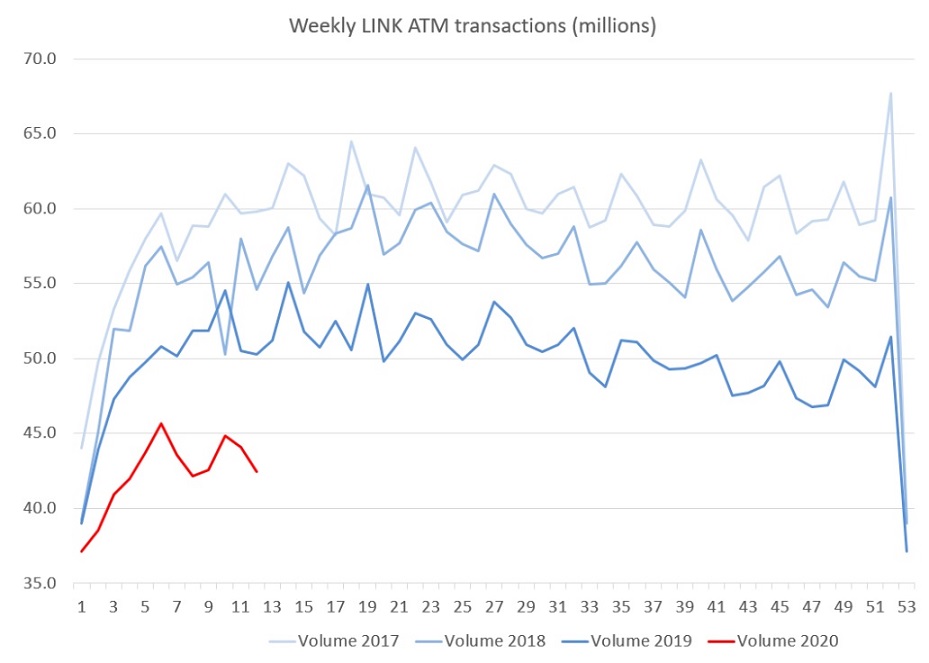

Cash usage in Britain has halved in just a few days following the Government’s imposition of a nationwide lock-down on freedom of movement. The dramatic decline in the use of cash comes as shops across the UK shut down and people move to contactless payments to avoid Covid-19 contamination from banknotes.

„As expected, consumers’ ATM and cash use has fallen significantly, (by around 50%) over the past few days and this is likely to continue as people move to follow the Prime Minister’s instructions to stay at home.”, according to the press release.

The figures, supplied by UK ATM network Link, may harbour a fundamental change is users’ cash habits as the country’s banks commit to raising the PIN-free contactless limit from £30 to £45, finextra.com says.

Looking forward to the end of this crisis it is very likely that some consumers’ cash usage habits will have fundamentally changed but that the requirement for cash access, as a contingency and for vulnerable consumers will be more important than ever.

„A fundamental review and potential restructuring of the country’s ATM network and its business model may therefore be necessary.”, LINK said.

John Howells, LINK CEO commented, “These are difficult and challenging times, but I would like to reassure everyone that LINK remains as committed as ever to ensuring people can continue to access their cash. I and the whole LINK Board would also like to thank our Members and the many, many people who are working hard behind the scenes to keep the ATM network going”.

Link itself has moved into remote working business continuity mode and is working with member banks, regulators, industry bodies and other stakeholders to ensure consumers can still access their cash during the ongoing crisis.

LINK is the UK’s largest cash machine (ATM) network, the most popular channel for cash withdrawals in UK, and the busiest ATM transaction switch in the world. The total value of LINK cash withdrawals can exceed £10 billion per month. Also, LINK processes over 22,000 transactions a minute.

Cash machine operators join LINK in order to offer cash to the 100 million plus LINK-enabled UK cards in circulation.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: