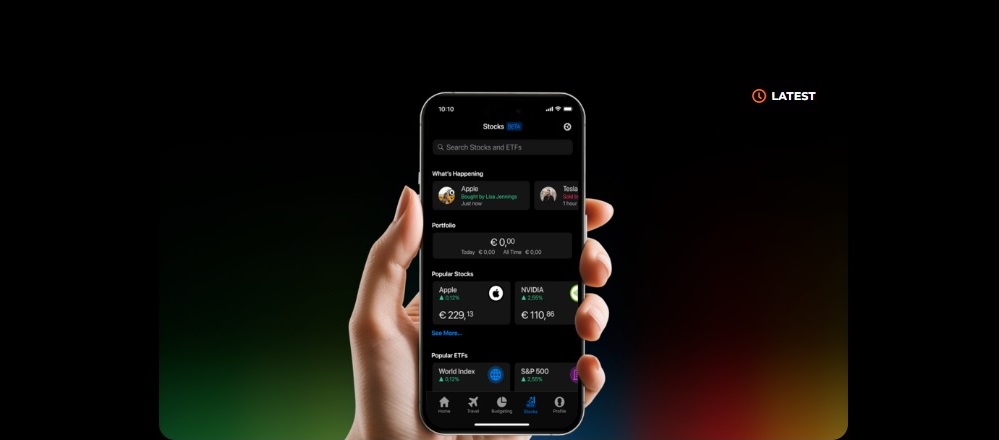

bunq, the second largest European neobank, debuts stock trading. Users will trade for free for the first three months.

Initially available in the Netherlands and France, Stocks will be gradually launched throughout the rest of Europe. Upvest provides the investment infrastructure for fractional trading and custodial services, ensuring efficient and secure transactions for end users.

bunq launches Stocks, a new investment product tailored for digital nomads. This comes as bunq actively gains trust in Europe, reaching 14.5 million users.

„Unlike traditional brokerages, bunq Stocks simplifies investment for beginners. It gives them access to a curated list of the most popular US and EU public companies and straightforward, global multi-asset ETFs through bunq’s partner Ginmon. With bunq, users will be able to open an investment account within seconds, and buy and sell stocks in fractional shares as low as €10. In the first three months, all trades are free.” – according to the press release.

The rise of digital nomads has challenged traditional notions of work and investment. According to bunq research, 47% of European digital nomads are already actively investing, while 41% are considering starting in the next 12 months. With over half of them investing for the long term (more than 5 years) and 57% preferring to invest on the go, monthly on average, digital nomads require a product tailored to their unique needs.

Ali Niknam – founder and CEO of bunq: “Investing in stocks should be as effortless as making a payment or checking your balance. That’s why we’ve designed the simplest way to start investing, allowing our users to buy shares of the world’s most exciting companies in seconds.”

In addition to Stocks, which is rolling out as beta, bunq also announced several other updates at its bunq Update 26 event in Amsterdam. The neobank’s AI money assistant, Finn, now can give ultra-personalized budgeting tips as well as recommend bars and restaurants in the area. Alongside this, bunq has introduced an eSIM for frequent travelers. Activated from the bunq app, the eSIM will give digital nomads uninterrupted internet access in 160+ countries, helping them save up to 90% on roaming costs.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: