Nigeria has lunched on Monday a digital currency, the eNaira, months after it barred banks and financial institutions from dealing in or facilitating transactions in cryptocurrencies, according to Reuters.

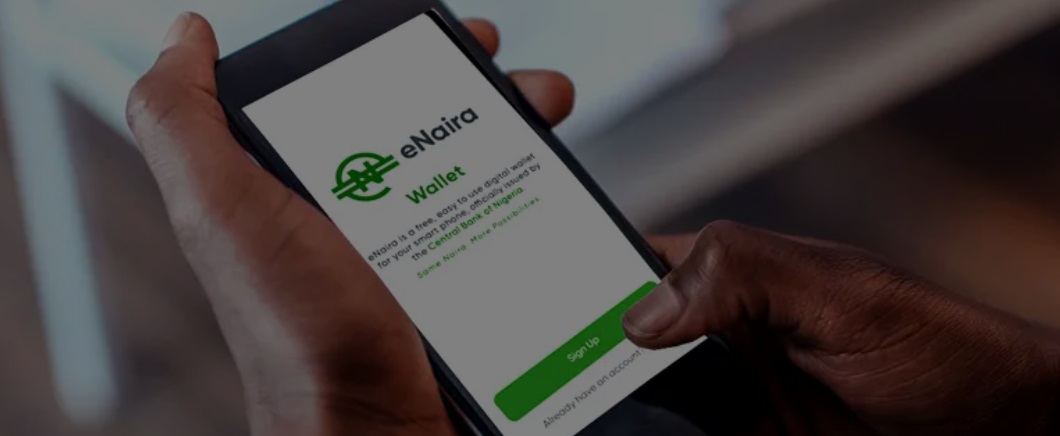

eNaira is a Central Bank of Nigeria-issued digital currency that provides a unique form of money denominated in Naira. eNaira serves as both a medium of exchange and a store of value, offering better payment prospects in retail transactions when compared to cash payments.

Customers can make in-store payment using their eNaira wallet by scanning QR codes. Also, eNaira allows users to send money to one another (P2P payments) through a linked bank account or card.

Central Bank of Nigeria (CBN) Governor Godwin Emefiele has said the eNaira would operate as a wallet against which customers can hold existing funds in their bank account.

„The eNaira therefore marks a major step forward in the evolution of money and the CBN is committed in ensuring that the eNaira, like the physical Naira, is accessible by everyone,” the bank said in a statement.

Nigeria has named Barbados-based Bitt Inc as a technical partner in developing the eNaira.

For more details download REGULATORY GUIDELINES ON THE eNAIRA

Official launch of the eNAIRA by President Buhari

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: