Retail central bank digital currencies (CBDCs) and fast payment systems (FPS) share a number of similarities. Both allow for instant transactions for end users, can rely on underlying infrastructures operated by the central bank and can allow for an important role for private payment service providers (PSPs) to offer their services to end users. The key difference is that retail CBDCs are a new form of central bank money for the general public, while FPS to date allow end users to transfer private money (eg commercial bank money or electronic money).

The paper analyses how retail CBDCs and FPS compare with each other and why some jurisdictions have opted for a retail CBDC, while others have chosen to introduce an FPS or both. Interviews with central banks in 14 jurisdictions around the world (at different stages of implementation of a retail CBDC and/or an FPS) show that some see a case for both to fulfil different policy goals and complement one another. The paper also compares emerging challenges and risks related to retail CBDCs and FPS.

What authors said: „Our key conclusion is that the choice between a retail CBDC or an FPS, or both, is very contextual and will depend on the market features, ecosystem and degree of maturity and innovation of existing payment infrastructures in a country. Decisions regarding a retail CBDC, FPS or both involve important considerations regarding success factors, design choices and the role of central banks and the private sector.„

This paper explores two key questions: How do retail CBDCs and FPS compare with each other? Why have some jurisdictions opted for one of them while others are considering both?

To answer these questions, the authors describe key similarities and differences between retail CBDCs and FPS, including functionalities, the role of central banks and other stakeholders, and risks and challenges.

„To inform our analysis and discussion, we interviewed central bank staff in 14 jurisdictions. These institutions are at different stages in terms of design, implementation and adoption of retail CBDCs and FPS. The interviews took place between December 2022 and February 2023. The sample of 14 central banks was selected in a way that covers a wide range of perspectives, from central banks that already have both a retail CBDC and an FPS, to those that have one of the two, to those that have neither (yet).” – the authors explained.

Currently, consumers and businesses in about 120 jurisdictions can make and/or receive fast payments through a domestic or regional FPS. These are operated by either central banks or private parties or as a public-private collaboration. While some of these systems are still at an early stage of development, others have demonstrated impressive uptake after their launch. For instance, Pix onboarded more than 150 million individual and business users in Brazil in its first year of operation and is now used by over 90% of adults in the country. PromptPay registered around 63 million end users in Thailand in early 2022, representing more than 85% of the population.

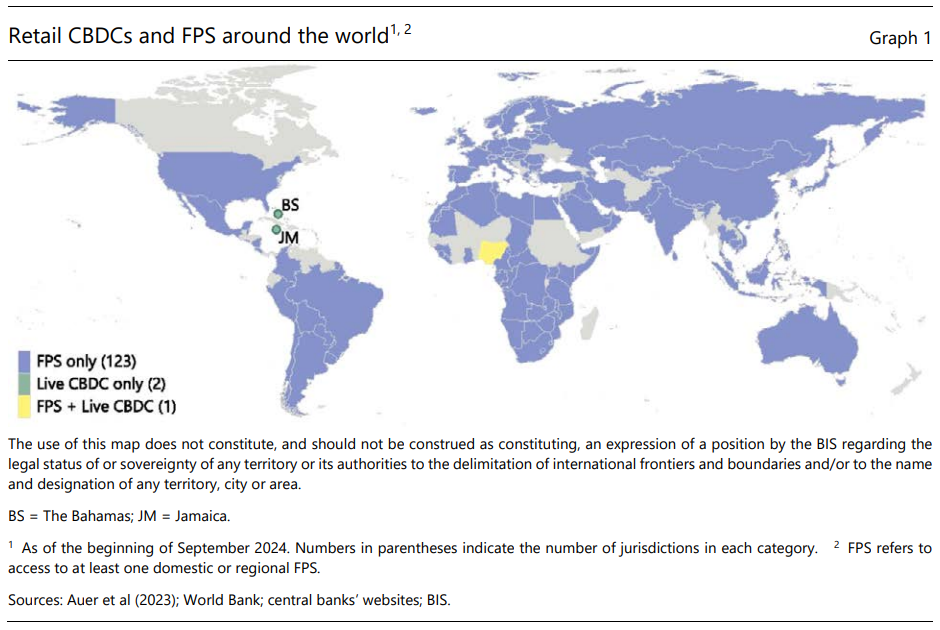

As of March 2024, nearly 600 banks were live on UPI in India, with more than 13 billion transactions carried out using that infrastructure in a peak month. Meanwhile, as of September 2024, three central banks have launched a live retail CBDC (in the Bahamas, Jamaica and Nigeria) for general use by households and businesses. Of these, Nigeria has implemented an FPS as well.

Adoption of these three retail CBDCs in terms of users as well as transactions has been relatively slow compared with the global uptake of FPS. In The Bahamas, roughly three years after the introduction, there were about 100,000 wallets in March 2023 (about 25% of the adult population), with about 200,000 transactions per month. In Nigeria, there were about 900,000 wallets (0.5% of the population) one year after the launch.

Nevertheless, a BIS survey of central banks found that about a quarter of central banks were piloting a retail CBDC in 2023. Graph 1 shows the status of retail CBDC projects and FPS around the world.

More details: BIS Papers No 151 – Central bank digital currencies and fast payment systems: rivals or partners?

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: