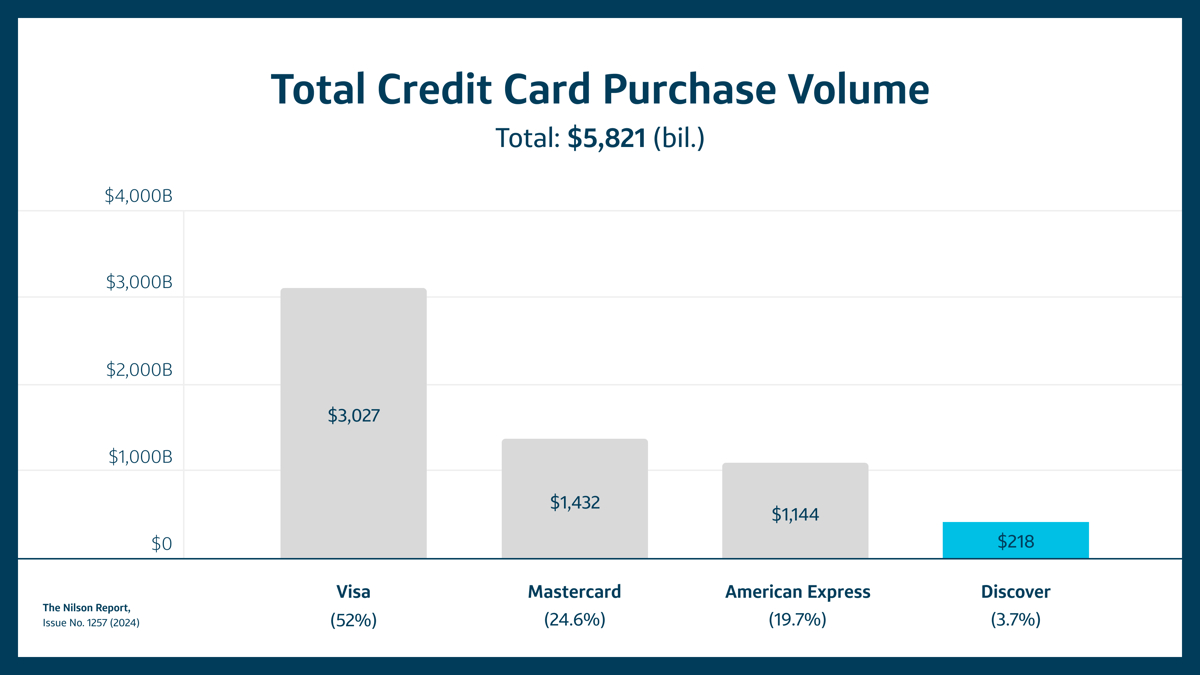

Capital One is currently the third largest credit card issuer in terms of credit card purchase volume, and it will remain in third place behind Chase and American Express after the deal. Currently there are four U.S.-based payment networks, of which Discover is the smallest, accounting for less than 4% of total credit card purchase volume, with Visa, Mastercard and American Express accounting for the remaining 96%.

Capital One Financial Corporation (COF) and Discover Financial Services (DFS) announced that the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency have approved Capital One’s proposed acquisition of Discover.

This approval follows approval of the transaction by the Delaware State Bank Commissioner in December 2024, and by shareholders of more than 99 percent of each company’s shares voting in February of this year.

The Federal Reserve Board announced its approval of the application by Capital One Financial Corporation, of McLean, Virginia, to merge with Discover Financial Services, of Riverwoods, Illinois, and thereby indirectly acquire Discover Bank, of Greenwood, Delaware.

„The Board evaluated the application under the statutory factors it is required to consider, including the financial and managerial resources of the companies, the convenience and needs of the communities to be served by the combined organization, and the competitive and financial stability impacts of the proposal.” – according to the press release.

The Fed’s approval of the merger also came with a consent order and a $100 million fine for Discover overcharging customers certain interchange fees from 2007 through 2023. Discover has since terminated these practices and is repaying those fees to affected customers, the Fed said.

All required regulatory approvals to complete the transaction have now been received, and the transaction is expected to close on May 18, 2025, subject to the satisfaction of customary closing conditions.

“This is an exciting moment for Capital One and Discover. We understand the critical importance of a strong and competitive banking system to our customers and our economy, and we appreciate the thoughtful and diligent engagement of our regulators as they thoroughly reviewed this deal over the past 14 months,” said Richard Fairbank, Founder, Chairman, and CEO of Capital One.

“The combination of our two great companies will increase competition in payment networks, offer a wider range of products to our customers, increase our resources devoted to innovation and security, and bring meaningful community benefits,” said Michael Shepherd, Interim CEO and President of Discover.

There will be no immediate changes to Capital One and Discover customer accounts and relationships now or in the period immediately following the closing of the transaction. Capital One will provide customers with comprehensive information regarding relevant conversion activities well in advance of any future change. Until then, customers will continue to be served through their respective Capital One and Discover customer communications channels.

Upon closing, Capital One will begin implementation of its historic, five-year Community Benefits Plan (CBP), developed in connection with the acquisition and in partnership with leading community organizations, mobilizing more than $265 billion in lending, investment, and services to advance economic opportunity and financial well-being across America.

A new biggest lender

A purchase of Discover by Capital One would make the biggest credit card issuer in the US by loan volume, bigger than even banking colossus JPMorgan Chase by that measure, according to Yahoo Finance.

The combined bank is expected to have consolidated assets of approximately $637.8 billion, making it the country’s eighth-largest insured depository institution and sixth-largest nationally chartered US bank, according to regulators.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: