Smart Payment Association (SPA), the global trade body of the smart payments industry, today publishes proposals for an Instant Payment Card that would extend SEPA instant Credit Transfer functionality to consumers paying at point of sale (POS) terminals in stores and retail outlets across Europe.

Often termed the closest thing to paying with cash, an instant payment solution allows payments by individuals or businesses to be made (and funds transferred and available) in real time, even during evenings and weekends when other options are unavailable.

This contrasts with other forms of money transfers and payments, including those made in-store and online with debit and credit cards, that can take several days to reach target accounts.

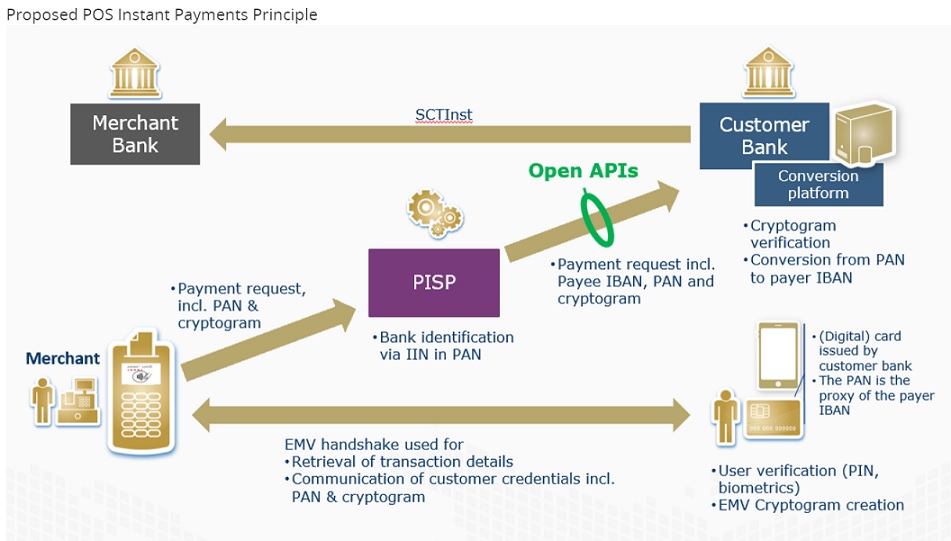

Under new proposals from SPA, real time transfers could be made available to consumers in-store using an Instant Payment Card or smartphone app – in the same way as we would pay using the contact or contactless functionality on conventional chip and PIN debit or credit cards today.

Designed to illustrate the possibility of this new in-store way to pay, the proposals by SPA showcase an approach that complies with existing EMV standards and takes advantage of existing payment terminals already widely adopted and operating across Europe.

There are significant benefits of doing so. By initiating instant payments at the POS using a payment card or app issued by banks, consumers would not only enjoy the fluidity, convenience and familiarity of conventional card-based payments, they would have more choice in how they pay. Merchants would be able to leverage existing POS infrastructures, while banks would benefit from reach and co-existence with today’s card schemes.

Alain Martin, President at SPA, who authored the paper, explains: “By showcasing how to make it possible to extend pan European instant payment options into the retail space, our proposals illustrate the art of the possible. They aim to build on the enthusiasm for such a solution amongst many retailers – further raising interest and triggering discussions within the wider payments industry.”

SPA would be pleased to engage with interested parties to pursue these discussions and contribute to the creation of a pan European payment solution based on instant credit transfer.

A more detailed synopsis and the full paper is available here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: