTs and the role that you play?

ConsenSys is the leading Ethereum software company. We enable developers, enterprises, and people worldwide to build next-generation applications, launch modern financial infrastructure, and access the decentralised web.

The ConsenSys NFT business unit enables organisations to bring web3 digital experiences to consumers through non-fungible tokens. With our full-lifecycle NFT management platform, we abstract the complexities of issuing and owning unique Ethereum-based assets. On one side of the spectrum, our platform serves customers who use our APIs to mint and manage NFTs, and on another side, we provide full service from ideation to marketing, community building, and multi-drop launches capable of serving millions of users.

What is your web 3.0 vision?

At ConsenSys we’re building software and solutions for the missing part of the internet: trust, money, and ownership. My vision for web3 is a world where permissionless innovation has a very low barrier for entry where a right-fit solution offers a maximum benefit to the community members who participate in its creation and usage.

Digital assets/goods transactions typically involve more steps and can require several minutes for the transaction to verify. How does web 3.0 deal with these payment inefficiencies?

The steps and acceptable wait time depend on your perspective. If you have ever sent a bank wire before then you know what those 3 days of uncertainty and worry feels like. Your money is transferred without any visibility on the status or the progress. With Ethereum or Bitcoin you can send millions of dollars in a single transaction for a very low fee. The current payment inefficiencies are transient problems. With additional Ethereum compatible layer two scalability solutions the throughput will grow by x10,000. Transaction speeds for purchasing Palm, Polygon, and even on the Ethereum mainnet are close to the amount of time it takes you to make a credit card transaction.

After we solve the technical inefficiencies, how are we going to deal with the moral / psychological impact on users?

The users are in for a pleasant surprise. For example, one of the least mentioned use cases is the ‘login with Ethereum’ scenario. Once you create an account with a wallet (e.g., MetaMask) you can use the same account to login into any app and on any Ethereum compatible networks. This means web3 technology can be used to power the login for the web2 infrastructure. It’s like having a single universal login that nobody can take away from you.

What is the commercial proposition of NFTs for banks, merchants, PSPs?

In the very early days of Ethereum, at ConsenSys, we developed many experimental solutions for these use cases. From titles of land ownership to bonds on the blockchain. The first wave of blockchain solutions is focused on augmenting and improving the efficiency of the existing business processes. The incremental innovation doesn’t warrant mass adoption.

The future ahead is much more promising as we’ll see money and the digital property being treated like lego blocks to permissionlessly create solutions. This is why the current wave of entertainment NFTs is so exciting. It created a brand-new asset class, similar to what Uber and Lyft did to the taxi industry. They not only expanded transportation options, but they also expanded the number of people participating in that class of transportation.

What causes friction and the fear of NFT adoption?

Two main issues cause friction: multiple steps required to get onboard and the fear of the unknown. As more people are onboarded onto web3 the easier it will be for others to do the same. We’re also re-arranging the onboarding steps and mixing the web2 and web3 worlds to make it easier to get onboarded. For example, for the MAC VivaGlam charity drop, the ConsenSys NFT team designed a solution to let you buy an NFT with a credit card without needing to create a wallet first. Then after the purchase process, the user can claim the NFT and through the process create a wallet. The platform transfers the purchased NFT to the wallet, thus eliminating the need for the user to own any crypto to buy and own the NFT.

Let’s imagine it is 2030. How would our interview be conducted and what topics would be discussed?

I’m writing an answer to this question using a keyboard and looking at a screen. This mode of communication for this type of interview has not changed in the past 30 years. We’ll be doing the same thing in 2030. What will be different will be the topics being discussed. Imagine that by then, 50% of the world population would be using crypto and blockchain-based services on a daily basis. A seismic shift is underway.

__________

Constantin Kostenko is a Solutions Executive with ConsenSys NFT. He’s a co-founder of EulerBeats NFT, an algorithmically generated art & music project stored on-chain with token economics on a bonding curve. Earlier he created multi-sided platform-based businesses with Ethereum. He is a former Chief Technologist with Booz Allen and a firebrand Ukrainian.

The full article here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: