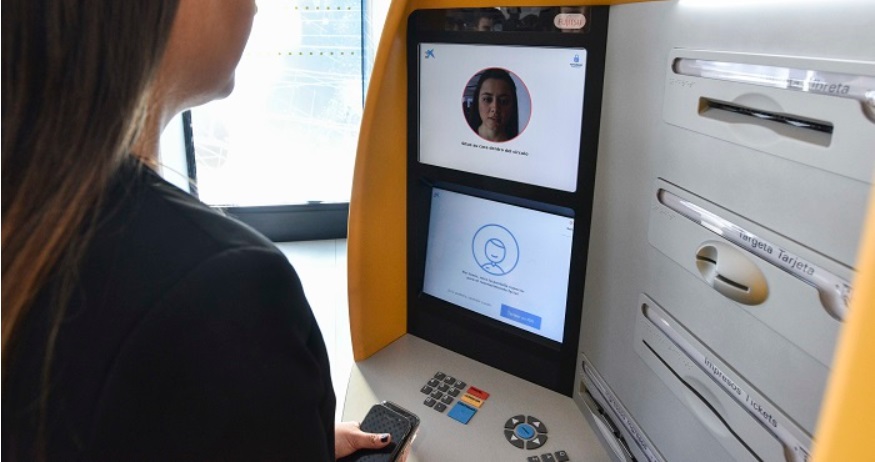

The company will have around 100 devices with facial recognition technology, which will make it one of the world’s biggest ATM networks to commercially adopt this biometric technology. The ATMs are equipped with cameras and software capable of validating up to 16,000 points on the user’s face, guaranteeing fully correct identification.

CaixaBank, Spain’s leading retail bank, launches the nationwide deployment of ATMs with facial recognition technology. „The system is the first launched by a financial institution on a global level that allows users to withdraw money by simply recognising them from the image captured by the terminal’s camera, meaning they do not have to manually enter their PIN.”, according to the press release.

„The goal of the expansion plan is to take this technology to more than 30 Store branches throughout Spain. Thus, all autonomous communities will have at least one branch fitted with this system, and the total number of CaixaBank ATMs with biometric recognition will exceed 100 terminals.”, the bank said.

At present, the company headed by Chairman Jordi Gual and Chief Executive Officer Gonzalo Gortázar already has some of these ATMs in operation at several Store branches in Barcelona, as well as in the all in one flagship centres in Barcelona and Valencia.

Upon completion of the expansion plan (forecast for mid-July 2020), CaixaBank will have one of the world’s biggest networks of ATMs fitted with commercially-adopted facial recognition technology, and the only one in which this biometric system has a sufficient level of security to enable users to make withdrawals without having to enter their PIN.

For Gonzalo Gortázar, Chief Executive Officer of the financial institution, “CaixaBank works with an innovation model in which technology is at the service of the best customer experience. We work to constantly evolve towards new needs and habits and, within the current financial context, security and agility are key across all transactions, and the incorporation of biometric technology at ATMs offers many benefits in these two areas„.

Gortázar also has pointed out that “in the current context of COVID-19, this project is particularly relevant given that it enables us to reduce the physical contact of customers with ATM surfaces. This measure comes in addition to using contactless cards, which contributes to promote safe terminal use”.

Technology that strengthens the user experience and security

CaixaBank is „the world’s first bank to create ATMs with effortlessly and securely integrated biometric technology”, according to the bank.

Thus, facial recognition is enough to identify the client when making a withdrawal and, therefore, no additional PIN is requested. The ATM has the hardware and software needed to validate up to 16,000 points on the image of the user’s face, which guarantees totally secure identification.

Facial recognition streamlines the customer identification process and enables them to make withdrawals without memorising multiple passwords. In addition, in the context of COVID-19, the system offers the added advantage of enabling users to withdraw cash from ATMs while minimising contact with the terminal’s surface, given that the customer does not need to use the keypad. The only time they have to touch the device is when selecting the amount of cash they want to withdraw, and they can do this by simply touching the ATM screen once.

The system has received The Banker award for the best technology project of the year in the “Delivery channels” category at The Banker Tech Projects Awards 2019. These awards acknowledge the best projects developed by financial institutions for their innovation and contribution to the technological transformation of the global financial sector.

CaixaBank customers who want to use facial recognition at ATMs should contact their advisor to carry out the registration process. They do not need to be customers of the Store branches where this technology is installed: they can have any other centre as their reference branch.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: