Global tech strategists Juniper Research today released its new Fraud & Security Tech Horizon; spotlighting three technologies that are expected to have the most significant impact in the fraud and security space over the next 12 months.

These are:

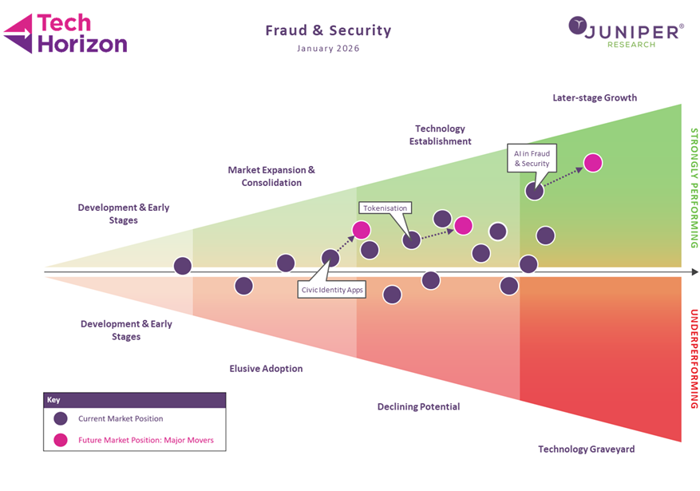

The Tech Horizon offers a visual assessment of 15 fraud and security technologies; ranking them as either ‘Above the Line’ (strongly performing) or ‘Below the Line’ (underperforming) in relation to market expectations. This gives operators and vendors a clear, data-driven view of which innovations are delivering value, and which are falling short.

Top Three Movers in Fraud & Security

Civic Identity Apps: By streamlining onboarding and enhancing user control, civic identity apps will revolutionise the way citizens store, manage, and share government-issued digital identities; becoming an established technology over the next 12 months.

Tokenisation: Operating at scale in mature markets, different types of tokenisation will drive efficiency gains by increasing settlement speeds and reducing costs; principally through reducing PCI compliance burdens and fraud.

AI in Fraud & Security: Although categorised in the ‘Later-stage Growth’ category, AI will continue to spearhead fraud security innovations through efficient automation, risk-based scoring and adaptive defences; minimising losses across the payments landscape.

“Civic identity apps are poised to experience sharp uptake over the next year. Following the success of apps like myID in Australia, regulations such as the EU’s eIDAS2 will mandate standardised digital identity wallets by late 2026,” said Thomas Wilson, Senior Research Analyst at Juniper Research. “Vendors must evaluate current KYC, onboarding, and authentication systems to ensure EU Digital Identity compatibility, or risk losing secure market access.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: