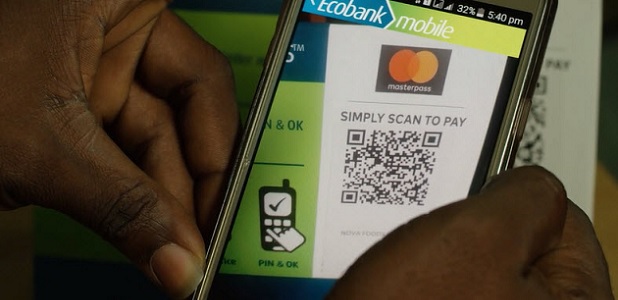

MasterCard has signed its largest-ever deal for Masterpass, snagging an agreement with the Ecobank Group for the roll out of its QR code-based mobile payment service across 33 African countries.

Ecobank, which has set itself a goal of reaching 100 million customers by 2020, has already deployed the QR code flavour of Masterpass in Nigeria. The MoU with MasterCard will see the mobile person-to-merchant system implemented across the remaining 32 Pan-African countries by the end of 2016.

„Masterpass QR is the first mobile-driven, Person-to-Merchant (P2M) payment solution. The solution is an enhancement to the Masterpass global digital payment service that will enable millions of micro, small and medium enterprises across Africa to begin accepting fast and secure digital payments. This service addresses the challenges of expensive infrastructural issues associated with point of sale devices and eliminates the need for cash.”, according to the press release.

Users of Ecobank’s mobile banking platform across the 33 countries will be able to safely pay for online and in-store purchases by scanning a Quick Response (QR) code displayed at checkout on their smartphones, or by entering a merchant identifier into their feature phones.

Daniel Monehin, Division President, Sub-Saharan Africa, Mastercard said, “Masterpass QR has been fulfilling the needs of micro merchants in Nigeria since it was launched in August this year. Our extended partnership with Ecobank signals one of the largest implementations of a digital payment solution in Africa, resulting in millions of previously excluded people joining the financial ecosystem.”

Patrick Akinwuntan, Ecobank Group Executive Consumer Banking said, “With Ecobank Masterpass QR, our customers across 33 countries will now be able to make fast, simple and safe digital payments via Ecobank mobile banking loaded on their mobile device where Masterpass QR is accepted globally. It will also help provide instant receipts for the numerous small, medium and large merchants across Africa.”

Micro, small and medium enterprises across Africa contribute significantly to economic growth, creating around 80 percent of the region’s employment and fueling demand for goods and services. „The introduction of digital payment solutions such as Masterpass QR, will help these businesses become more efficient”, MasterCard says.

With Nigerians soon to enjoy the benefits of the solution first in Africa, the additional 32 markets that will receive Masterpass QR as part of the groups drive to connect with 100 million new customers by 2020 across: Benin, Burkina Faso, Burundi, Cameroon, Cape Verde, Central African Republic, Chad, Congo (Brazzaville), Congo (Democratic Republic), Côte d’Ivoire, Equatorial Guinea, Gabon, Ghana, Guinea Conakry, Guinea Bissau, Kenya, Liberia, Malawi, Mali, Mozambique, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, South Sudan, Tanzania, The Gambia, Togo, Uganda, Zambia and Zimbabwe.

Incorporated in Lomé, Togo in 1988, Ecobank Transnational Incorporated (‘ETI’) the parent company of Ecobank is the leading independent pan-African banking group. It currently has a presence in 36 African countries employing over 20,000 people in 40 different countries in over 1,200 branches and offices. Ecobank is a full-service bank providing wholesale, retail, investment and transaction banking services and products to governments, financial institutions, multinationals, international organisations, medium, small and micro businesses and individuals.

Source: MasterCard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: