Vancity partners with ecolytiq to be the first financial institution in Canada to provide a Carbon Counter on your Visa credit card.

Vancity is taking another step in its commitment to climate action. „It will be the first financial institution in Canada to offer its individual and business members a way to estimate the CO2 emissions that come from their purchases.” – according to the press release.

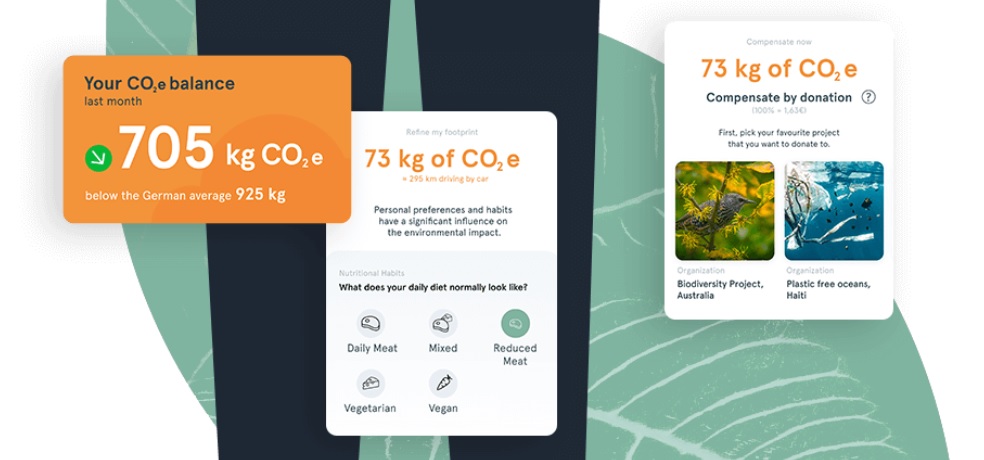

Starting in the new year, every Vancity Visa credit card holder will be able to track the estimated carbon emissions of their credit card purchases. Members will be able to see how their monthly tally compares to the national average, or which credit card purchases have the highest environmental cost. The Carbon Counter will help Vancity card holders understand the carbon footprint of their purchases as well as provide advice on what they can do to reduce their emissions footprint.

“We know many Vancity members are looking for ways to reduce the impact they have on the environment, particularly when it comes to the emissions that cause climate change,” said Jonathan Fowlie, Vancity’s Chief External Relations Officer who oversees the credit union’s impact and climate efforts. “As a member-owned financial cooperative, we believe it is our job to do everything we can to help, especially when it comes to the decisions people make with their money. This tool will equip Vancity Visa credit cardholders with valuable information on their purchases and enable them to connect their daily spending decisions to the change they want to see in the world.”

Vancity is partnering with ecolytiq, one of Europe’s leading climate engagement technology companies, to provide the first Visa Carbon Counter in Canada. The ecolytiq solution combines climate awareness, education, and behavioral nudging in its tool for financial institutions.

“We are proud to support the launch of Vancity’s CO2 calculator, a first on a Visa card in Canada. This is a great example of how we can empower consumers to understand their environmental impact and honour Visa’s commitment to a sustainable future,” said Stacey Madge, Country Manager & President, Visa Canada.

Vancity is a values-driven member-owned cooperative where many of the members choose to bank because of the credit union’s record and ongoing work on the environment. Consumer research* by Visa indicates 70 per cent of Canadian consumers say sustainability is very important to them, and, importantly, more than half want to better understand their carbon footprint. The Vancity Carbon Counter will allow them to do that.

“We are breaking new ground here,” said Ulrich Pietsch, ecolytiq Co-Founder and Managing Director. “We developed a White Label solution to offer financial institutions all over the world an agile and effective way to offer their customers tools to forge a better tomorrow. With the launch of Carbon Counter, Vancity is solidifying its role as a leading sustainability innovator both in Canada and in the global banking world.”

Vancity wants to not only help its members understand the impact of their spending on the environment, but also provide insights into lower emission options. In addition to providing a snapshot of your “count,” the Carbon Counter provides insights on how to reduce your carbon “spending” and tips for more sustainable choices.

________________

Vancity is a values-based financial co-operative serving the needs of its more than 560,000 member-owners and their communities, with offices and 54 branches. With $33 billion in assets plus assets under administration, Vancity is Canada’s largest community credit union.

The Sustainability-as-a-Service® solution from ecolytiq enables banks, fintech companies and financial service providers to show their customers the individual impact their purchasing behavior is having on the environment in real time. The ecolytiq software calculates personal environmental impacts, such as CO2 values, on the basis of payment transactions. In November 2020, ecolytiq joined the Visa Fintech Partner Connect programme, enabling banks to seamlessly implement their sustainability strategies using payment data.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: