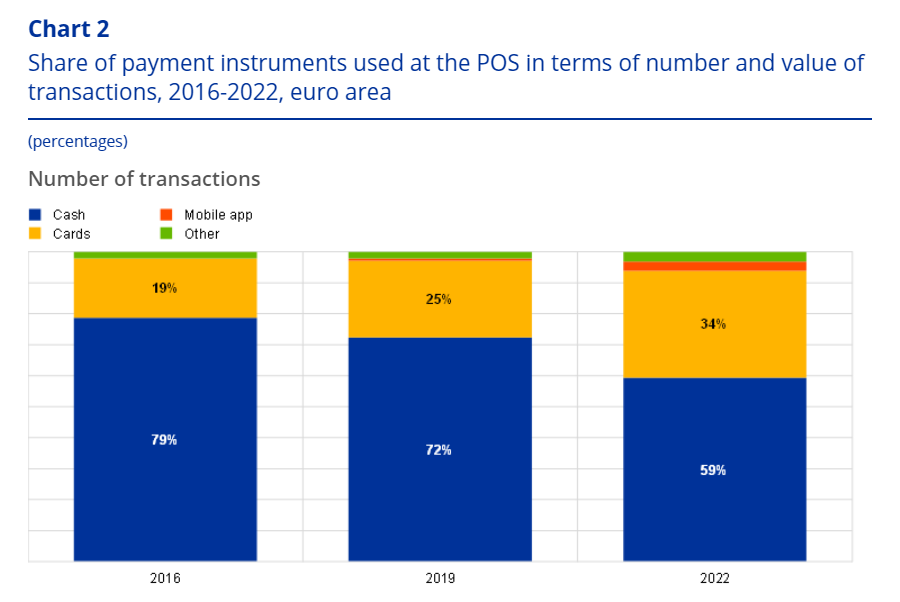

Card payments were used in 34% of POS transactions, up from 19% in 2016 and 25% in 2019. Cash was accepted in 95% of physical payment locations throughout the euro area, down from 98% in 2019. In the euro area it was possible to pay with non-cash instruments in 81% of transactions in 2022.

Cash is still the most frequently used means of payment at the point of sale, but its share is declining according to the latest study on the payment attitudes of consumers in the euro area, published by the European Central Bank (ECB). Cash was used for 59% of point-of-sale transactions in 2022, down from 72% in 2019. It is the means of payment most often used for small-value payments in stores and for person-to-person transactions. A majority (60%) also consider it important to have cash as a payment option. Consumers perceive cash as helpful to remain aware of their expenditures, to protect their privacy and to allow transactions to be settled immediately. Overall, consumers are satisfied with their access to cash, with a large majority of consumers finding it easy to get to an ATM or a bank to withdraw cash in most countries.

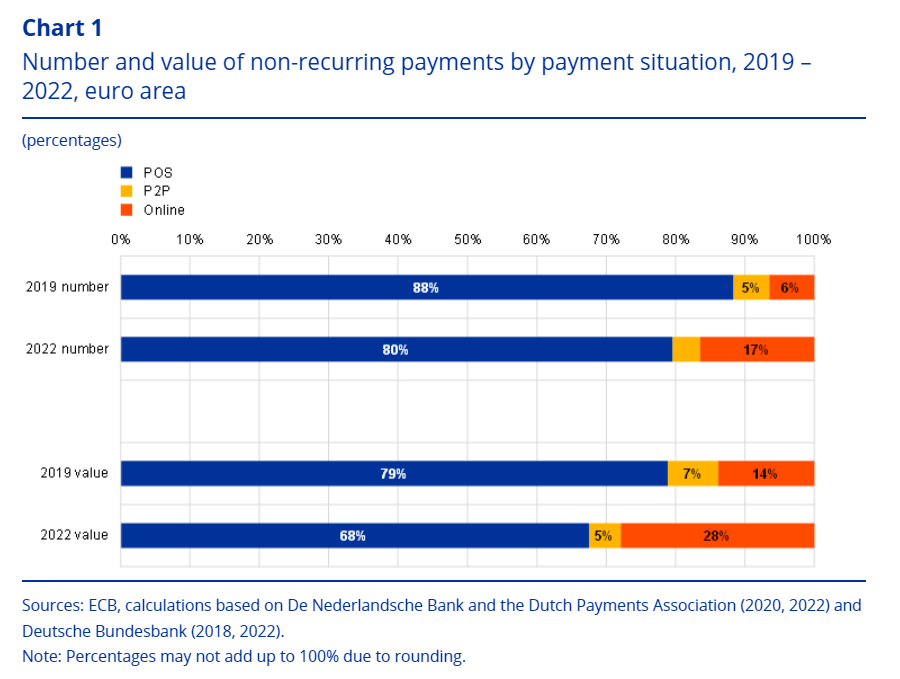

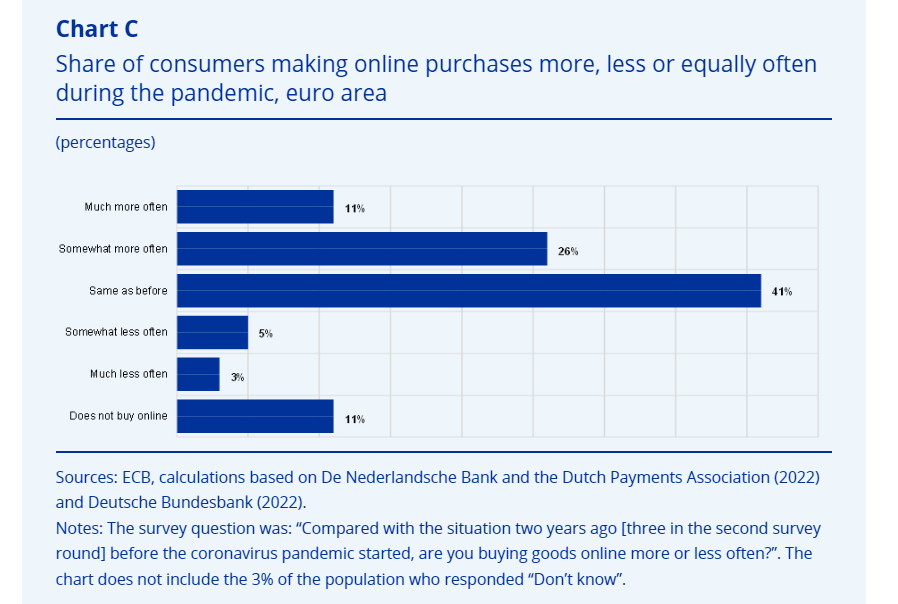

At the same time, the trend towards electronic means of payments has accelerated with the pandemic and a majority of consumers now prefer to use electronic payment methods. The share of online purchases as a percentage of all euro area day-to-day transactions has increased significantly to stand at 17% in 2022, up from 6% in 2019.

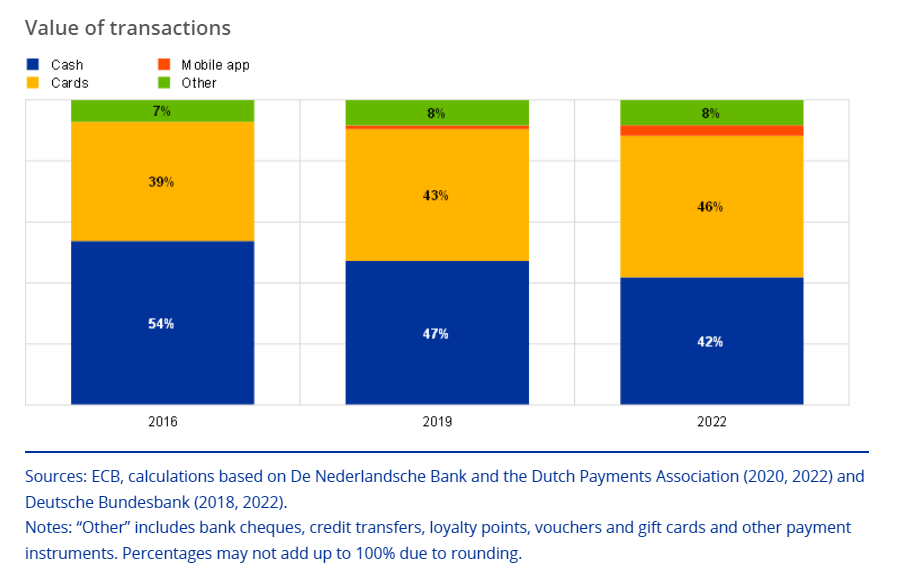

For purchases at a point of sale, the share of card payments has grown by 9 percentage points to 34% in 2022, with contactless payments now making up the majority of card payments. Cards are considered faster and easier to use and are seen as reducing the need to carry large amounts of cash. Cards are the most frequently used payment method for larger payments and account now for a higher share of payments than cash in value terms.

“The ECB is committed to ensuring that consumers remain free to choose how to pay, both now and in the future,” said Executive Board member Fabio Panetta. “We are seeing confirmation of strong demand for both cash and digital payments. Our commitment to cash and our ongoing work on a digital euro aims to ensure that paying with public money is always an option.”

The SPACE 2022 results show that:

. Cash was the most frequently used payment method at the point of sale (POS) in the euro area and was used in 59% of transactions, down from 79% in 2016 and 72% in 2019.

. Card payments were used in 34% of POS transactions, up from 19% in 2016 and 25% in 2019.

. Other payment methods were used for 7% of POS transactions.

. The share of payments using mobile apps increased from less than 1% in 2019 to 3% in 2022.

. In terms of value of payments, cards (46%) accounted for a higher share of transactions than cash payments (42%). This contrasts with 2016 and 2019, when the share of cash transactions was higher than the share of card transactions (54% compared to 39% in 2016 and 47% compared to 43% in 2019).

. Contactless card payments at the POS increased considerably in three years, from 41% of all card payments in 2019 to 62% in 2022.

. Cash was most frequently used for small value payments at the POS, in line with previous comparable surveys. For payments over €50, cards were the most frequently used method.

. Cash was the dominant means of payment in person-to-person (P2P) transactions in the euro area. However, its share in the total number of payments declined from 86% in 2019 to 73% in 2022, and from 65% to 59% in terms of value.

. Cashless means of payments, particularly mobile phone apps, increased in P2P payments. Between 2019 and 2022, the share of mobile payments more than tripled in terms of number from 3% to 10%, and rose from 4% to 11% in terms of value.

. The share of online payments in consumers’ non-recurring payments increased from 6% in 2019 to 17% in 2022.

. Online payments were used especially for buying food and daily supplies from supermarkets and restaurants.

. The large majority of recurring payments were made using either direct debit or credit transfers.

. In the SPACE 2022 questionnaire, 55% of euro area consumers expressed a preference for cards and other cashless payments when paying in a shop, while 22% preferred cash and 23% had no clear preference.

. Nevertheless, the majority of euro area consumers considered having cash as a payment option to be important or very important.

. The perceived key advantages of cards were that consumers don’t have to carry cash with them, coupled with the convenience of contactless payments.

. The perceived key advantages of cash were its anonymity and protection of privacy and the perception that it makes one more aware of one’s own expenses.

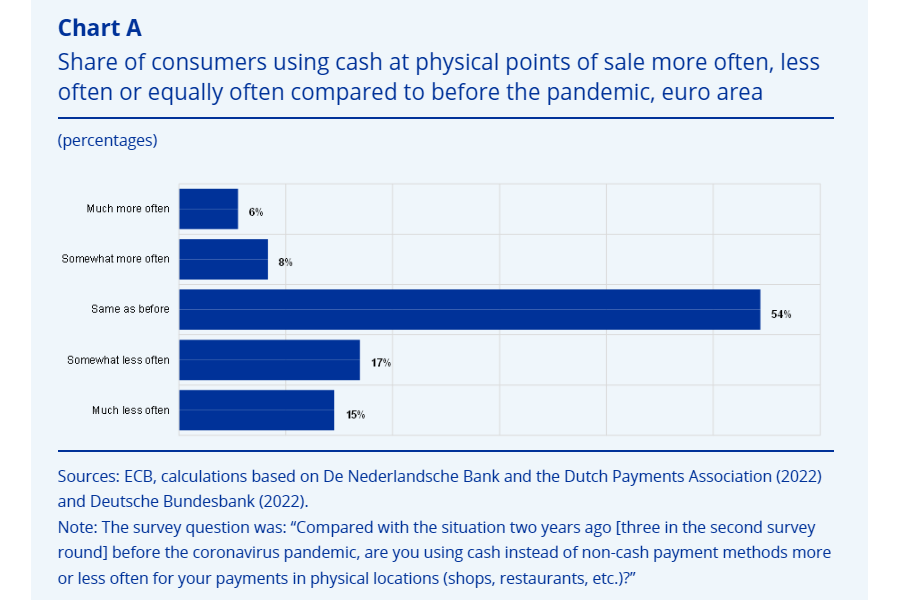

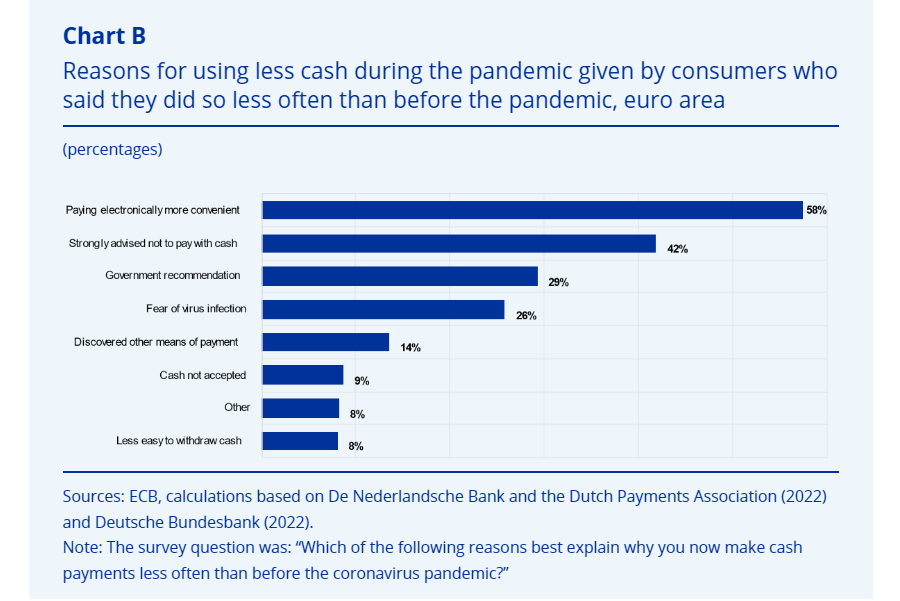

. Compared to before the outbreak of the pandemic, the majority of consumers (54%) said there had been no change in how often they use cash at physical points of sale; 31% of consumers indicated that they were using cash less often and 14% more often.

. For those who reported using cash less often, the most frequently mentioned reason was that paying electronically has become more convenient.

. Cash withdrawals were mostly made from automated teller machines (ATMs), which account for 74% of all cash withdrawals. The use of own cash reserves accounted for 11% and withdrawals over the bank counter for 6%.

. Most euro area consumers were satisfied with their access to cash. The vast majority of consumers (90%) found it fairly easy or very easy to get to an ATM or a bank (up from 89% in 2019). The remaining 10% said it was fairly or very difficult.

. 37% of consumers kept cash reserves at home, outside the wallet or a bank account, up from 34% in 2019.

. Cash was accepted in 95% of physical payment locations throughout the euro area, down from 98% in 2019.

. In the euro area it was possible to pay with non-cash instruments in 81% of transactions in 2022.

More details here

The next study on the payment attitudes of consumers in the euro area will be published in 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: