Following the closure of the US operations, the German neobank is planning now to launch a cryptocurrencies trading business this year.

The co-founder of N26 admits that the German online bank rushed to be global too quickly and missed out on the cryptocurrency boom, as it battles to justify its status as one of Europe’s most highly valued fintechs, according to the Financial Times.

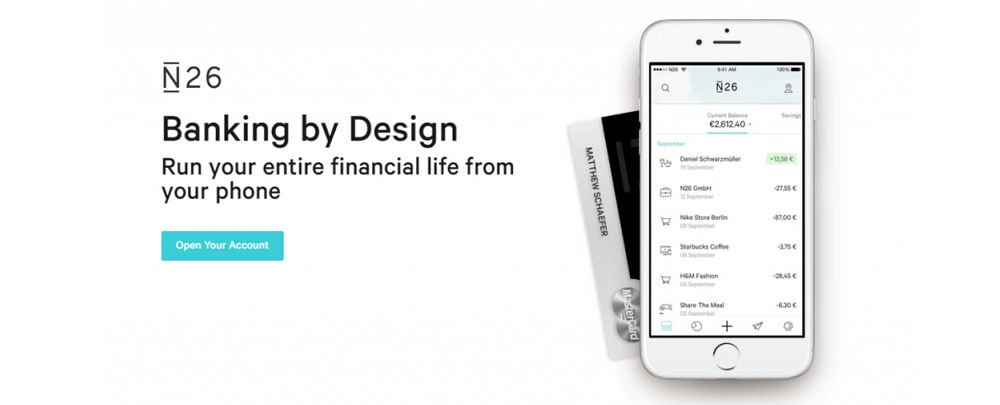

N26 recently closed operations in the US after leaving the UK in early 2020. While the group offers current accounts to 7m customers in 24 countries, its rapid geographical expansion left it flat-footed in developing other services, such as crypto or catering to the retail boom in equities trading.

“Should we have built trading and crypto instead of launching in the US? In hindsight, it might have been a smart idea,” N26 co-founder and co-chief executive Max Tayenthal told the Financial Times in an interview.

Tayenthal acknowledged that in recent months the bank had realised that “we were spreading ourselves extremely thinly”, adding that there are “so many things we can work on instead of putting flags in new markets”.

N26 is planning to launch a cryptocurrencies trading business this year and an equities brokerage after that, Tayenthal said.

“We really want to expand our product universe and we have to.”

Although N26 was valued at €7.8bn last year (almost a decade since its founding), when it raised a further €780m, rival fintech Revolut was valued at more than three times as much.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: