Among the top five cryptocurrencies by market capitalization, ripple has fared the worst, down more than 74 percent this year following an epic 35,000 percent increase in 2017, according to CoinMarketCap. Cryptocurrency prices, with few exceptions, are struggling in 2018 from regulatory uncertainty and news of hacks.

Cryptocurrency ripple is the worst performer among the top digital currencies by market capitalization as the first quarter comes to a close. The entire sector has taken a hit this year due to regulatory concerns and an advertising crackdown. Total market capitalization for cryptocurrencies has fallen by more than 50 percent in 2018 so far, according to CoinMarketCap.

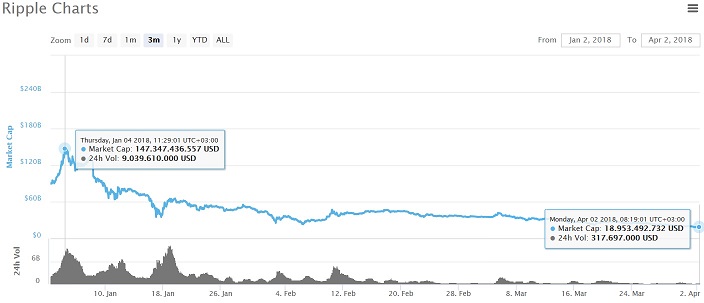

Ripple is leading that downturn, and has lost more than 74 percent this year, according to CoinMarketCap. The two largest digital currencies by market cap, bitcoin and ethereum, are also down more than 40 percent.

San Francisco-based Ripple is developing a network for fast, global financial payments. XRP is the name of the digital token that financial institutions on the network can use to transact quickly.

The cryptocurrency skyrocketed 35,000 percent in 2017 after kicking off the year at less than a penny, according to data from CoinMarketCap. Ripple hit a high near $3.50 on January 7, and was trading near 54 cents Thursday.

XRP, which has a market cap above $21 billion, is listed on more than 60 exchanges but is not yet available on popular U.S. exchange Coinbase. Speculation of when it might get added to Coinbase drove up prices earlier this year.

Joe DiPasquale, CEO of BitBull Capital pointed to crypto-specific events including Facebook and Google cracking down on advertising, and initial coin offering „fatigue” as reasons for the broader digital cryptocurrency sell-off.

„We believe the macroeconomic factors and regulatory factors and time to market with many crypto products will take the rest of the year to settle out,” DiPasquale said.

Regulation was another factor in crypto sell-off.

„There’s a lot of short-term trepidation based on regulatory uncertainty based on the SEC, with what the European Union is doing, and what various Asian regulators are doing,” said John Lore, managing partner at Capital Fund Law Group.

Bitcoin began heading below the key $10,000 level earlier in March after the Securities and Exchange Commission said it will require digital asset exchanges to register with the agency. The SEC statement came after weeks of subpoenas to rein in control over the growing number of exchanges.

Lore’s firm advises hedge funds and private equity groups in the crypto-space. He said he’s seeing an „unprecedented” number of new fund starts continuing from February.

„I think the sell-off this year has more to do with short term concern than any long-term general distaste for the asset,” Lore said.

Source: CNBC

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: