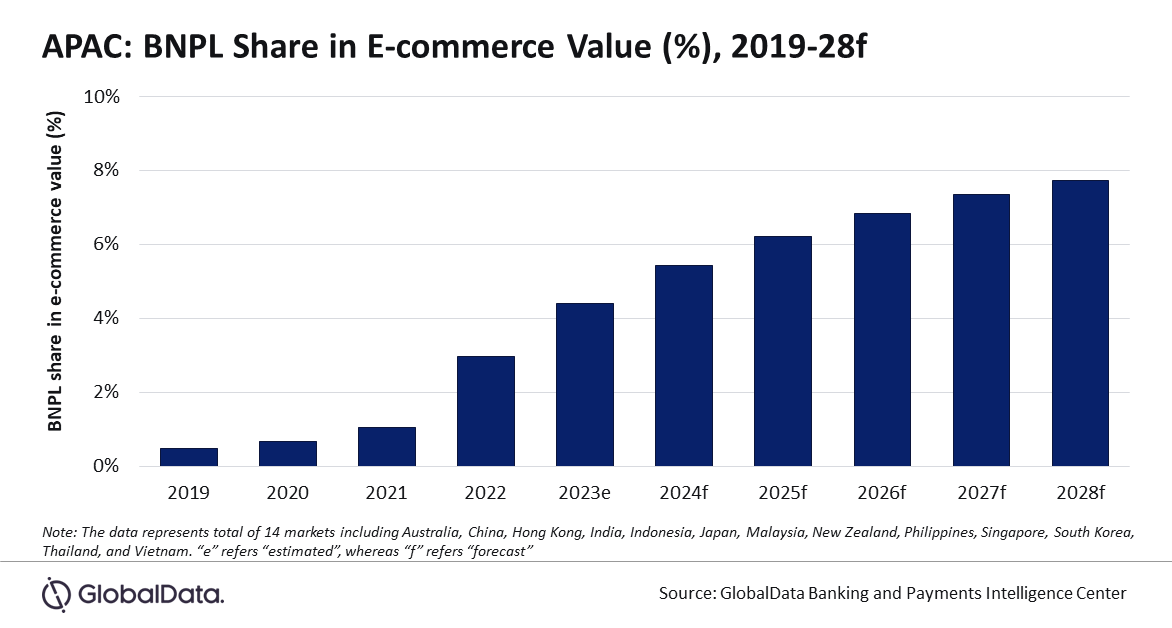

Buy now pay later (BNPL) has become a popular payment tool in Asia-Pacific (APAC), due to increasing demand for short-term credit coupled with growing consumer preference for online shopping. Given its popularity, the BNPL market is expected to account for 7.7% share of e-commerce payments value by 2028, forecasts GlobalData, a leading data and analytics company.

Already popular in countries like Australia and New Zealand, BNPL is gradually gaining traction in other APAC markets as well. GlobalData’s E-Commerce Analytics reveals that, BNPL accounted for 4.4% of e-commerce payments in 2023 in the APAC region, which is further expected to rise to 5.4% in 2024.

Shivani Gupta, Senior Banking and Payments Analyst at GlobalData, comments: “BNPL payment solution is widely popular as an alternative payment option in the region with large number of payments and fintech companies competing for a slice of this market. The increasing demand for this solution is supported by high consumer awareness, rising demand for short-term finance, especially among the millennials, and proliferation of BNPL service providers.”

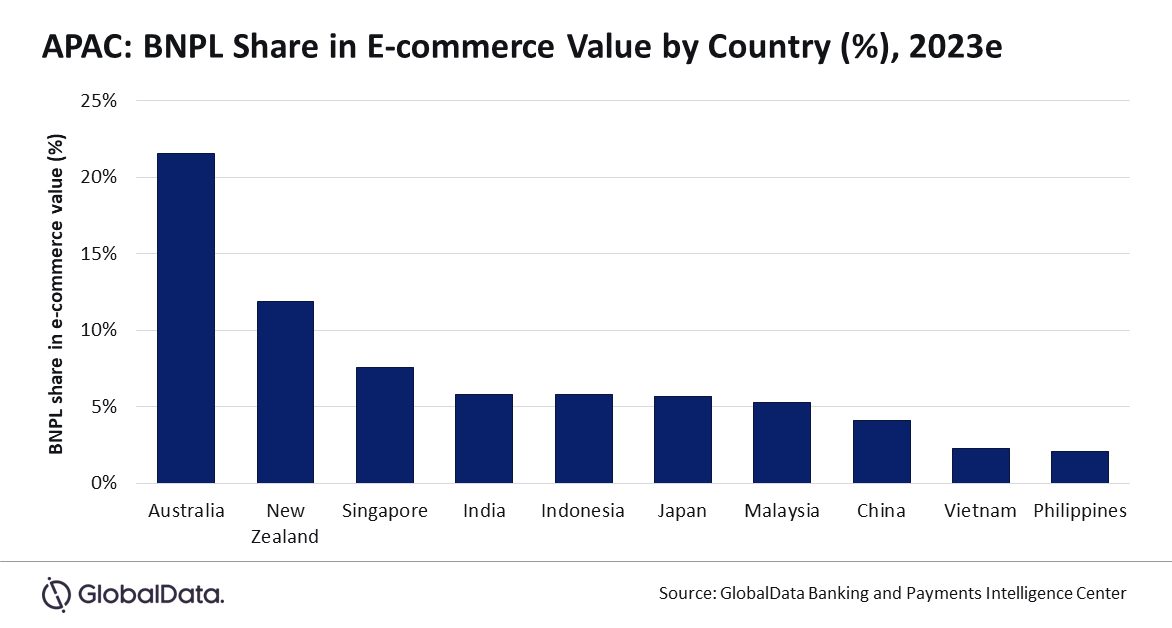

Within the region, Australia and New Zealand have higher adoption rates compared to their peers. The share of BNPL solutions in the total e-commerce payments in Australia is estimated at 21.5% in 2023, while it is 11.9% in New Zealand. Other Asian markets are also catching up to this with countries like Singapore, India, Indonesia and Japan now seeing high adoption of BNPL services.

BNPL has high growth potential in countries like India, which has low credit card penetration and limited access to formal credit. India has seen the fastest jump in BNPL share in the region, which increased from 0.1% of e-commerce sales in 2019 to an estimated 5.8% in 2023.

A burgeoning e-commerce market is also expected to support the rapid growth of BNPL services in India. For instance, Flipkart offers a pay-later service, allowing users to make online purchases in monthly instalments. Similarly, Amazon, which is the leading player in this space, offers its own Pay Later option, allowing consumers to make payments for their purchases in 3-12 monthly instalments. As of December 2023, there were over 8 million customer sign-ups on Amazon Pay Later.

As BNPL gains traction, concerns such as BNPL services encouraging impulse purchases and concerns of over-indebtedness have emerged. In response, the central banks in the region are gradually taking regulatory steps. For instance, New Zealand’s Minister of Commerce and Consumer Affairs proposed a regulation in November 2022 to bring BNPL under the purview of ‘Credit Contracts and Consumer Finance Act 2003’, which governs all regular credit services like credit cards and personal loans.

According to the proposed regulation, like other credit providers, BNPL lenders are also required to assist borrowers to make informed decisions and help them with repayment during unforeseen circumstances. Borrowers will be protected from unreasonable default fees and BNPL providers would provide compensation to borrowers if any rules were breached. The regulation will become effective from September 2024.

Gupta concludes: “The APAC region is expected to see a rise in the adoption of BNPL services due to the shift of consumer shopping habits towards online platforms and the growing number of online merchants accepting BNPL options. Despite this, BNPL services still make up minimal share of total consumer payments in the region, therefore far from mass adoption. Nevertheless, growing consumer demand for flexible payment options among young, and tech-savvy population and government initiatives to boost consumer confidence are expected to provide drive BNPL adoption in APAC.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: