Coindesk report – Bitcoin struggles to gain mainstream consumer traction

Despite the huge Venture Capital investments in new Bitcoin startups, the rate of growth in the number of bitcoin-accepting merchants continued to taper off this quarter. „Discussions around the slowdown of merchant adoption suggest the fundamental problem is not a lack of merchant interest in bitcoin, but rather the lack of consumer adoption.”, according to the latest Coidesk quaterly report „State of bitcoin”.

In its latest quarterly State of Bitcoin report, Coindesk focuses on events in the bitcoin ecosystem since the beginning of 2015.

Bitcoin’s investments

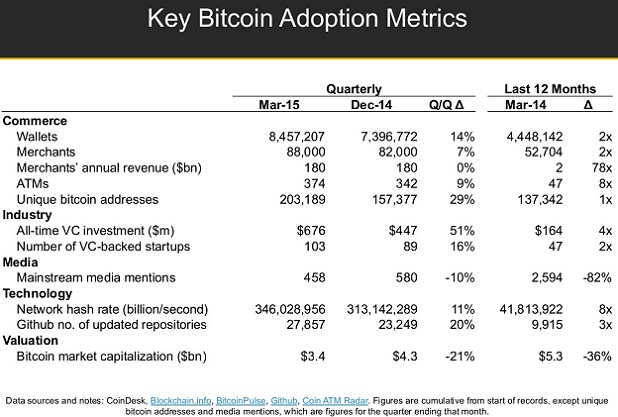

The first quarter of 2015 saw a record-breaking amount of venture capital invested in bitcoin startups: $229m. Since 2012, a total of $676m has been invested in bitcoin startups, with a 51% increase from the end of 2014. The number of countries that received VC investment also grew from 18 to 22 in the first quarter of 2015. The four new countries are Barbados, France, Kenya and Switzerland. Remittance platform BitPesa also became the first bitcoin startup based in Africa to receive VC funding.

Total number of VC-backed bitcoin companies increased from 89 in Q4 2014 to 103 in Q1, a 16% increase. 87% of the total Q1 bitcoin VC funding went to Silicon Valley-based startups. US-based Bitcoin Venture Capital investments are nearly twice greater than rest of the world combined. The top 10 countries in terms of VC investments is followed by UK, The Netherlands, Sweden, China, Israel, South Korea, Canada, Argentina and France.

Since the start of our State of Bitcoin reports, Coindesk aimed to quantify the well-worn statement that ‘bitcoin is like the the early Internet’ by comparing levels of VC interest between the two. Its last report indicated that total VC investment for bitcoin companies in 2014 well exceeded the $250m invested in first-sequence Internet startups in 1995.

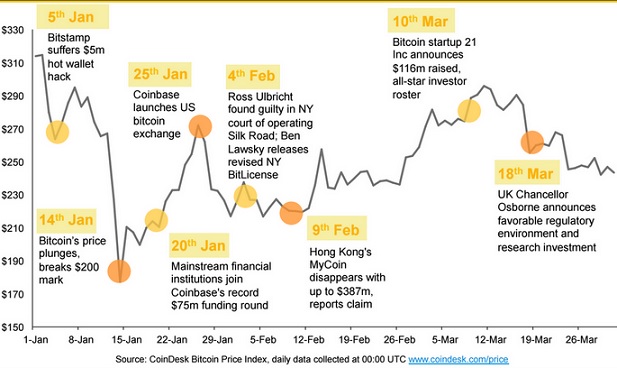

Overall, the bitcoin ecosystem showed robust growth in the start of 2015, despite the price plunge in the first half of January. Bitcoin’s price surprised many by breaking below $200, considered to be an important psychological marker. On 14th January, the CoinDesk BPI dropped to $177, and is down 24% in 2015.

Although bitcoin saw a significant decline at the start of 2015, its price has since stabilized around $250. In turn, the upward trend in monthly trading volume has not been negatively impacted by bitcoin’s price decline. This could be a reflection of expanded opportunities to trade on both bitcoin’s upward and downward volatility.

Bitcoin’s acceptance

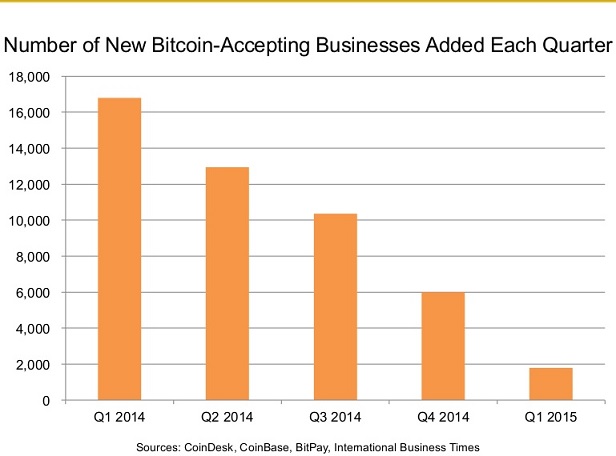

The rate of growth in the number of bitcoin-accepting merchants continued to taper off this quarter (Slide 47). Bitcoin’s lack of use in commerce is not just „chicken and egg” problem. Discussions around the slowdown of merchant adoption suggest the fundamental problem is not a lack of merchant interest in bitcoin, but rather the lack of consumer adoption. Consumers ned compelling reasons to use the volatile and still relatively hard to acquire bitcoin over alternatives.CoinDesk is forecasting 120,000 merchants by the end of 2015

„I believe merchants have been widely disappointed by the number of transactions they see în bitcoin. Most merchants have taken a passive aproach to integrating bitcoin aș a payment method, instead of strategically testing and optimizing checkout flows to encourage consumer adoption.” – says Steve Beauregard, CEO of GoCoin.

Now over 374 bitcoin ATMs around the world, but growth in new terminals is slowing. Half of them are operating in North America and 32% in Europe. According to Coindesk, break even for Bitcoin ATM owners is 11 months – average ATM generates more than $5,000 profit per year. Anual profits vary significantly depending on transaction volume.

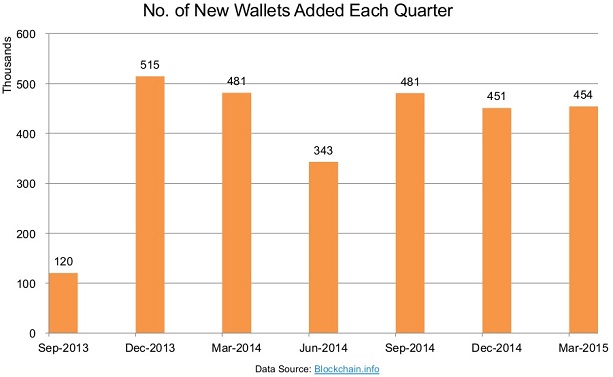

There were 1 million new bitcoin wallets created in Q1, representing 14% growth quarter-over-quarter. The total number of Blockchain wallets passed three million in February. The pace of wallet growth is almost constant over the past year, leading to some concern about the credibility of these numbers and questions about how many wallets are actively used for bona fide transactions. CoinDesk is forecasting 12 million total bitcoin wallets by the end of 2015.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: