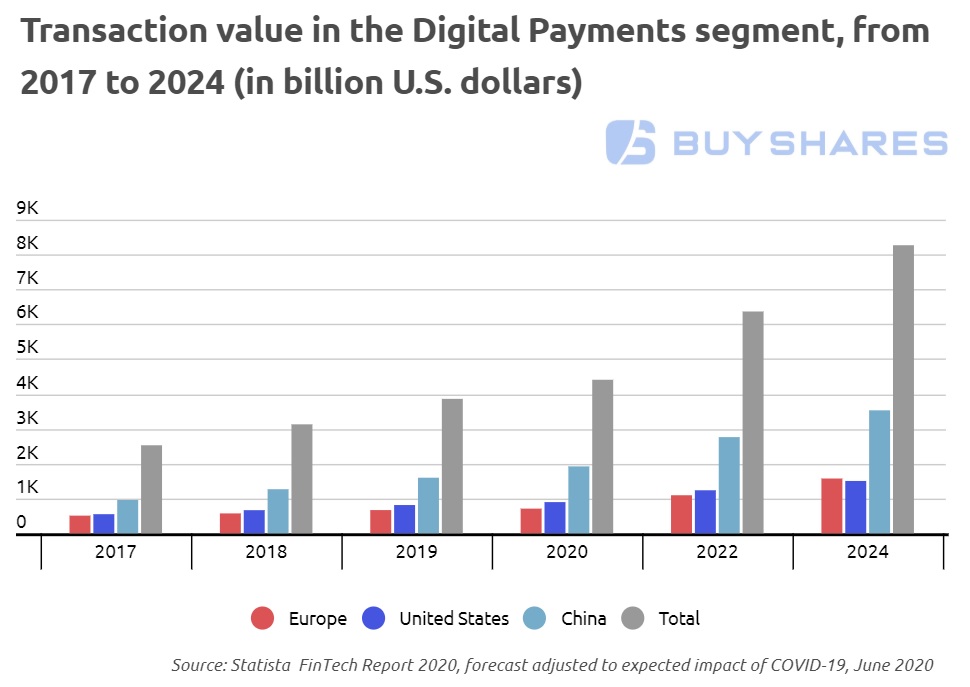

As the largest revenue source of the global Fintech market, digital payments are set to reach $4.4trn transaction value this year, a 5% drop compared to pre-COVID-19 figures. According to data gathered by BuyShares, China, and the United States, as the world’s two largest digital payments industries, are expected to generate 65% of that value.

Transaction value to jump 85% in the next four years

The digital payments segment includes payments for products and services made over the Internet and mobile (POS) payments via smartphone applications. As the world’s largest digital payments industry, China is expected to generate $1.9trn worth transactions this year, or nearly 45% of all digital payments in 2020, revealed the Statista 2020 FinTech Survey.

The United States ranked as the second-largest market, with an $895.7bn transaction value and a 20% market share in 2020. Japan, the United Kingdom, and South Korea follow with $165.2bn, $164.4bn, and $113.5bn worth transactions, respectively.

Chinese digital payments market is expected to surge by 84%, with the combined value of transactions reaching $3.5trn by 2024. The United States is forecast to reach $1.5trn transaction value by 2024, a 67% jump in four years.

The entire European digital payments industry is expected to boom in the next four years, growing by CARG of 18.7% and reaching nearly $1.6trn transaction value by 2024.

The total transaction value of the global digital payments industry is forecast to jump by 85% and reach $8.2trn in 2024.

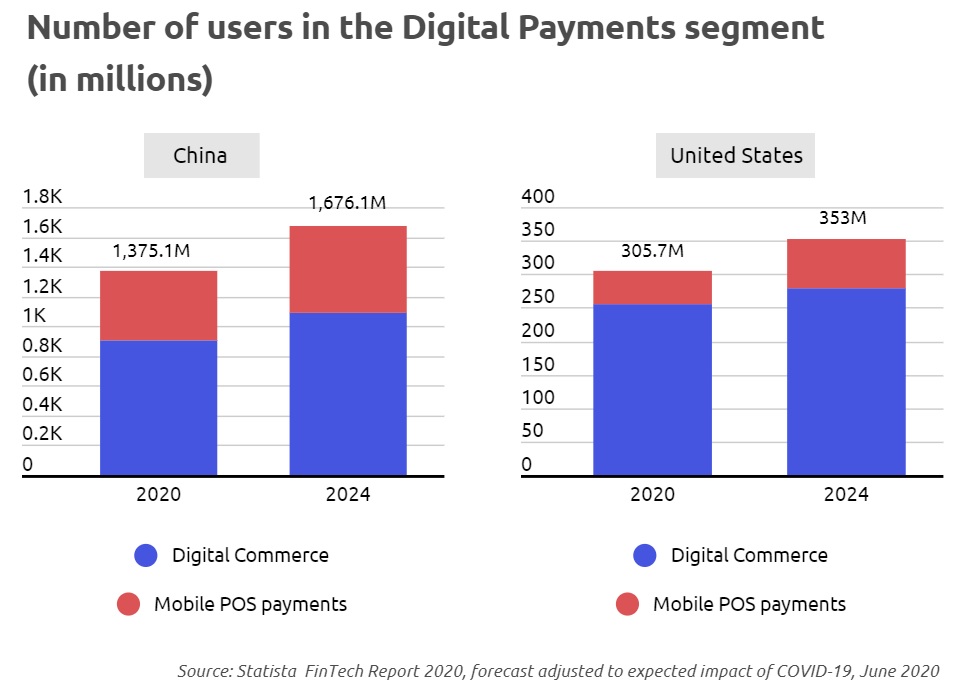

Most digital payments users live in China

Recent years have witnessed a surge in the number of people handling digital payments, with the figure growing from 2.7bn in 2017 to over 4.6bn in 2020. In the next four years, the number of users in the digital payment segment is set to touch 6.4bn.

Statistics show most digital payment users live in China. In the last three years, the number of Chinese users utilizing online payments has soared from 840 million to 1.3bn, nearly 30% of all users in the world. This figure is expected to jump over 1.6bn in the next four years.

The United States is set to reach 305.7 million users in the digital payments segment in 2020, four times less than leading China. According to Statista 2020 FinTech Survey, this number will rise to 353 million by 2024. Statistics indicate the number of Europeans using digital payments is forecast to grow by 24% in the next four years, reaching 721.7 million by 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: