The study estimates a total investment gap in AI and blockchain technologies in the European Union of approximately €5-10 billion per year. The European Union accounts only for 7% of annual equity investments in both technologies, while the US and China together account for 80%.

The European Investment Bank (EIB) published a report which concluded that companies and governments in Europe are substantially underinvesting in artificial intelligence (AI) and blockchain. This is especially in comparison with other leading regions. It declared that “the European Union struggles to translate its scientific excellence into business application and economic success”.

„Artificial intelligence (AI) and blockchain are two of the most significant disruptive technologies of our time, set to have a major impact on future societies and economies. But the European Union accounts only for 7% of annual equity investments in both technologies, while the US and China together account for 80%. However, the EU excels in research and has the largest pool of digital talents,” the report says.

Total estimated VC equity investment in AI and BC SMEs by geography, 2010–2019

Artificial intelligence, blockchain and the future of Europe: How disruptive technologies create opportunities for a green and digital economy, a report conducted by the European Investment Bank and the European Commission, recommends that Europe needs to step up its efforts to address the estimated €10 billion investment gap that is holding back development and deployment of artificial intelligence and blockchain technologies in the EU.

The report on AI and blockchain found that Europe’s venture capital ecosystem focuses predominantly on providing early-stage finance for AI/blockchain-based small and medium-sized enterprises (SMEs) but underperforms in the subsequent expansion and growth stages.

The study estimates a total investment gap in AI and blockchain technologies in the European Union of approximately €5-10 billion ($6-12 bn) per year. Whilst the United States and China collectively account for over 80% of the €25 billion ($30 bn) annual equity investments in AI and blockchain technologies, the EU27 only represents 7% of this global amount with an annual equity investment of €1.75 billion ($2.1 bn).

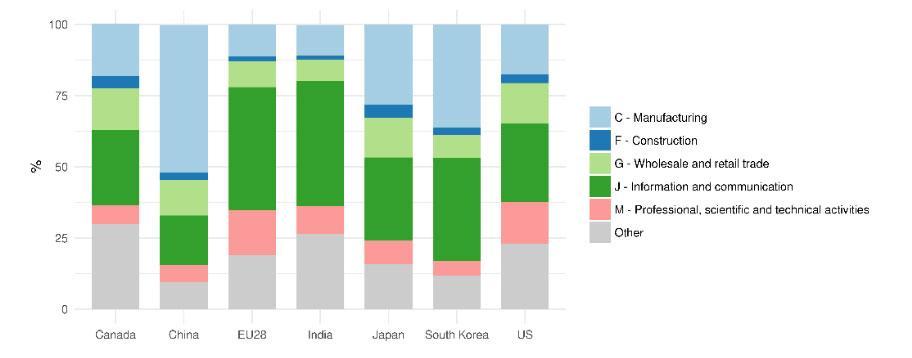

While virtually all sectors in the EU economy are embracing AI technologies, deployment has been more systematic in certain sectors and the application of AI varies across jurisdictions. In Europe, the United States and India, a relatively large share of AI firms operate in information and communications or in professional, scientific and technical activities. By contrast, in China, about half of the country’s AI firms operate in the manufacturing sector, mirroring the overall strength of China in the manufacturing sector. Japan presents a more balanced distribution of AI firms across different sectors; in particular, more than 25% operate in manufacturing and a prominent share in wholesale and retail trade, which is similar to the situation in the United States and Canada.

AI firms by economic sector (%), 2009–2018

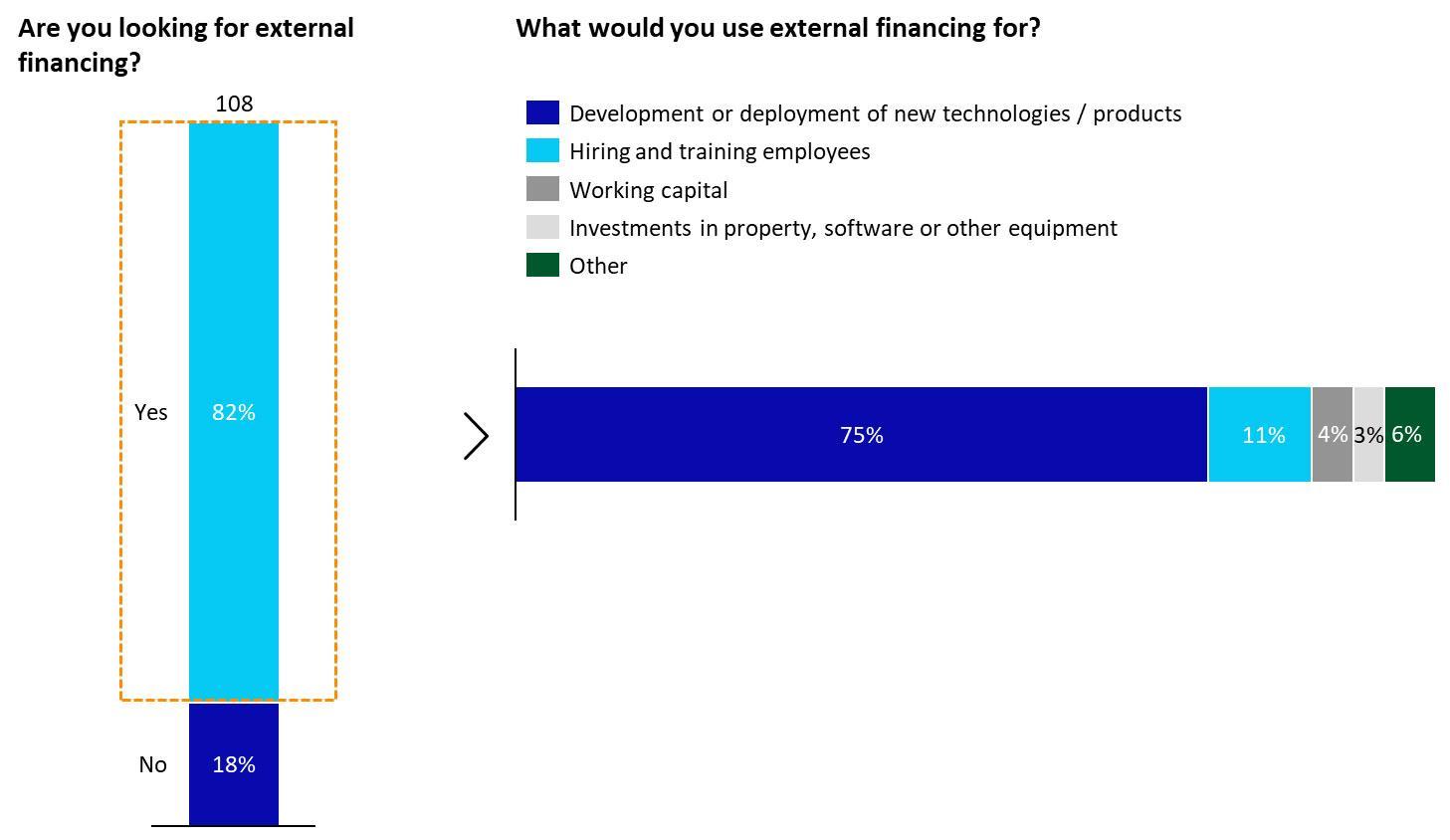

Analysis, survey and interviews have identified several bottlenecks constraining access to finance for AI and blockchain companies in Europe.

On the demand side, it is critical that small businesses have the right talent to push innovation and produce high-quality R&D, and can scale up their products in a unified digital market. But on the supply side, venture capital investors, banks and other financial providers need to have sufficient capital for investing, the right tools to assess complicated technologies, and the willingness to invest in them.

AI and BC SMEs seeking external financing (SME survey results)

Besides supply and demand, the study also examined the market matching system, which brings together small and medium firms and investors to the benefit of all parties. Finally, the study analysed the overall innovation ecosystem and its value chain, in which all players need to cooperate in a coordinated manner, with government initiatives having a central role in defining strategy, and prioritising and enabling the cooperation of such key players.

Total number of AI and BC SMEs per 1 million workers, April 2020

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: