Article written by Panagiotis Kriaris, Head of Business Development at Unzer. He will deliver a keynote speech at the international conference Banking 4.0 focused on „PSD3 beyond compliance”.

As we move from Open Banking to Open Finance, Variable Recurring Payments (VRPs) represent one of the most promising use cases. But are they really in a position to replace direct debit? Let’s take a look.

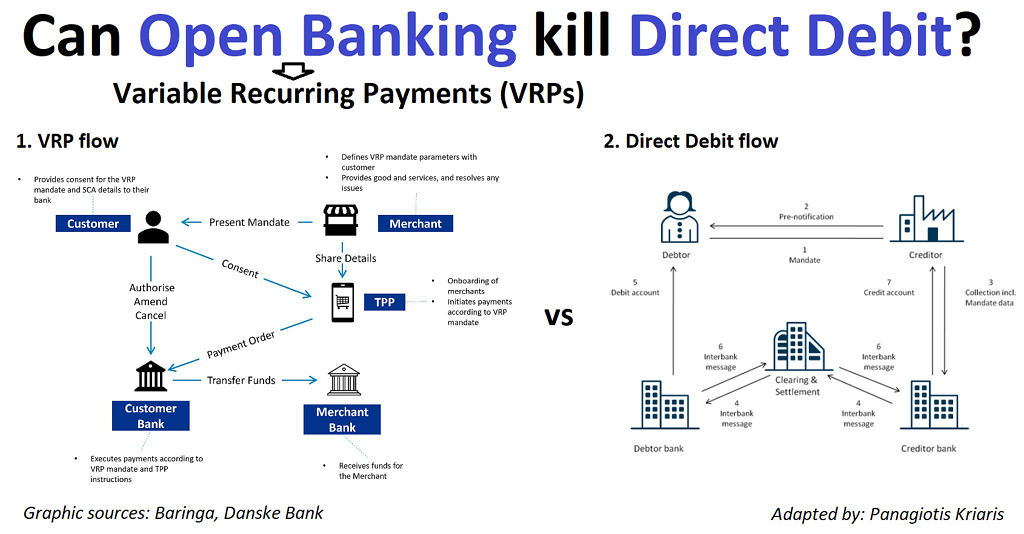

VRPs are based on the concept of payment initiation (PIS) introduced by open banking and allow account-holders to give permission to authorised payments providers (PISPs) to make payments on their behalf on a recurring basis and not just once.

VRPs have a mechanism similar to the one of direct debit but built on open banking rails:

– Like direct debit they require a mandate, but their huge benefit is that this is done only once, meaning that authentication (SCA) for every transaction is not necessary (one of open banking’s main UX pain points)

– Consumers have complete control, as they can cancel them at any time and get to define in detail the parameters of the transactions upfront (i.e. start and end date, amount per transaction, max amount, frequency, etc)

The big game changer is that VRPs offer a very reliable or even better alternative to direct debit or card-on-file payments since they:

– offer a high level of security

– are real-time (instant for consumers and instant processing and settlement for merchants)

– are irrevocable

– render overcharging practically impossible (given that the customer’s consent is needed)

– minimize fraud since there are no card details to be stolen

– do not require any information update (vs expired credit or debit card details that need to be updated)

If you think about it, many of our daily life payments are, in fact, recurring payments: from streaming services (i.e. Netflix, Spoitfy) to all kinds of memberships (gym, athletic clubs, etc) to bill payments. To pay such services today we use a combination of methods, mainly direct debit, standing orders or card payments. The big opportunity for VRPs is to replace all of the above with a more reliable and flexible set-up that can save us time and money while giving us more control. Avoiding subscription traps by limiting test duration or fees by sweeping funds to my overdraft are good examples.

VRPs are not yet available in Europe, but they have been live in the UK since July 2022 via the so-called sweeping, which is the automated transfer between accounts of the same person.

Going forward a few conclusions stand out: 1) we are still in very early stages 2) the biggest opportunity is still in front of us and is connected to e-commerce payments and subscription management 3) many of the existing players – from banks, to merchants, to payment providers, to FinTechs and to card schemes – may find themselves in need of re-defining their roles and business model 4) adoption will be a rather slow growth curve that will depend on educating both consumers and merchants and on pricing.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: