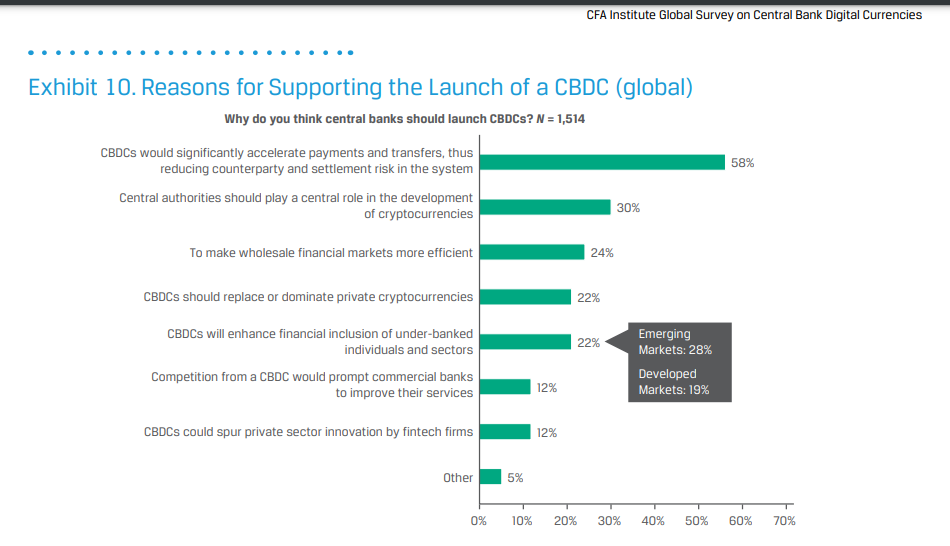

Respondents in emerging markets were more receptive to CBDCs and believed the digital currencies would enhance financial inclusion. Respondents in advanced economies, in contrast, were generally more satisfied with the current financial infrastructure and more skeptical of the need for a CBDC.

A global survey on Central Bank Digital Currencies (CBDC) released by CFA Institute, the global association of investment professionals, examines the possible implications for capital markets and investment practitioners if central banks develop and launch digital versions of fiat currencies.

The global survey of CFA Institute members found limited understanding of and support for CBDCs. A plurality of 42 percent of respondents believe that central banks should launch CBDCs, while 34 percent disagreed. Only 13 percent said they had a strong understanding of CBDCs.

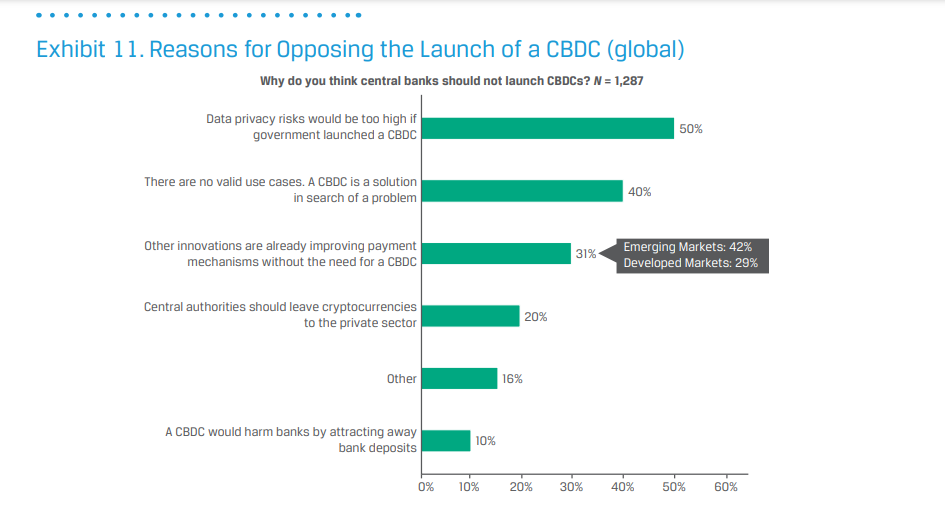

„In all markets, the top reason cited to support launching a CBDC was to accelerate payments and transfers, with the chief concerns being focused on three issues: cybersecurity and fraud, data privacy, and lack of use cases.” according to the press release.

Globally, a majority of respondents believe that CBDCs can coexist with private cryptocurrencies, which points to some dichotomy in results. While a large majority agrees that public trust in fiat money is suffering because of monetary policy, a solid majority also believes that private money will always be inferior to government money.

Olivier Fines, CFA, Head, EMEA Advocacy, CFA Institute comments: “Acceptance by end-users will be critical for any central bank digital currency. Although central banks have solicited public comment on various consultation documents, much remains unknown about the public’s understanding of, interest in, and demand for CBDCs. While many of the current studies on CBDCs focus on the preferences of central banks promoting of digital currencies our survey explores the demand side of this debate.”

“Perhaps the biggest finding from our survey was the difference in attitudes between emerging and developed economies,” said Stephen Deane – Senior Director for Capital Markets Policy. “Respondents in emerging markets were more receptive to CBDCs and believed the digital currencies would enhance financial inclusion. Respondents in advanced economies, in contrast, were generally more satisfied with the current financial infrastructure and more skeptical of the need for a CBDC.„

“Another major finding was that public opinion remains largely a blank slate,” Deane continued. “That gives an opening to any central banks that may wish to promote public support and demand for CBDCs.”

CBDCs and financial inclusion

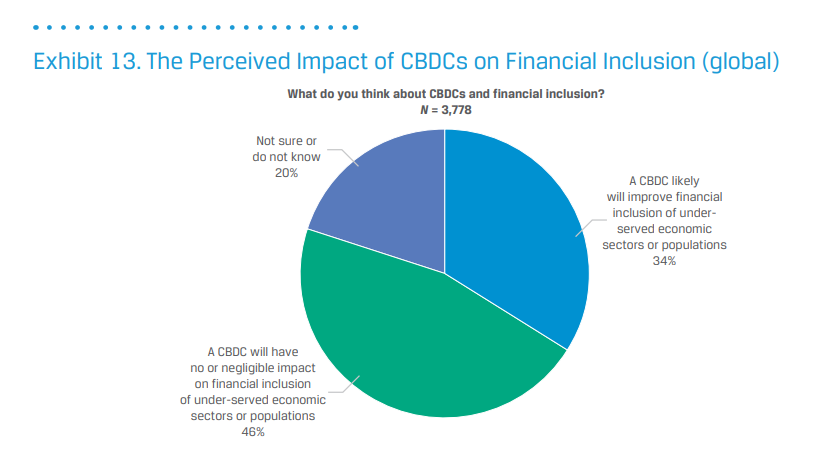

The case for CBDCs to improve financial inclusion is not straightforward, and there is significant regional variation.

Globally, a plurality (46%) said that a CBDC would have no or negligible impact on financial inclusion, while only 34% said that a CBDC likely would improve financial inclusion (Exhibit 13).

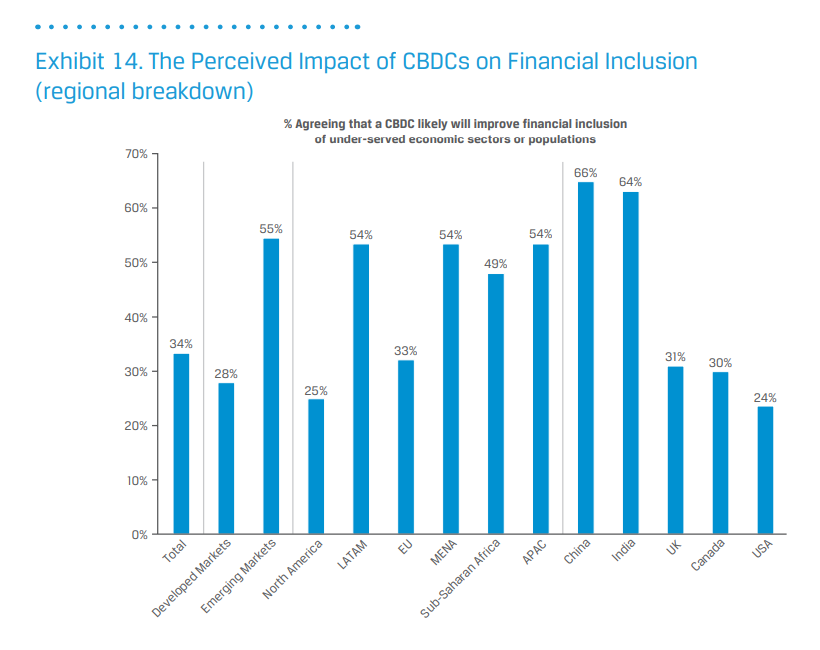

The global average, however, masked wide regional variation in responses (Exhibit 14). A majority (54%) in APAC said that a CBDC likely will improve financial inclusion, while only a minority expressed that view in the EU (33%) and North America (25%).

The differences gain sharper focus when viewed through the lens of economic development.

A majority of respondents in emerging markets (55%) held the view that a CBDC will improve financial inclusion —with even stronger majorities in China (66%) and India (64%). In contrast, only 28% of respondents in developed markets shared this view, with a low of 24% in the United States.

A clear division based on age also emerged: The younger, the more positive (42% of those under

30 agreed that CBDCs will likely improve financial inclusion), and the older, the less so (only 25%

of those over 55 agreed).

The survey brings together the views of the professional investment community, offering a valuable insight into some of the challenges faced by central banks, notably:

. Developing markets, the Asia-Pacific region, and individual countries such as India and China present a more favorable view of CBDCs.

. Respondents in developing markets place greater emphasis on financial inclusion.

. Public acceptance of a CBDC is not assured.

. To a large extent, public opinion remains an empty slate, presenting opportunity for central banks to build public support for CBDCs.

. A majority believes that CBDCs can coexist with private cryptocurrencies, but also that private money will always be inferior.

. Central banks need to address three top public concerns: cybersecurity, privacy, and the search for actual use cases.

. Central banks should consult with the private sector to better understand the demand side of the debate on CBDC development.

Key questions remain on how implementation and adoption might work, how a CBDC might be used relative to other payment instruments, and how market structure and financial stability might be impacted. There is much more work to do before the successful adoption of CBDCs.

The online survey ran from 13 February to 27 February 2023. It was sent to a random sample of 90,443 CFA Institute members on a global basis. Where applicable, regional limitations to surveying scope are explained in the exhibits throughout the survey report. The survey received 4,157 valid responses, for a 5% response rate and a margin of error of ±1.5%, with a 99% confidence interval.

A copy of the report is available to download here: https://www.cfainstitute.org/research/survey-reports/survey-central-bank-digital-currencies

___________

About CFA Institute is the global association of investment professionals that sets the standard for professional excellence and credentials. The organization is a champion of ethical behavior in investment markets and a respected source of knowledge in the global financial community. Our aim is to create an environment where investors’ interests come first, markets function at their best, and economies grow. There are more than 190,000 CFA charterholders worldwide in more than 160 markets. CFA Institute has nine offices worldwide and 160 local societies.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: