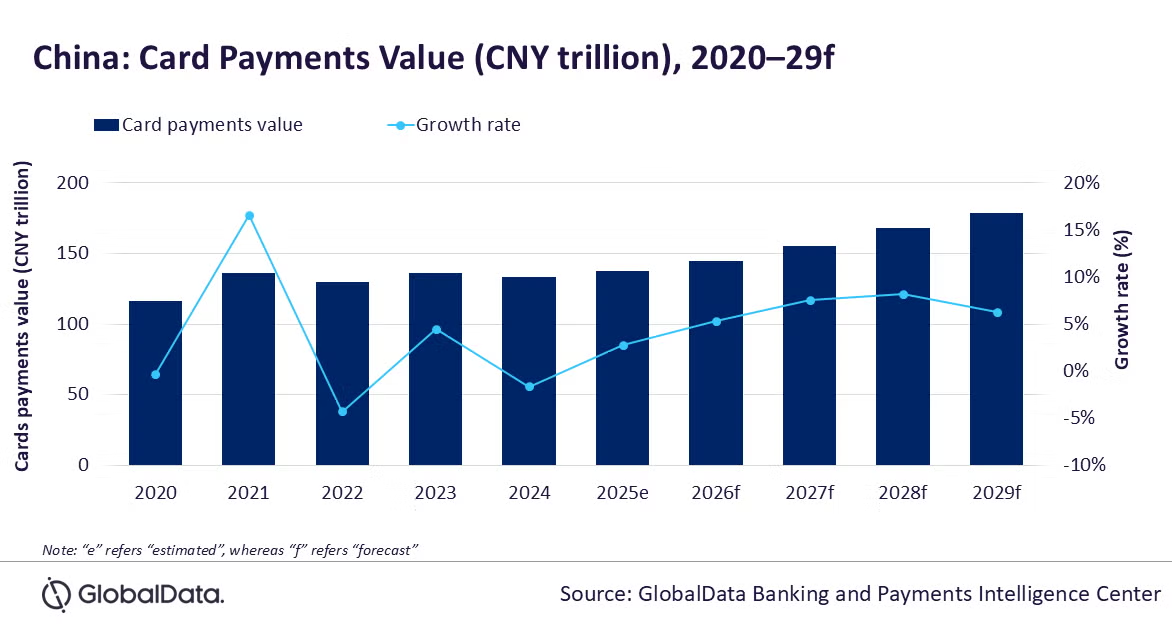

China’s card payments market is on a steady growth trajectory, underpinned by strong digital adoption, robust infrastructure, and rising consumer demand for cashless transactions. Despite macroeconomic headwinds, including the impact of recent US tariffs, the market is projected to grow at a compound annual growth rate (CAGR) of 6.8% between 2025 and 2029 to reach CNY179 trillion ($24.9 trillion) by 2029, reflecting a resilient ecosystem supported by policy reforms and increasing financial inclusion, according to GlobalData, a leading data and analytics company.

GlobalData’s Payment Cards Analytics reveals that China saw a growth of 4.5% in card payments value in 2023 driven by the rise in consumer spending. However, the current global uncertainty because of the latest US tariffs can pose a challenge for the overall economic growth, resulting in slowdown in the overall card payments value, which is expected to grow by 2.8% in 2025.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “China is the world’s largest payment card market in terms of transaction value, well ahead of developed countries such as the US. The growth in card payments has been driven by the country’s well-developed payment infrastructure, high consumer awareness, and a wide card acceptance network.”

The growth of card payments has also been supported by government initiatives to push cashless payments. In April 2024, the country’s central bank People’s Bank of China (PBOC), along with the Ministry of Culture and Tourism, the State Administration of Foreign Exchange and the State Administration of Cultural Heritage departments issued notice to encourage electronic payment acceptance in the country. As part of this, government agencies are required to provide adequate acceptance payment infrastructure, enabling consumers to pay for cultural and tourism transactions digitally using debit/credit cards, and digital wallets.

The central bank’s decision to open card payment space, which was primarily dominated by China UnionPay, to international players like American Express and Mastercard will enable them to process domestic card payments thereby bringing in more competition in them.

Debit cards are preferred over credit and charge cards. Debit cards are increasingly being used for payments – especially for low-to-medium value transactions. This is mainly due to the growing banked population and the availability of domestic card scheme CUP. Despite low penetration, credit cards are widely used for payments. Consumers primarily use these cards to take advantage of value-added services such as reward points, instalment payment facilities and discounts offered by banks.

However, despite the high payment card adoption, their usage is overshadowed by digital wallets. Chinese consumers prefer digital wallets for low-value daily transactions due to their convenience and wide merchant acceptance. PBOC and card issuers are taking steps to boost card payments, including enforcing a cap on merchant service fees, mandating merchants to accept cards at select tourist locations/hotels, and granting licenses to international scheme providers.

Sharma concludes: “Looking ahead, China’s card payments market is poised for continued expansion supported by growing banked population, rising financial awareness, and the growing adoption of digital payment solutions will underpin future growth. However, economic uncertainty caused because of the announcement of US tariff is expected to have adverse impact on the Chinese economy and in the payment industry. As a result, the China card payments market is expected to grow by marginal growth rate of 2.8% to reach CNY137.5 trillion ($19.1 trillion) in 2025.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: