Nigeria has lunched on Monday a digital currency, the eNaira, months after it barred banks and financial institutions from dealing in or facilitating transactions in cryptocurrencies, according to Reuters.

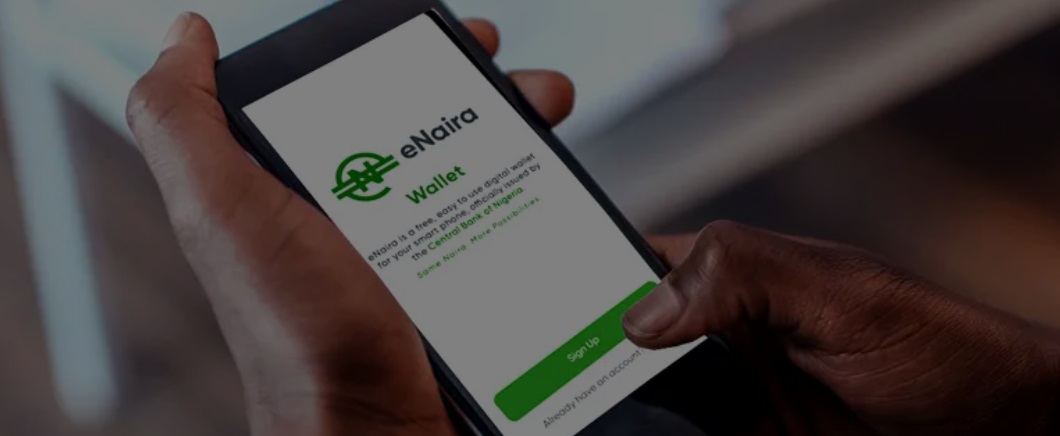

eNaira is a Central Bank of Nigeria-issued digital currency that provides a unique form of money denominated in Naira. eNaira serves as both a medium of exchange and a store of value, offering better payment prospects in retail transactions when compared to cash payments.

Customers can make in-store payment using their eNaira wallet by scanning QR codes. Also, eNaira allows users to send money to one another (P2P payments) through a linked bank account or card.

Central Bank of Nigeria (CBN) Governor Godwin Emefiele has said the eNaira would operate as a wallet against which customers can hold existing funds in their bank account.

„The eNaira therefore marks a major step forward in the evolution of money and the CBN is committed in ensuring that the eNaira, like the physical Naira, is accessible by everyone,” the bank said in a statement.

Nigeria has named Barbados-based Bitt Inc as a technical partner in developing the eNaira.

For more details download REGULATORY GUIDELINES ON THE eNAIRA

Official launch of the eNAIRA by President Buhari

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: