In recent years, emerging market economy (EME) central banks have increasingly engaged in projects related to central bank digital currencies (CBDCs).

The stage of their engagement – research, pilot or launch – varies according to differences in country circumstances, including the availability of digital infrastructure, their focus among different policy objectives, and the attendant motivations and concerns, according to a BIS Paper – CBDCs in emerging market economies.

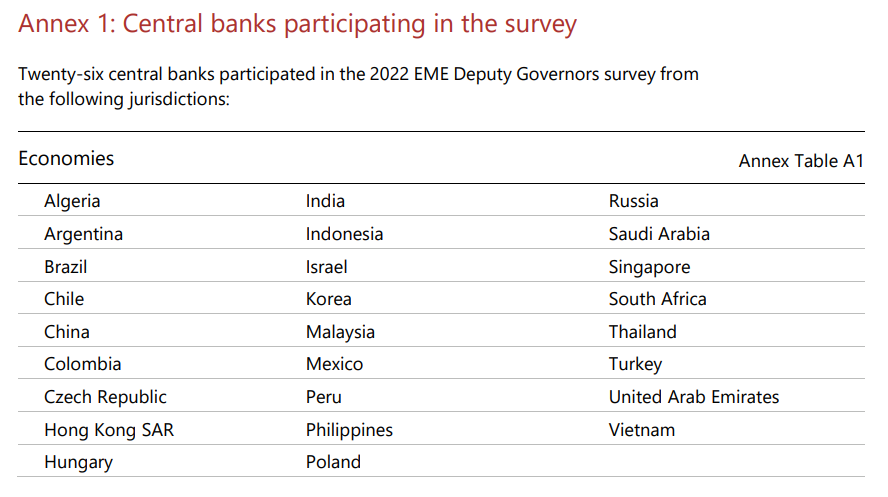

This volume contains papers that were prepared for a meeting of Deputy Governors of central banks from EMEs, which took place on 9–10 February 2022 and explored issues such as: the main objectives of introducing CBDCs; the guiding principles of CBDC design and data governance; challenges of CBDCs for monetary policy, financial intermediation and financial stability; the implications of CBDCs on financial inclusion; and the cross-border aspects of CBDCs. Discussions at the meeting also drew on insights from a survey on the roles of and considerations for CBDCs in EMEs.

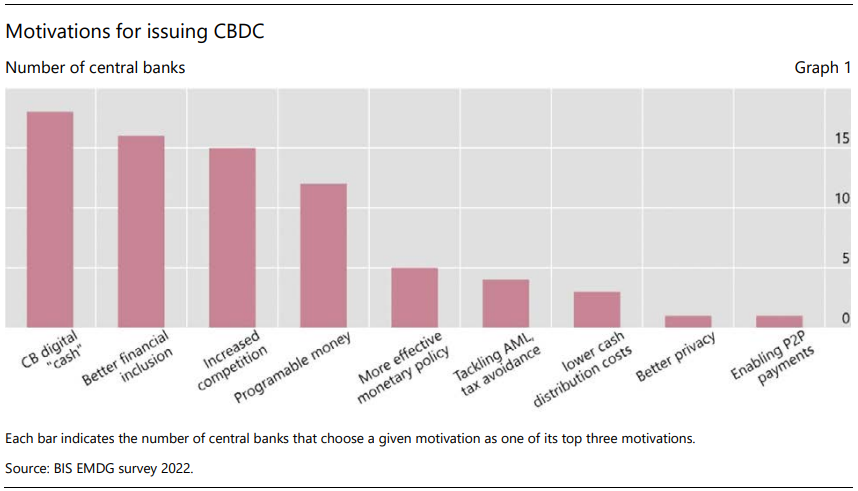

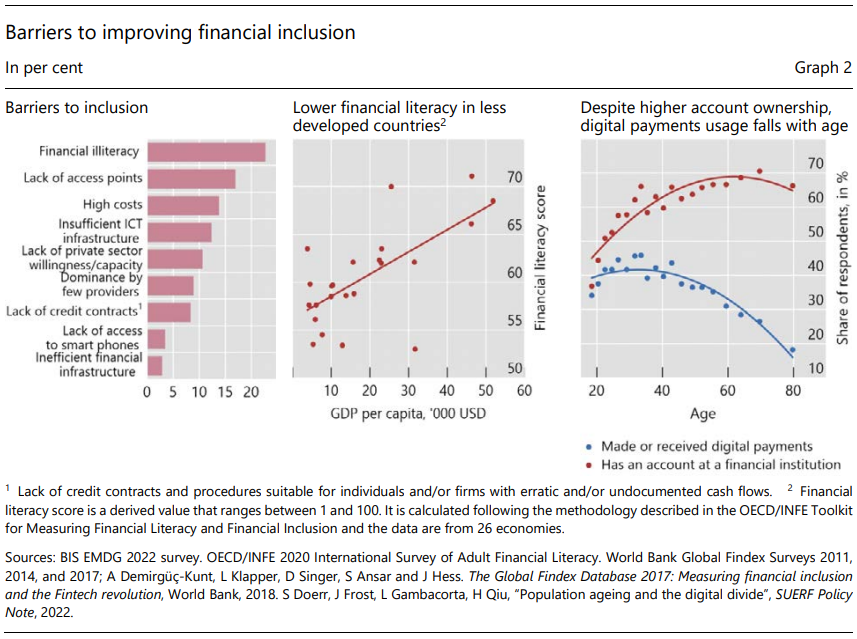

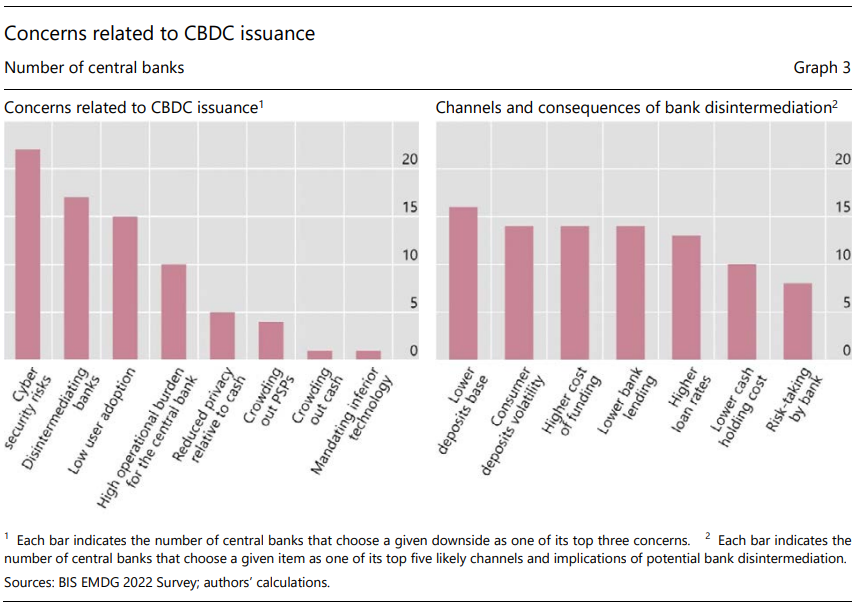

Many papers in this volume discuss the key motivations for CBDC issuance as well as the primary concerns. Achieving greater payment system efficiency is at the heart of EME central banks’ motivations. EME central banks also place great emphasis on financial inclusion and are concerned about cyber security risks, potential bank disintermediation and cross-border spillovers.

A related topic discussed is the value added of CBDCs for existing payment systems, and country papers offer concrete examples of deliberations on this topic at the current juncture.

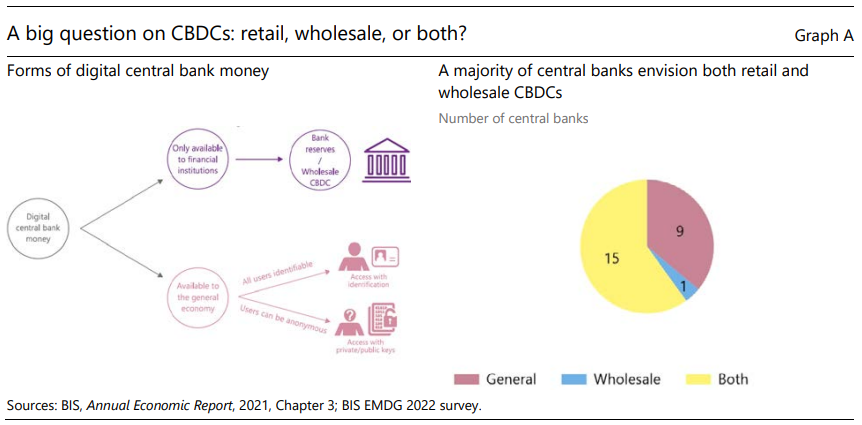

Another area covered by the papers in this volume is CBDC design considerations. Many EME central banks are of the view that careful design can keep risks to a minimum, while yielding net benefits.

All 26 central banks participating in this meeting (Annex Table A1) are active in CBDC research. Several have progressed to the pilot or proof-of-concept stage (eg Hong Kong SAR, Saudi Arabia, Thailand, the United Arab Emiratis (UAE)). A few are close to launching (eg China’s eCNY), while some do not see a pressing need for a CBDC in the near future (eg Poland, Singapore).

BIS background paper

CBDCs in emerging market economies

Authors: Sally Chen, Tirupam Goel, Han Qiu and Ilhyock Shim

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: