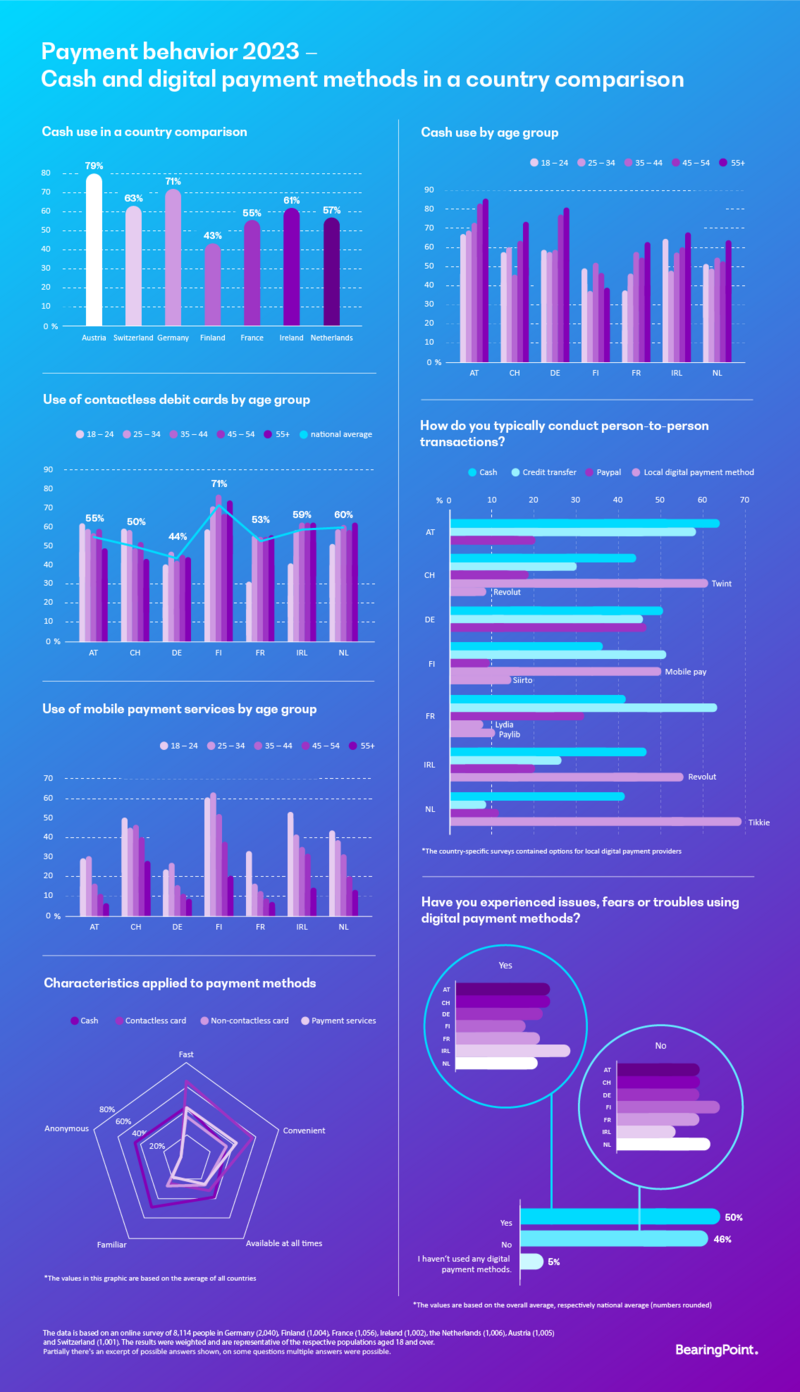

The contactless debit card is the most frequently used digital payment method in a European comparison, while cash is the most frequently used payment method overall. Anonymity is only attributed to cash. One in two had experienced problems with digital payment methods. These are the findings of a new survey conducted by management and technology consultancy BearingPoint in seven European countries.

Cash is the primary form of payment across Europe, being most frequently used in Austria and Germany and least frequently used in Finland. However, the frequency of payment method usage varies greatly between countries and age groups. The characteristic of anonymity is only attributed to cash, while the characteristics of speed and convenience are attributed to digital payment methods such as card payments and payment services.

Cash use is significantly higher in Austria (79%) and Germany (71%) than in other European countries. Respondents from Switzerland (63%), Ireland (61%), the Netherlands (57%), and France (55%) also show a relatively high level of cash use but are well behind Germany and Austria. Finland has a significantly lower frequency of cash usage at 43%.

Cash usage also varied across the surveyed age groups. The most frequent use of cash is seen in the 55+ age group in Austria, at 86%, while Finland has the lowest frequency in this age group at 39%. In general, the 55+ age group uses cash most frequently, except in Finland, where the 35-44 age group uses cash most frequently at 51%. In the 18-24 age group, Austria again tops other countries at 68%, whereas France has the lowest frequency of cash usage in this age group at 37%.

In Finland, the contactless debit card is the most frequently used payment method across all age groups at 71%, which is significantly higher than cash use. On average, the contactless debit card is the second most frequently used payment method in the countries surveyed at 56%. Cash and contactless debit cards are used almost equally frequent in France, Ireland, and the Netherlands. Compared to the other countries, the frequency of use of non-contactless debit cards is lowest in Finland at 17%, which is well below the average of 33% for the countries surveyed.

For France, it can be seen in the 18-24 age group that no payment method is preferred for frequent use. At a relatively low level, there is a very homogeneous frequency of use of cash, card payments, mobile payment services and online payment services and digital wallets in the range between 24% and 37%. Cheques, on the other hand, are clearly lagging behind at 6%, while the frequency of use in France is steadily increasing across the age groups and is highest for the 55+ age group at 41%. Cheques are almost not used as a payment method in the other countries.

In most countries, contactless debit cards are used evenly across all surveyed age groups. The exceptions are France and Ireland, where the 18-24 age group differs significantly compared to the national average, with the lowest frequency of contactless debit card use in this age group at 31% in France, closely followed by Ireland at 40%. In contrast, mobile payment services are used significantly more frequently in the 18-24 age group in France at 33% and Ireland at 54% than the national average for the other age groups.

„It is interesting to see that cash is very common across all age groups and is clearly number one among respondents. It is also noteworthy that in the 18-24 age group, cash is used more frequently on average than mobile payment services. From my point of view, the contactless debit card has experienced more intensive use during the pandemic and established itself as a heavily used digital payment method in Europe.” says Christian Bruck, Partner and payments expert at BearingPoint

43% of respondents attribute the characteristic of anonymity to cash, while card payments and payment services are not assigned this characteristic. With 56% of respondents, Austria is the leader in the country comparison for the anonymity characteristic of cash. Contactless cards are rated as fast by 64% and as convenient by 57% of respondents on average, putting them above the other payment methods surveyed. There are clear differences between countries. Regarding contactless cards, 74% of respondents in Finland agree with the characteristic of fast, and 69% agree that they are convenient, while in Germany, only 54% agree with fast, and 42% agree that they are convenient.

Austria and France remain loyal to the traditional payment methods of cash and bank transfer, with cash being the most frequently used payment method for payments among private individuals in Austria at 64% and bank transfer at 64% in France.

Individual digital payment providers are the first port of call for payments among private individuals in the Netherlands (69%), Switzerland (62%) and Ireland (55%).

Around one in two respondents had problems or concerns when using digital payment methods. In Ireland, most respondents (63%) stated they had experienced problems or concerns, whereas in Finland, only 38% had experienced either.

„The survey showed that there are clear, country-specific characteristics in the usage behavior of payment methods across Europe. Mobile payment services are more widely used in countries where country-specific solutions are offered and widely supported. From my point of view, there is still a high potential for a future, uniform, European mobile payment solution.” says Dr. Robert Bosch, Partner and Head of Banking & Capital Markets at BearingPoint.

_________

The data is based on an online survey of 8,114 people in Germany (2,040), Finland (1,004), France (1,056), Ireland (1,002), the Netherlands (1,006), Austria (1,005) and Switzerland (1,001) conducted between September 11-22, 2023. The results were weighted and are representative of the respective populations aged 18 and over.

The survey was designed by BearingPoint and conducted by the market research institute YouGov in the seven countries mentioned. The results were analyzed by the BearingPoint payments experts. BearingPoint has conducted the survey regularly in the DACH region since 2019 and expanded the panel to other European countries this year.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: