France – Cash transactions are now set to fall at a compound annual growth rate (CAGR) of -2.3% up to 2023

France’s payments industry will be hit by ongoing disruption to its essential tourism industry, though e-commerce is seeing increases, says GlobalData.

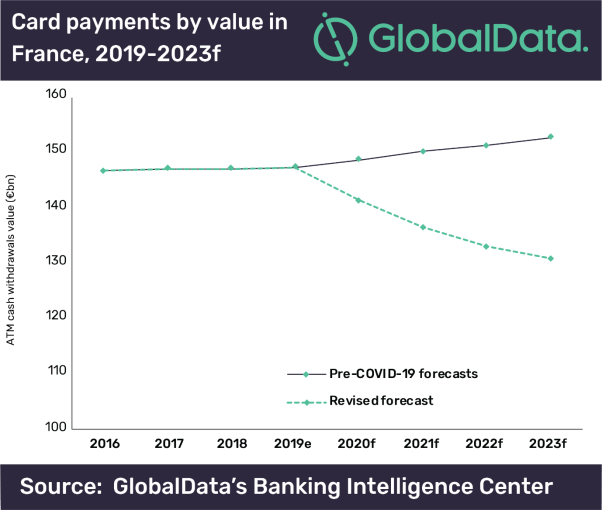

GlobalData’s post-COVID-19 revised-forecasts predict cash transactions will change from steady growth to yearly declines between 2019 and 2023. Cash transactions are now set to fall at a compound annual growth rate (CAGR) of -2.3% up to 2023.

Ravi Sharma, Banking and Payments Analyst at GlobalData, commented: “The French tourism industry is particularly reliant on Chinese consumers, as 2.2 million visitors per year spend $4.4bn (in 2019, according to the French Government.) There have been no Chinese visitors since February, which will mean a drastic reduction in consumer spend.”

France is further along than the UK, having been in lockdown since 16th March. All restaurants, cafes, bars, shopping malls, museums and entertainment venues have been shut since the 14th March, meaning that consumer spending has already dipped significantly. Key retailers such as Carrefour are open for online and payments and delivery, meaning that card payments and online checkout solutions have held up better than cash transactions.

Sharma continues: “Payments companies will lose out on significant business in consumer spending from sectors such as travel and tourism, accommodation and retail. It is essential to them that the outbreak is contained at the earliest. They will be watching countries ahead of France in the curve, such as China and South Korea, to see how things evolve when they relax the severe lockdown measures.”

Japan – while the number of card payments will grow by 2.6%, there will be a decline of -5.5% in ATM cash withdrawals in 2020

The share of cash in the overall payment transaction volume in Japan is set to decrease over the next five years, as users are increasingly considering currency notes to have the potential to transfer the deadly coronavirus (Covid-19) infection, according to GlobalData, a leading data and analytics company.

Subsequently, the pandemic is expected to push digital payments transaction value and volume among consumers and merchants as they shift away from cash payments to avoid exposure to disease vectors such as cash and POS terminals. According to GlobalData’s revised forecasts, while the number of card payments will grow by 2.6%, there will be a decline of -5.5% in ATM cash withdrawals in 2020.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “In order to avoid exposing themselves to disease vectors, increasing number of consumers are switching from in-store to online purchases. This will potentially benefit online payment solutions such as Konbini, Amazon Pay and PayPal.”

GlobalData also observed a sharp rise in the cancellation of flights, hotel booking, and even the postponement of 2020 Olympic and Paralympic Games due to the Covid-19 pandemic. There is expected to be a decrease in consumer spending in 2020, particularly in sectors like travel and tourism, hospitability, accommodation, and food & drinks. These will in-turn impact cards and payment industry growth.

Sharma concludes: “As Japan imposed state of emergency involving social distancing and other restrictions until 6 May 2020, domestic spending will continue to remain weak with the deterioration in transaction volume during April-May. Payments sector is expected to revive towards end of Q2 2020 once the restrictions are completely lifted. Consumers are expected to defer on some of the high value purchases by few months at least till they have better view of the situation.”

U.S. – cash payments to decline by 4.5% between 2019 and 2023 due to COVID-19

The rapidly rising number of coronavirus (COVID-19) cases in the US has caused an economic slowdown in the country, which has resulted in the number and value of expected transactions being significantly reduced – largely due to a substantial fall in cash transactions, says GlobalData, a leading data and analytics company.

Pre-COVID-19, GlobalData forecasts saw total transactions rising at a compound annual growth rate (CAGR) of 7.6% between 2019 and 2023. However, this has now been revised to 4.5%, mainly due to the CAGR for cash payments dropping from 2.5% to -1.5% in the same period.

Ravi Sharma, Banking and Payments Analyst at GlobalData, said: “The decline in overall spending will be somewhat offset by a rise in online payments. Wary consumers will stay home and use the online channel to purchase goods in order to avoid exposing themselves to the disease.”

GlobalData forecasts predict steady declines for cash payments up to 2023, but card payments will witness a consistent increase, albeit at a slower CAGR than originally predicted before the pandemic. Growth will be slowed by availability of goods and many vendors closing.

However, COVID-19 is likely to have a lasting impact on consumer behavior, as mobile wallets and especially contactless payments will likely be more widely used.

Sharma adds: “While the uptake of contactless card payments in the US has been relatively slow, this crisis should give a push to these payments, since they allow consumers to avoid handling cash or point-of-sale terminals.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: