Cash is the new safe haven as Crypto and Gold continue to tank. Bitcoin dropped almost 50% in less than 24 hours!

It turns out cold, hard cash with a helping of government bonds — not bitcoin or even gold — is where people turn in the face of a pandemic and market turmoil.

Liquidations set in on the cryptocurrency market the day after the U.S. announced European travel restrictions due to coronavirus fears Wednesday. Bitcoin (BTC) is down 21 percent and ether (ETH) is down 27 percent over the past 24 hours. That’s more than the traditional markets, with the Standard & Poor’s 500 down nearly 8 percent at 2:45 p.m. ET (1845 UTC).

“It’s apocalyptic out there. Traditional safe havens like gold are down,” said Rupert Douglas, head of Business Development, Institutional Sales at Koine.

Traders liquidating holdings on crypto’s bellwether derivatives exchange, BitMEX, fueled some of these moves. Gold also got hit as traders sold the yellow metal for the safety of much-needed cash as losses mounted in equities.

“This downward pressure caused crypto markets to suffer a liquidity crunch as the cost of capital spiked up across trading venues,” said Denis Vinokourov, head of research at Bequant, a London-based digital asset firm.

“This tightening was exacerbated by the fact that the market is highly dominated by sell-side liquidity providers/market-making firms, with only a limited buy-side demand,” he added.

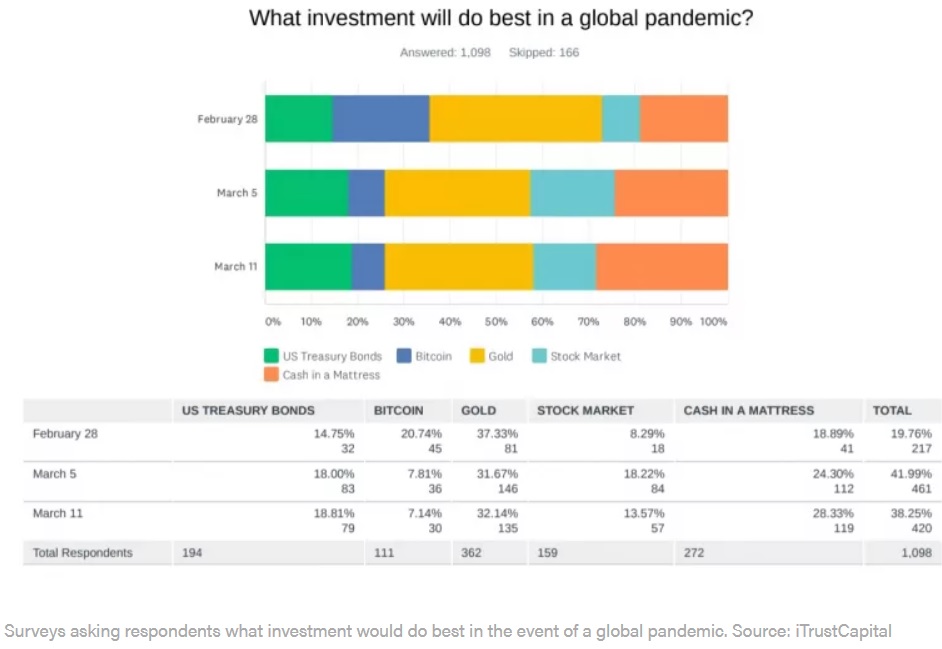

For an increasing number of investors, the haven in crisis times seems to be cash, not cryptocurrency or gold. A recent survey conducted by iTrustCapital, a firm that offers cryptocurrency investments in retirement accounts, highlights how safe-haven tendencies have changed since the end of last month.

Those answering “cash in a mattress” as a safe haven jumped from 18 percent of respondents in February to almost 27 percent by March 11. “Gold” as an answer fell from 37 percent to 33 percent during that same period. The survey was conducted before gold’s 3 percent drop on Thursday.

„Margin calls and de-risking [are seeing] investors shedding gold positions to pay for losses elsewhere,” says one London bullion desk. „This is quite visible in Comex gold futures…[now] losing Open Interest in the past 3 days. „[This] highlights [how] long liquidation from short-term investors is currently driving price.”

While many cryptocurrency advocates have long likened bitcoin to gold as the ultimate financial haven (“digital gold” is an oft-used phrase), in these times the markets are saying otherwise.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: