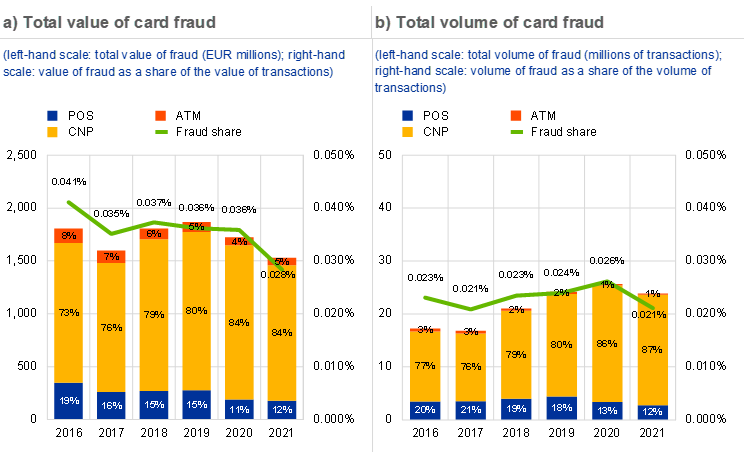

In 2021, card fraud as a share of the total value of payments using cards issued in SEPA was at its lowest level (0.028%) since the Eurosystem started to collect such information from card payment schemes in 2008.

After decreasing by 8% in 2020, the value of overall card fraud declined by 11% in 2021.

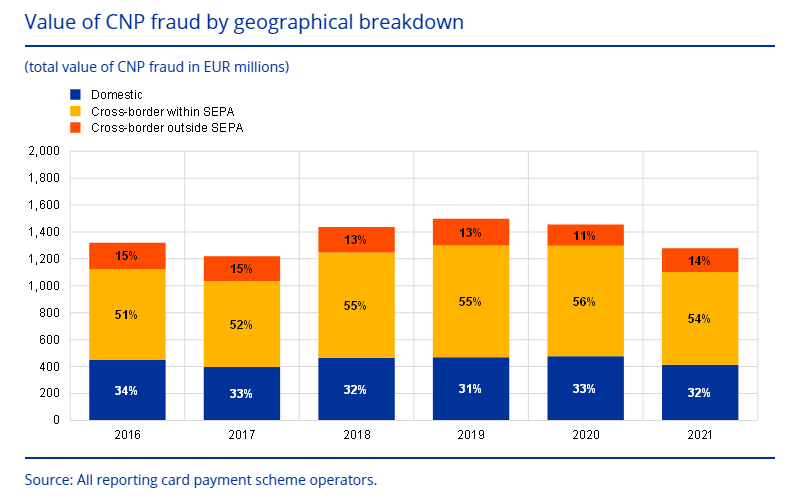

The value of card-not-present fraud declined by 12% in 2021 in light of the market-wide implementation of strong customer authentication.

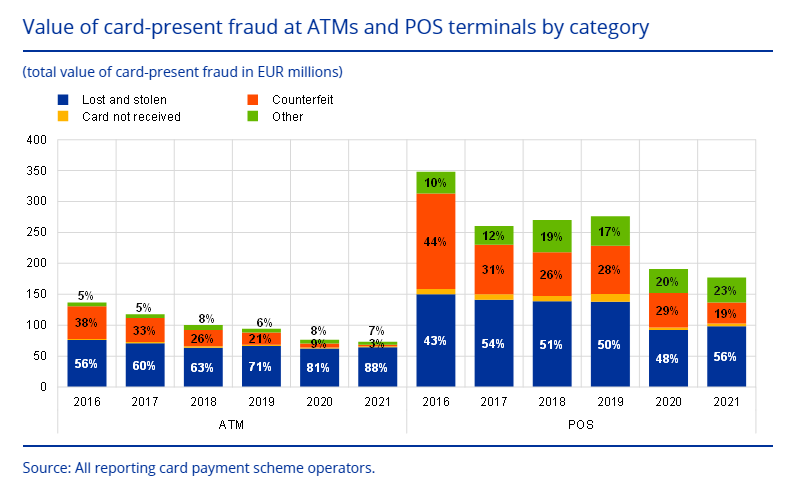

Card-present fraud in the form of using counterfeit cards at shops and ATMs declined by 37% in 2020 and by 42% in 2021, as the global roll-out of industry standards almost eradicated such fraud.

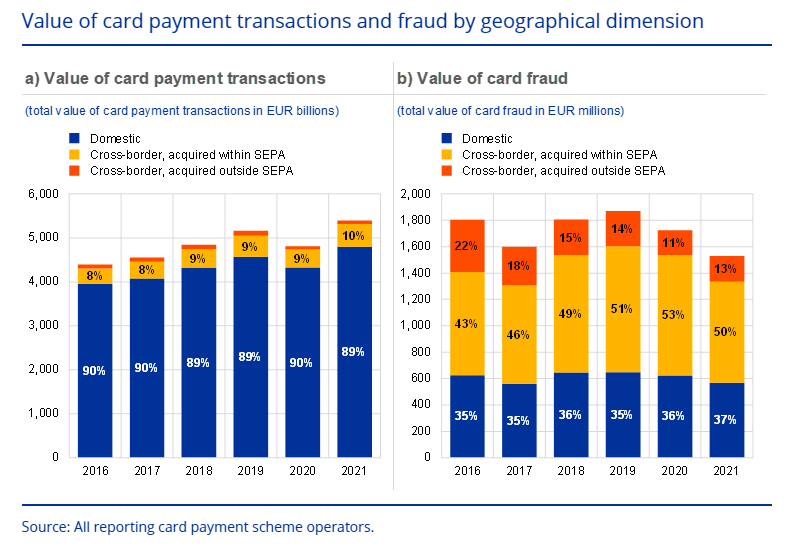

For cards issued in SEPA, cross-border transactions accounted for 63% of the total value of card fraud in 2021.

###

The European Central Bank (ECB) has today published its card fraud report, which is based on information provided by 20 card payment scheme operators. Card fraud in 2021 continued its downward trend, falling to its lowest level since data collection began. It constituted 0.028% of the total value of card payments made using cards issued in the Single Euro Payments Area (SEPA), amounting to €1.53 billion from a total value of €5.40 trillion. By comparison, card fraud in 2019 amounted to €1.87 billion from a total value of €5.16 trillion. The highest share of card fraud observed to date was 0.048% in 2008.

There are two distinct types of card fraud: (1) card-not-present fraud, i.e. fraud conducted remotely in online and telephone payments, using card details obtained by scams such as phishing; and (2) card-present fraud, which typically occurs at retail outlets and ATMs and involves the use of counterfeit cards.

Card-not-present fraud, which accounted for approximately 84% of the total value of card fraud in 2021, declined by 12% from 2020 following the market-wide implementation of strong customer authentication under the revised EU Payment Services Directive (PSD2). Card-present fraud fell by 6% in 2021 from its 2020 level, owing to the continued global roll-out of industry standards, which have been effective in reducing opportunities to commit magnetic stripe counterfeit fraud.

As in previous reports, most of the card fraud in both 2020 and 2021 involved cross-border transactions. Although cross-border transactions only accounted for 11% of the total value of card payment transactions, they accounted for 63% of the total value of card fraud in 2021.

Total value and volume of card fraud using cards issued within SEPA

The Eurosystem is closely monitoring trends in card fraud in its capacity as overseer of card payment schemes operating in the euro area. Statistical information on the volumes and values of card transactions and corresponding fraud is collected, analysed and reported regularly. The latest report on card fraud focuses on data for both 2020 and 2021, providing a more differentiated overview of the impact on card fraud of both the recent regulatory measures and the coronavirus (COVID-19) pandemic. Fraud data for 2022 is currently being collected.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: