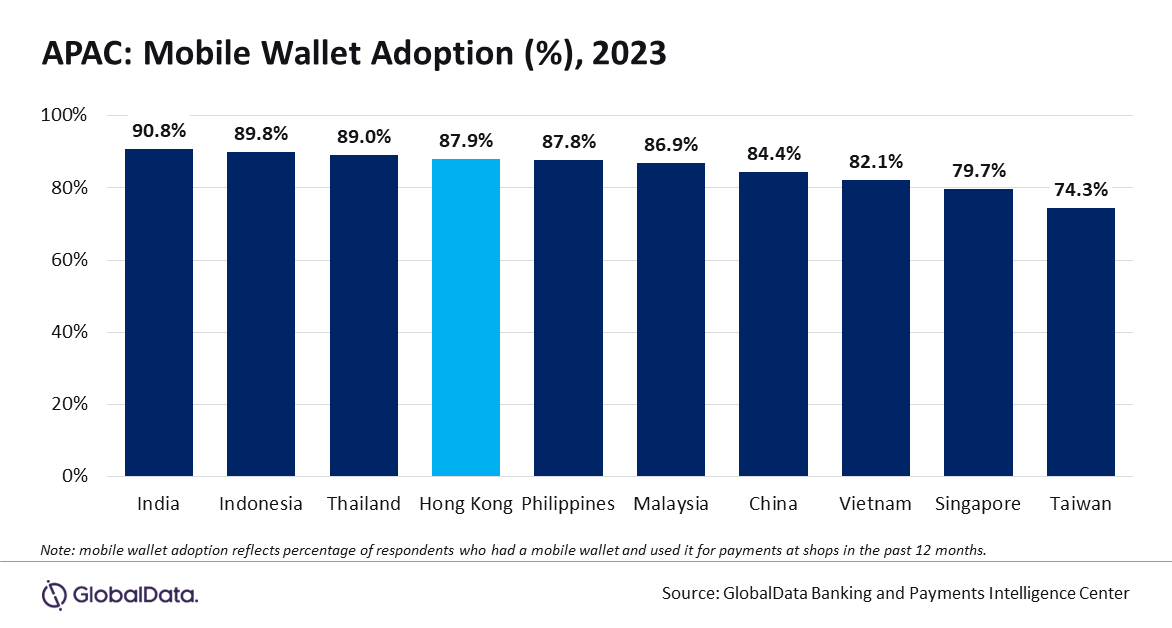

Mobile wallet usage is on the rise in the Asia-Pacific (APAC) region, a trend that is prevalent in Hong Kong (China SAR) as well, with nearly 88% respondents using mobile wallets for payments at shops, according to GlobalData, a leading data and analytics company.

GlobalData’s 2023 Financial Services Consumer Survey* shows that Hong Kong ranks fourth globally in terms of mobile wallet adoption with 87.9% survey respondents indicating that they had a mobile wallet and used in a shop in the past 12 months. The COVID-19 pandemic also accelerated mobile wallet adoption as consumers shifted from cash to electronic payments.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Mobile wallet usage is all set to disrupt the consumer payments space in Hong Kong and gradually displace cash. Widespread QR code infrastructure, the availability of mobile-based instant payment systems, and rising consumer and merchant preference all contributed towards mobile wallet usage.”

While cards remain the preferred non-cash payment instrument, the rise in mobile payments is evident. The country’s strong adult banked population and smartphone penetration; the availability of mobile wallets including domestic and international brands such as Octopus Wallet, AlipayHK, Apple Pay, and Google Pay; and growing merchant acceptance are driving the number of potential mobile wallet users.

AlipayHK is one of the Hong Kong’s most prominent mobile wallet brands with 3.3 million users and a merchant base of 150,000, as of May 2024.

Hong Kong has been investing in building infrastructure for mobile wallet payments, with Hong Kong Common QR Code (HKQR) code being one such initiative. To further encourage digital payment acceptance, the Hong Kong Monetary Authority (HKMA) rolled out common QR code standard (HKQR), thereby eliminating the need for merchants to display multiple QR codes and thus encouraging the use of QR codes for payments.

The introduction of real-time (instant) Faster Payment System (FPS) complimented HKQR in driving the mobile wallet adoption and usage. In addition to facilitating real-time fund transfers between bank accounts, FPS supports QR-code based merchant payments. As of May 2024, 36 banks and 10 payment services providers support FPS.

Sharma concludes: “Mobile wallet has become a mainstream payment solution in Hong Kong, driven by the government push, supporting payment infrastructure, and the proliferation of mobile wallet brands. With smartphones being integral to everyday life in Hong Kong, and consumers becoming more comfortable utilizing mobile phones for making payments, this space is likely to record further growth going forward.”

Card payments in Hong Kong to grow by 12.2% in 2024

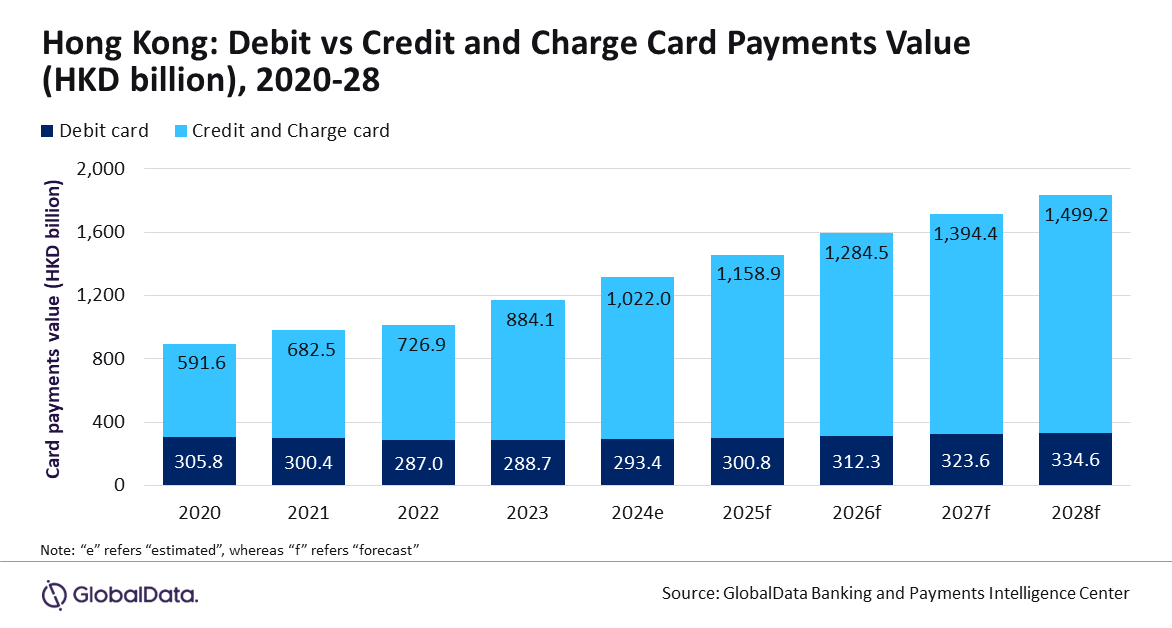

The Hong Kong card payments market is forecast to grow by 12.2% to reach HKD1.3 trillion ($168.1 billion) in 2024, supported by a constant consumer shift towards non-cash payments, according to GlobalData.

GlobalData’s Payment Cards Analytics reveals that Hong Kong saw a slower growth of 3.2% in card payments value in 2022, as soaring inflation, rising unemployment, and geopolitical uncertainty affected consumer spending, which in turn impacted card payments. However, with the Hong Kong economy registering a positive real GDP growth of 3.3% in 2023 after a decline of 3.5% in 2022, the country’s card market revived to witness 15.7% growth in 2023, reaching HK$1.2 trillion ($149.9 billion).

Shivani Gupta, Senior Banking and Payments Analyst at GlobalData, comments: “Although cash remains the favored payment method in Hong Kong, the uptake of electronic payment methods is on the rise. Consumers are increasingly adopting payment cards, spurred by a strong banked population and the expansion of payment acceptance infrastructure. This shift in consumer behavior signals a move away from conventional payment method like cash to embrace digital alternatives.”

A well-developed payment infrastructure has supported the overall card payments growth in Hong Kong, with POS terminal penetration per 1 million individuals standing at 26,579 in 2023, which is higher than peer countries including Malaysia (26,228), China (25,513), Japan (20,867), and Thailand (16,358).

Gupta adds: “The growth of card payments has also been supported by the high adoption and usage of contactless cards, driven by increased awareness of contactless cards among consumers and merchants in Hong Kong. Consumers and financial institutions alike have embraced the technology, with widespread acceptance infrastructure being the major reason why the cards are popular.”

According to GlobalData’s 2023 Financial Services Consumer Survey*, over 66% of the respondents in Hong Kong indicated having access to a contactless card and used it for payments. The rising usage of contactless payments for public transport payments is also contributing to this. Effective from December 2023, Visa contactless payment cards are accepted at entrance and exit gates for fare payments on Hong Kong’s Mass Transit Railway (MTR) system.

Among the card types, credit and charge cards accounted for 75.4% share of the overall card payment value in 2023. This is mainly due to the value-added benefits associated with these cards, such as flexible payment options and reward programs.

Debit cards, on the other hand, account for the remaining 24.6% share. Although debit cards are traditionally preferred for cash withdrawals, they are now increasingly being used for payments as well, especially low-to-medium value transactions.

Shivani concludes: “Hong Kong’s payment card market is expected to continue its upward growth trajectory, supported by widespread payment infrastructure and the increased convenience of contactless technology. The market is expected to grow at a CAGR of 8.7% between 2024 and 2028 to reach HKD1.8 trillion ($234.3 billion) in 2028.”

____________

*GlobalData’s 2023 Financial Services Consumer Survey was carried out in Q2 2023. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: