Chief Commercial Officer at Visa: ”July’s fall in spending is concerning. Household budgets are streched.”

It seems the warm weather and World Cup failed to help lift spending on Visa cards in UK for the third month in a row.

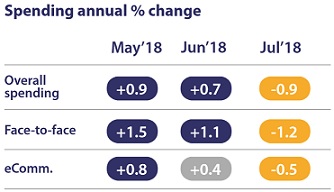

Visa’s UK Consumer Spending Index, compiled by IHS Markit, pointed to a renewed fall in consumer spending at the start of the third quarter. Although the reduction was only slight (-0.9% on the year), this compared to increases in expenditure in the prior two months. Channel data signalled that the decrease in total spend was broadbased with both eCommerce and Face-to-Face categories noting lower expenditure on an annual basis for the first time since April.

The quickest fall in spend was registered in Face-to-Face categories (-1.2% year-on-year). This followed a slight increase during June (+1.1%). However, the pace of reduction remained weaker than those seen earlier in 2018. Meanwhile, eCommerce expenditure fell by -0.5% on the year, after a marginal rise during June (+0.4%).

The quickest fall in spend was registered in Face-to-Face categories (-1.2% year-on-year). This followed a slight increase during June (+1.1%). However, the pace of reduction remained weaker than those seen earlier in 2018. Meanwhile, eCommerce expenditure fell by -0.5% on the year, after a marginal rise during June (+0.4%).

Mark Antipof, Chief Commercial Officer at Visa, commented: “Food and drink, followed by hotels, bars and restaurants, saw the highest spending increases of all categories in July, which the warm weather and football clearly contributed to. However, retailers of household goods and those operating within recreation and culture noted significant declines, an indication that household budgets are stretched.”

“Retailers had a difficult time in early 2018, and while there was some respite in May and June, July’s fall in spending is concerning, particularly as we look ahead when the impact of the interest rate rise and back-to-school costs will likely put further pressure on Britons’ wallets.”

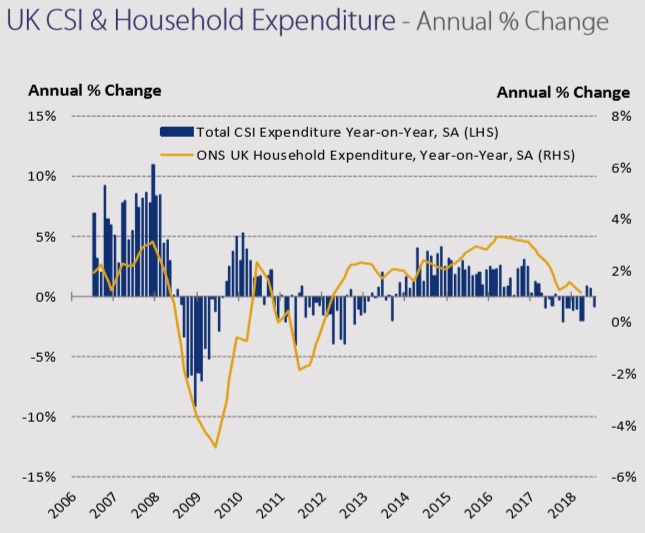

Annabel Fiddes, Principal Economist at IHS Markit, said: “The Visa UK CSI pointed to a renewed fall in household spending during July, as it seems the warm weather and World Cup failed to help lift spending for the third month in a row. However, the rate of reduction (-0.9% year-on-year) was not as strong than those seen earlier in the year. “

“Expenditure trends have been relatively subdued in 2018 so far, which can be linked in part to disappointing growth in real earnings despite a tight labour market, while the recent interest rate hike by the Bank of England is likely to add further pressure on households’ budgets. Combined with anxieties around the ongoing Brexit negotiations and lower consumer confidence, it seems unlikely that expenditure trends will improve in the near-term.”

Visa’s UK Consumer Spending Index uses card transaction data to provide a robust indicator of total consumer expenditure across all payment methods and is used by a range of stakeholders to gain insights into consumer spending, including HM Treasury. It is based on spending on all Visa debit, credit and prepaid cards which are used to make an average of over 2.3 billion transactions every quarter and account for £1 in £3 of all UK spending.

Working with Markit, these card spending data figures are adjusted for a variety of factors such as card issuance, changing consumer preferences to pay by card rather than cash and inflation. These adjustments mean that these data are distinct from Visa’s business performance and the Index reflects overall consumer spending, not just that on cards.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: