Cash usage increased for the second consecutive year. Fees paid to banks and card schemes rose by over 25%. Debit and credit cards accounted for over 85% of all spending.

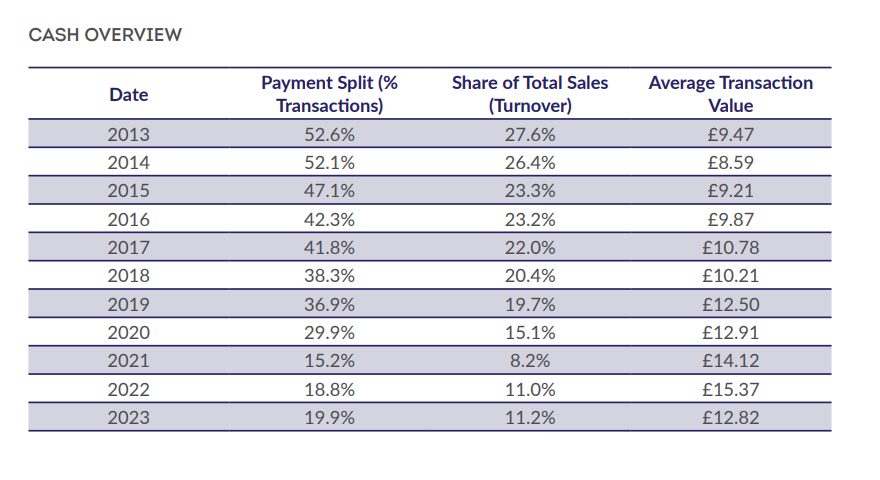

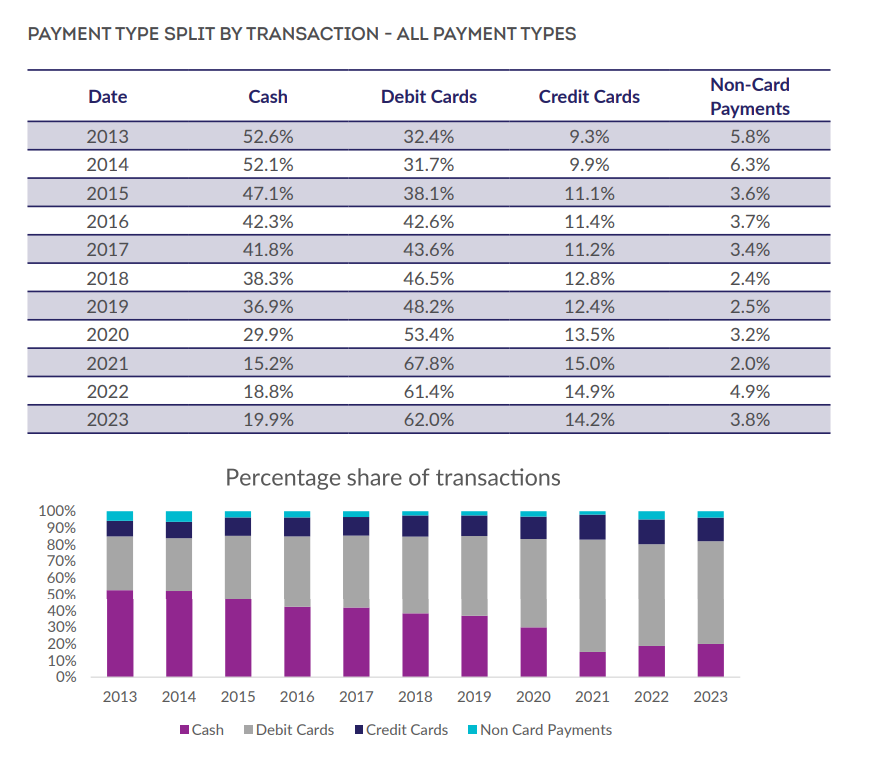

The British Retail Consortium (BRC) has published its BRC Payments Survey, showing a rise in the use of cash for the second year in a row to 19.9% of transactions in 2023 (from 18.8% in 2022). Debit cards remained far and away the most common method of payment, increasing to 62.0% of transactions (66.7% by spending). Taken together with credit cards, card payments accounted for over 75% of transactions and 85% of spending.

Overall, customers visited shops more frequently but made smaller purchases, as the cost of living crisis continued to pinch in 2023. The total number of transactions rose from 19.6 billion to 21.0 billion while the average amount spent (per transaction) fell from £22.43 to £22.03.

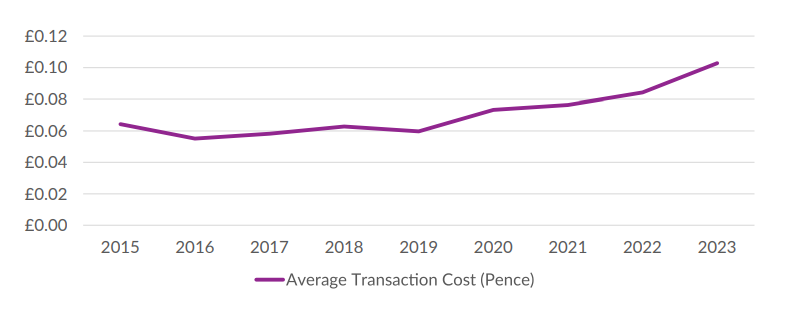

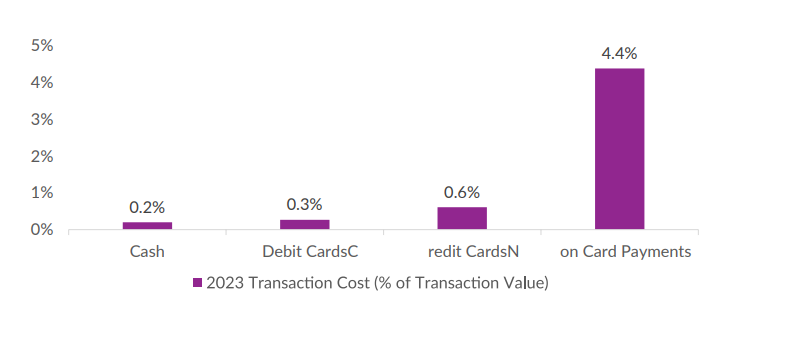

Meanwhile, card fees paid by retailers continued to grow. The total amount paid by retailers to banks and card schemes rose by over 25% in 2023, at an extra cost of £380 million. This brought the total card fees paid to £1.64 billion. Card companies continue to raise these fees without transparency or justification and retailers hope that the Payment Systems Regulator (PSR) will now implement meaningful reforms to tackle the lack of competition and rising costs identified in their current market reviews.

Cash remains a vital form of payment for a sizeable minority of the population, particularly for its role in budgeting. This has made it important to many households during the recent cost of living squeeze. All large retailers are committed to accepting cash in their stores, which has a lower processing cost than other forms of payment and we welcome the new FCA rules introduced this year to support consumers’ continued access to cash. However, the dominance of cards as the preferred payment method highlights the urgency for reform on costs.

Chris Owen, Payments Policy Advisor, British Retail Consortium said:

„Persistent inflation and the cost of living crisis continued to affect households across the country and many consumers used cash to budget more effectively. However, the dominance of card payments continues apace, accounting for over 85% of spending. Card fees continue to rise at a substantial rate and the PSR must act upon the harms it has identified in its current market reviews. It must move swiftly to reform the market and implement remedies including price caps on fees and price rebalancing measures.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: